Even with a seasonal housing market cooling, more buyers are entering the market due to continued ultra-low interest rates.

Even with a seasonal housing market cooling, more buyers are entering the market due to continued ultra-low interest rates.

During a four-week survey period ending September 19, most housing metrics showed an expected seasonal slowdown: pending sales were down 12% from their peak this year, the share of homes sold above list price fell below 50%, and the average time a home was on the market rose to 20 days.

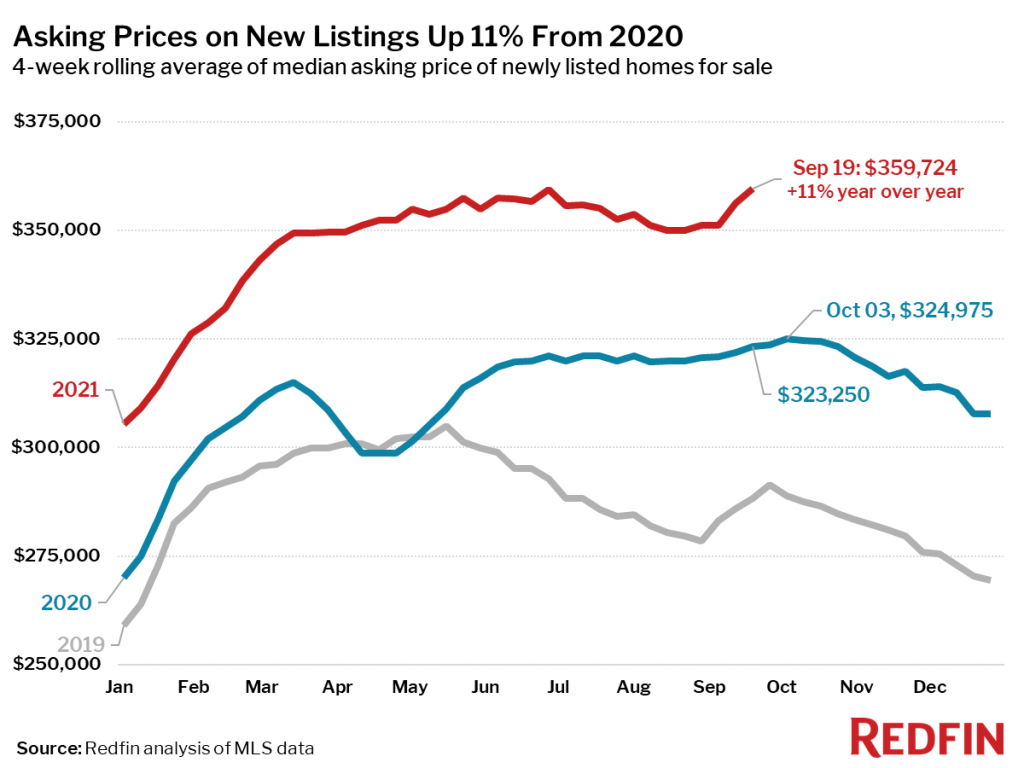

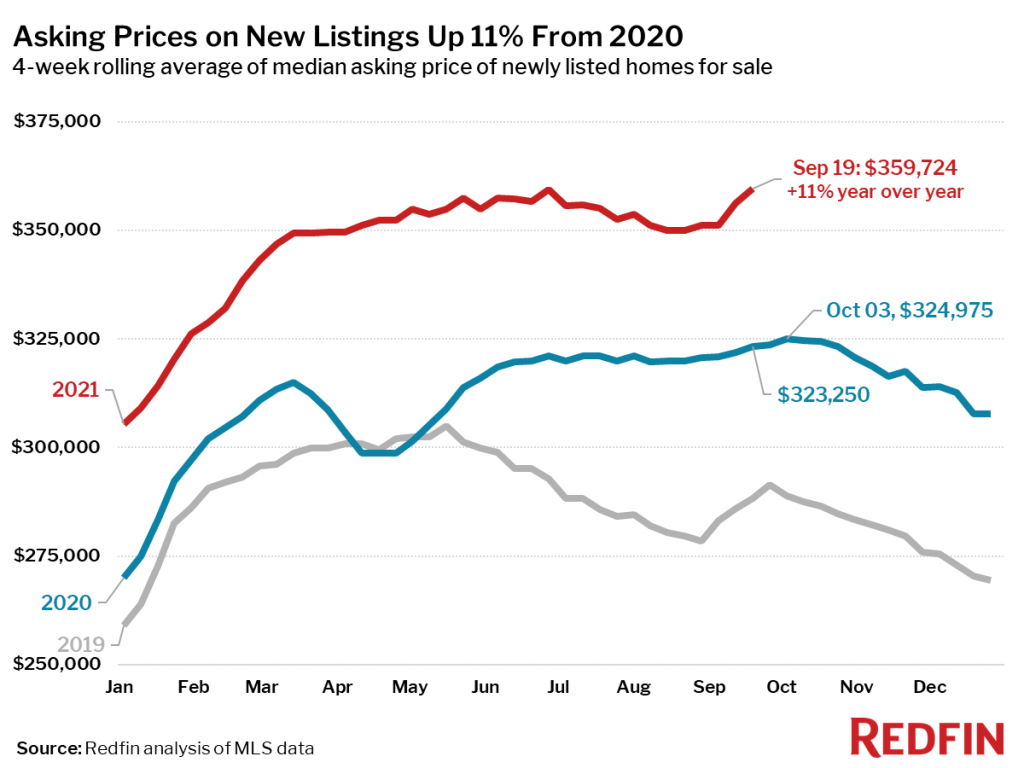

However, according to Redfin analyst Tim Ellis, the average asking price for homes was up 2.4% and median home sale price rose 13% year-over-year to $356,663. In addition, asking prices of newly listed homes were up 11% from the same time a year ago to a median of $359,724, an all-time high.

“The fact that homebuyer demand is setting new records as summer draws to a close leads me to believe that home prices have room to grow,” said Redfin Chief Economist Daryl Fairweather. “This fall will be a litmus test for how hot the 2022 housing market will get. And it looks like we are heading into another unseasonably hot fall as ultra-low mortgage rates and employers’ remote-work policies mean Americans are still on the move.”

The report also found:

- Pending home sales were up 6% year-over-year.

- New listings of homes for sale were down 6% from a year earlier.

- Active listings (the number of homes listed for sale at any point during the period) fell 21% from 2020.

- 46% of homes under contract had an accepted offer within the first two weeks on the market, 3% more than last year

- 33% of homes under contract had an accepted offer within one week of hitting the market, up from 31% during the same period a year earlier.

- 49% of homes sold above list price, up from 34% a year earlier.

- On average, 4.9% of homes for sale each week had a price drop, up 0.8 percentage points from the same time in 2020, and the highest level since the four-week period ending October 13, 2019

- Mortgage purchase applications increased 2% week over week (seasonally adjusted) during the week ending September 17. For the week ending September 16, 30-year mortgage rates were down slightly at 2.86%.

- From January 1 to September 19, home tours were up 11%, compared to a 33% increase over the same period last year, according to home tour technology company ShowingTime.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news