While consumers continue navigating the housing market amid rising conflicts in Ukraine, a severe lack of housing inventory is dramatically affecting home sales. Homebuyer competition and price gains reach record highs in February, according to a new report from Redfin.

More homes are selling above list price than ever seen at this time of year, as a record-low inventory of homes for sale continues to fuel unprecedented levels of competition. This directly affects median sale prices, which rose 3.5% between January and February—the fastest month-over-month gain ever seen during the winter season.

“An acute shortage of homes for sale continues to stymie buyers in the current market,” said Redfin chief economist Daryl Fairweather. “Rather than dropping out of the housing market, homebuyers only seem to be getting even more voracious, driving prices up at a startling clip. Typically, rising mortgage rates weaken demand for homes—we don’t see demand weakening yet, but we will be watching to see if buyers back off or remain steadfast amidst rising borrowing costs.”

Seasonally-adjusted home sales in February were down 7% from a month earlier, and down 6% from a 2021. Overall, seasonally adjusted active listings fell 14% year over year to an all-time low in February.

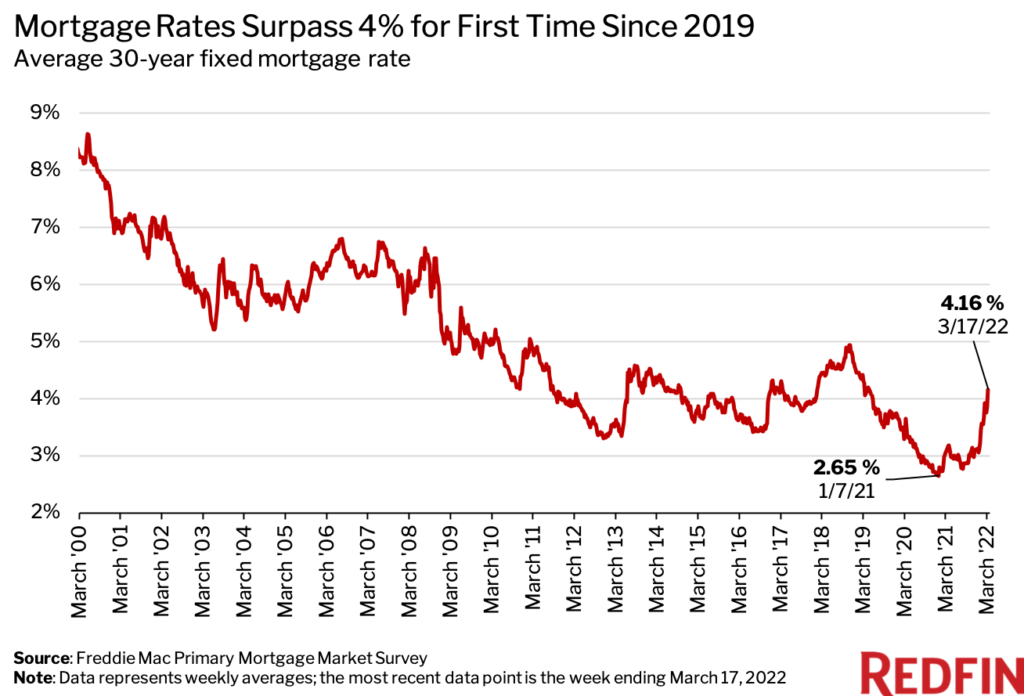

Mortgage rates have continued to increase as the government seeks to combat inflation. The Federal Reserve raised interest rates for the first time in four years this week.

Directly affecting the average 30-year fixed mortgage, rates jumped past 4% for the first time since 2019, hitting 4.16% during the week ending March 17. That’s up from a record low of 2.65% in 2020. The Fed forecasts six more rate hikes this year, despite economic uncertainty stemming from the war in Ukraine.

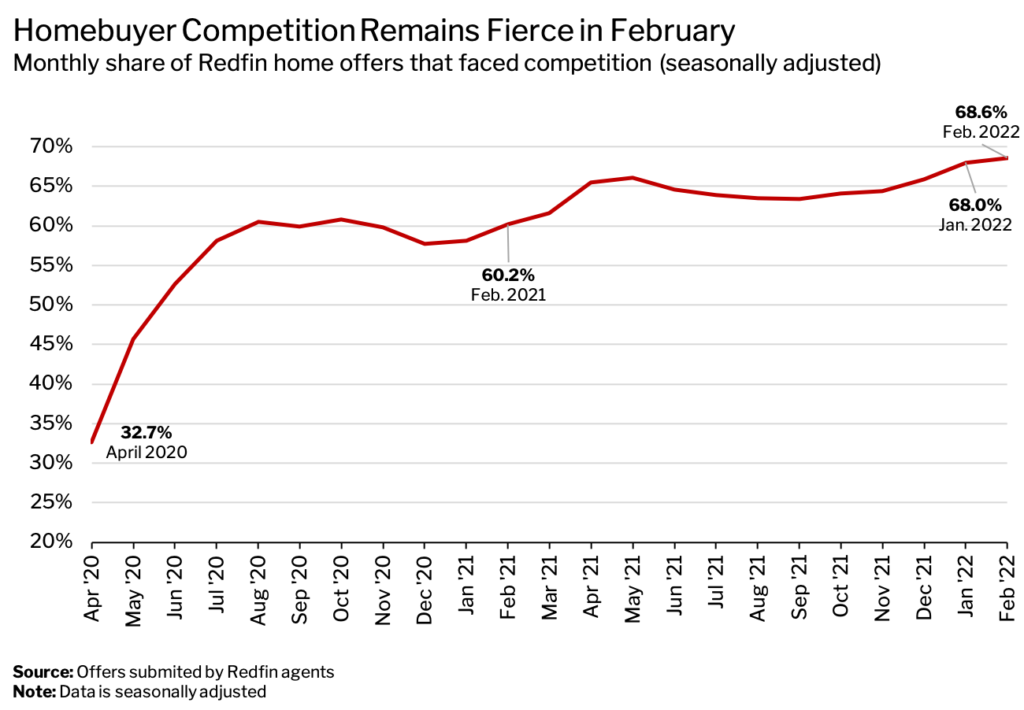

An estimated 69% of home offers written by Redfin agents faced bidding wars on a seasonally adjusted basis in February. Meanwhile, home prices climbed 16% year-over-year to a new record-high of $389,500, as the number of homes for sale fell to another new low.

February’s bidding war rate was the highest level in Redfin’s records, up slightly from a revised rate of 68% in January, and 60.2% a year earlier. Homes listed in the $1 million to $1.5 million range were most likely to face competition, with a bidding-war rate of 76.6% in February.

It’s the most competitive time in history to purchase a home because mortgage rates are rising from historic lows amid a worsening supply shortage,” said Redfin Chief Economist Daryl Fairweather. “Bidding wars intensified this year after rates started spiking, which lit a fire under buyers. Competition will likely plateau or even decline if rates keep increasing as expected. Monthly mortgage payments for new buyers are already at a record high. As they continue to creep up, some buyers will move to the sidelines.”

Approximately 75.3% of Redfin offers for townhouses faced competition in February—a higher share than any other property type. Next came single-family homes, with a bidding-war rate of 72.9%. Multi-family properties and condos/co-ops essentially tied for third place, with respective rates of 64.8% and 64.6%. Many homebuyers are seeking out townhomes because they’ve been priced out of the market for single-family homes due to surging housing prices.

Home sales that closed in February reflected a turn toward a more competitive housing market, a trend that is typical for this time of year, even as we exit the most competitive winter ever. The average sale-to-list price ratio in February was 101.3%, up from 99.8% a year earlier, and up from 100.4% in January—the highest level on record for a February.

The typical home that sold in February went under contract in 25 days—eight days faster than a year earlier, when homes sold in a median 33 days, and the shortest time on market in history for a February. In February, 47% of homes also sold above list price, up 11 percentage points from a year earlier, up 5 points from January and the highest level seen in February.

To read the full report, including charts and methodology, click here.

Fore more information, including metro-level highlights, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news