U.S. private mortgage insurers (PMIs) are expected to continue benefiting from economic growth, good house price affordability, and strong mortgage credit quality. According to recent report from Moody's Investors Service, PMIs have been positioned in a favorable housing finance environment that will allow them to reap the benefits in the industry, even if the Federal Reserve increases interest rates.

U.S. private mortgage insurers (PMIs) are expected to continue benefiting from economic growth, good house price affordability, and strong mortgage credit quality. According to recent report from Moody's Investors Service, PMIs have been positioned in a favorable housing finance environment that will allow them to reap the benefits in the industry, even if the Federal Reserve increases interest rates.

"The growth in market share for US private mortgage insurers has been in an environment of exceptionally strong mortgage credit quality, and in many ways the industry is benefiting from a sweet spot in the credit cycle," said Brandan Holmes Moody's VP. "The current housing finance environment is as good as it will likely be for US private insurers in this cycle."

Moody’s name three key attributes of the housing environment that they feel are the main macro factors that affect PMIs: 1) the demand for mortgage insurance; 2) the generic mortgage loan attributes; and 3) the prevailing housing market conditions.

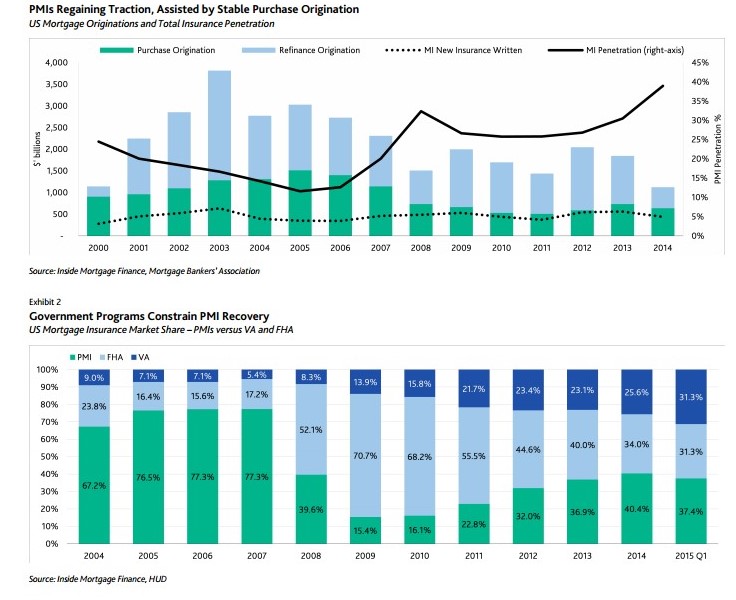

According to the report, since 2009, US private mortgage insurers have increased their market share from 15.4 percent to 37.4 percent against government issued options from the Federal Housing Administration (FHA) and the U.S. Department of Veterans Affairs (VA).

In a new report, Moody's said it expects GDP growth, improvement in employment, and pent-up demand for housing, will continue to support stable housing market conditions benefiting PMIs.

Low interest rates and moderate appreciation in-house prices have limited the negative risk on recent vintage business for many mortgage insurers, according to Moody’s. Even with the Federal Reserve hinting of an increase rate increase before the end of the year, Moody analysts determined that an incremental rise in rates would have limited impact on the PMI sector.

"US private insurers have had limited downside risk as low interest rates have contributed to strong housing affordability," Holmes said. "While there will be negative pressures on housing markets when the Fed moves on interest rates, we expect such markets to withstand measured rates increase, as a the return to typical housing affordability levels will be met by a cyclical increase in demand for housing."

The report also noted that since the financial crisis, PMI writing business is nearly exclusively in the prime, first-lien segment of the mortgage market, with almost all conforming originations being made to borrowers with high credit scores.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news