Rebound in U.S. cities is being driven more by wealthy buyers, whereas suburban growth is being driven by those who can’t afford to buy into urban neighborhoods, said Sam Khater Deputy Chief Economist at CoreLogic on Friday.

Rebound in U.S. cities is being driven more by wealthy buyers, whereas suburban growth is being driven by those who can’t afford to buy into urban neighborhoods, said Sam Khater Deputy Chief Economist at CoreLogic on Friday.

According to Khater, the return of solid sales and growth in American cities is, from the mortgage industry perspective, “something of a head-fake.” Since 2000, housing prices in cities and suburbs have flipped; where once a home in the suburbs priced newer and credit-strapped buyers out of the market, today’s urban residential landscape is returning the favor.

“While the urban rebound has been well documented,” Khater said, “there is a countervailing trend in the suburbs. Higher prices in cities and inner suburbs has caused purchase applicants, and especially lower-credit borrowers, to seek affordability farther out.”

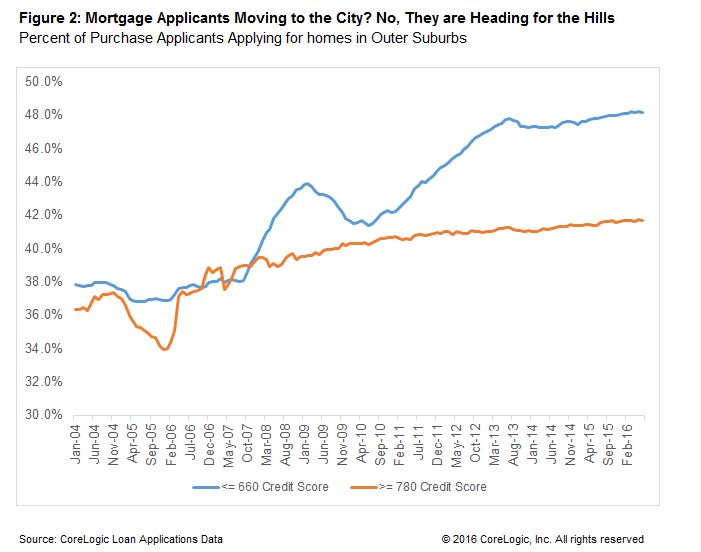

During the boom years of the mid-2000s, 38 percent of low credit purchase mortgage applicants applied to the outer suburbs, he said. But as the crash and its fallout hit, lower-credit buyers navigated waves in the mortgage system, trying to find cheaper houses at first in the suburbs and then the cities.

Now, Khater said, nearly half (48 percent) of lower-credit purchase applicants were applying to the outer suburbs, farther from job centers and city amenities. The number is 10 percentage higher than it was in 2004.

“Higher-credit borrowers are also increasingly applying to live in properties in the outer suburbs,” he said, “but the rate of increase is less than half of lower-credit borrowers. There is a clear sorting of lower-credit and -income borrowers to the outer suburbs.”

Khater said the combination of an improving economy and jobs outlook is driving purchase demand higher.

“The increased sorting has economic and policy implications for spatial risk and increased concentration of lower credit borrowers in America’s outer suburbs.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news