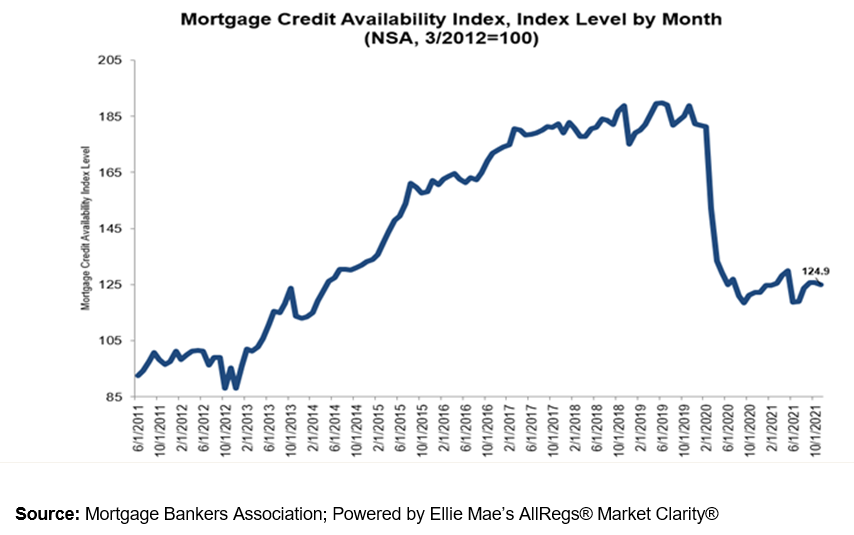

Mortgage credit availability declined in November according to recent reports from the Mortgage Bankers Association. The Mortgage Credit Availability Index (MCAI) showed data analyzed from Ellie Mae’s AllRegs Market Clarity business information tool that measures increased and decreased percentages relative to credit availability and limits.

Mortgage credit availability declined in November according to recent reports from the Mortgage Bankers Association. The Mortgage Credit Availability Index (MCAI) showed data analyzed from Ellie Mae’s AllRegs Market Clarity business information tool that measures increased and decreased percentages relative to credit availability and limits.

Declines in the MCAI indicate that lending standards are tightening, while increases in the index are suggestive of loosening credit. The index was benchmarked to 100 in March 2012.

“Credit availability in November was down slightly, even as the housing market continues to thrive amidst the improving job market. However, the picture was different depending on the market segment. An increase in conventional credit availability was offset by a decrease in government credit, as lenders reduced their offerings of government loan programs with lower credit scores, as well as those for investment homes,” said Joel Kan, MBA’s Associate VP of Economic and Industry Forecasting.

Percentage differences included:

- The MCAI fell by 0.6% to 124.9% in November

- Conventional MCAI increased 1.9%

- Government MCAI decreased by 2.7%

- Jumbo MCAI increased by 3.0%

- Conforming MCAI rose by 0.2%

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

The Conforming and Jumbo indices have the same “base levels” as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted “base levels” in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.

“Credit supply for jumbo loans increased for the fifth straight month. Lenders scaled back on jumbo supply at the onset of the pandemic, and even with the recent growth in credit availability, the jumbo index remains more than 40 percent below February 2020 levels. As home-price growth continues, and mortgage rates creep higher, increased credit availability is needed for qualified borrowers looking to purchase a home – especially for first-time homebuyers, who rely heavily on government mortgage programs,” said Kan.

The Total MCAI has an expanded historical series that gives perspective on credit availability going back approximately 10-years. Expanded historical series does not include Conventional, Government, Conforming, or Jumbo MCAI. The expanded historical series covers 2004 through 2010 and was created to provide historical context to the current series by showing how credit availability has changed over the last 10 years – including the housing crisis and ensuing recession.

Data prior to March 31, 2011 was generated using less frequent and less complete data measured at 6-month intervals and interpolated in the months between for charting purposes. Methodology on the expanded historical series from 2004 to 2010 has not been updated. Data prior to 3/31/2011 was generated using less frequent and less complete data measured at 6-month intervals interpolated in the months between for charting purposes

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news