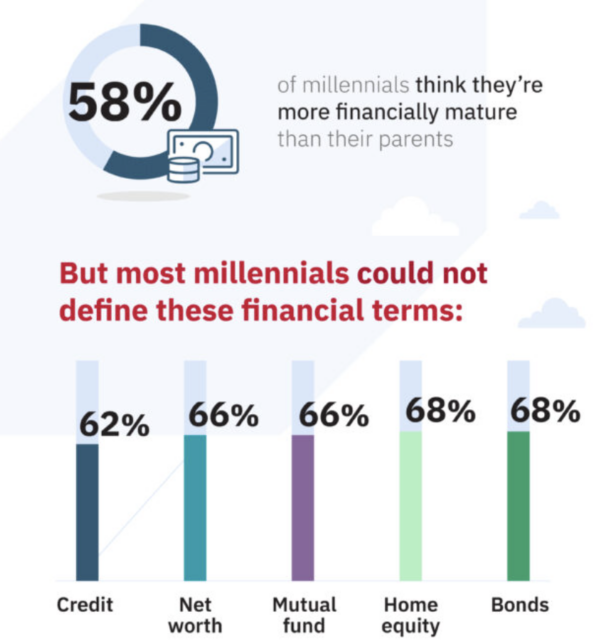

According to new SWNS Digital research, more than half (58%) of millennials think they’re more "financially mature" than their parents. But are they really?

A survey of 2,000 millennials examined their financial knowledge and found that while many feel they know more than their parents, a whopping 71% still want to learn more.

But respondents aren’t sitting on their hands—half of those surveyed said they’ve already taken more of an interest in managing their finances this year than last year.

So much so that eight in 10 are confident in their ability to manage their finances.

Conducted by OnePoll and commissioned by BOK Financial, the survey found that there's still plenty to learn, as just over a third were able to correctly match each of six basic financial terms to their correct definitions.

One in nine millennials admit that they’re not confident in understanding how the credit score system works.

Similarly, nearly a fifth of respondents haven’t heard of the term “rising rate environment” (19%), and even more aren’t aware that they’ve likely been impacted by this kind of economy (36%).

Surprisingly, 62% of millennials could not correctly identify the definition of "credit,” and others couldn’t define “net worth” (66%), “mutual fund” (66%), “home equity” (68%), or “bonds” (68%).

To avoid misinformation and make sure they’re guided correctly, most have sought information from a financial professional (59%), citing that this is the top source (33%) they trust beyond their own research.

Interestingly, the second-most go-to resource for financial information is their friends (54%), and another 47% look for guidance from social media or influencers.

“Millennials gather information from a variety of sources, and the survey reiterated the importance of having a financial professional you can rely on,” said Kimberly Bridges, Director of Financial Planning at BOK Financial. “With all of the information out there coming from many directions, we encourage you to double-check the qualifications of your sources and consult a professional advisor prior to making significant financial decisions.”

Many are playing the long game when it comes to their finances, but one in seven still lacks confidence in their financial plans to save for long-term goals, especially female respondents (58% of women feel confident compared to 65% of men).

But maybe millennials are being too hard on themselves. While the average respondent expected that they’d purchase a home at 37 years old, the average millennial homeowner surveyed accomplished this feat at age 29.

Seventy percent of millennials surveyed are homeowners, and while women felt less confident in their long-term financial plans, more women (78%) than men (63%) currently own their home.

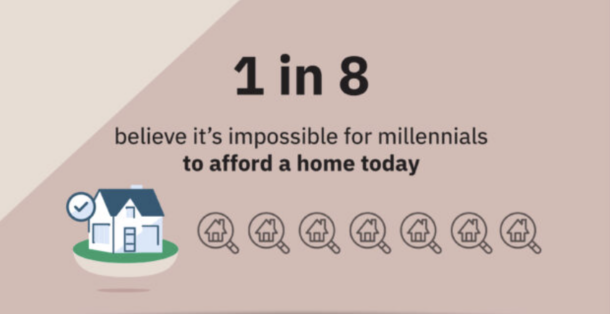

However, times have changed, according to one in eight people who believe it’s impossible for others their age to afford a home today.

A quarter of millennial non-homeowners have saved up money to purchase a house (26%), but most of these respondents have put those plans on hold (62%) in the current economic cycle.

The average millennial who was saving up for a home but hasn’t yet purchased one has $46,560.51 from their home fund in the bank.

Further, half of all respondents said the current economy has had an impact on where they always imagined themselves living (48%), putting their plans for moving somewhere secluded (27%), or to a big city (22%), on hold for now.

“Millennials are confident and optimistic on the whole, in spite of the economic challenges they have experienced. Even with today's rising home prices, they are not deterred, with 70% still believing it is possible for people their age to afford to purchase a home,” said Bridges. “With their positive outlook, willingness to educate themselves, and desire to partner with trusted financial professionals, I have no doubt they will be able to accomplish their long-term goals.”

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news