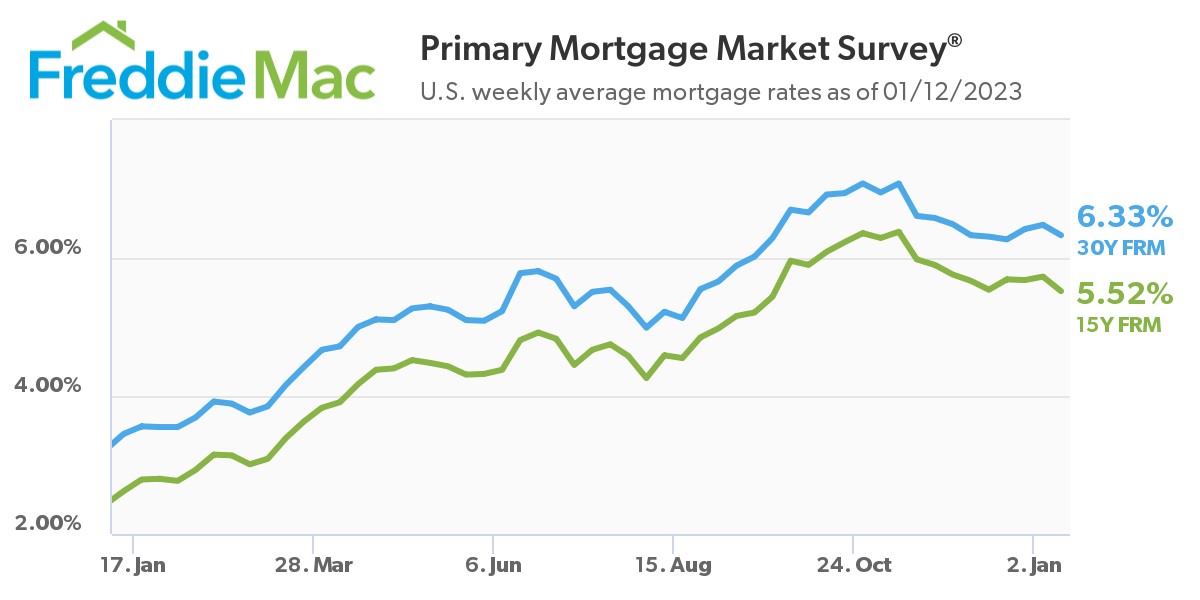

After starting the year 2023 with mortgage rates on the rise, Freddie Mac reports that the 30-year fixed-rate mortgage (FRM) averaged 6.33%, down 15 basis points from last week’s reading of 6.48% for the week ending January 12, 2023. A year ago at this time, the 30-year FRM averaged 3.45%.

After starting the year 2023 with mortgage rates on the rise, Freddie Mac reports that the 30-year fixed-rate mortgage (FRM) averaged 6.33%, down 15 basis points from last week’s reading of 6.48% for the week ending January 12, 2023. A year ago at this time, the 30-year FRM averaged 3.45%.

“While mortgage rates have resumed their decline, the market remains hypersensitive to rate movements, with purchase demand experiencing large swings relative to small changes in rates,” said Sam Khater, Freddie Mac’s Chief Economist. “Over the last few weeks, latent demand has been on display with buyers jumping in and out of the market as rates move.”

Freddie Mac also reported that the 15-year FRM averaged 5.52% for the week, down from last week when it averaged 5.73%. A year ago at this time, the 15-year FRM averaged 2.62%.

The dip in rates gave a slight rise in mortgage application volume, led by refi apps, as the Mortgage Bankers Association (MBA) reported a 1.2% week-over-week gain in app volume. The MBA’s Refinance Index increased 5% over the previous week, and was 86% lower than the same week one year ago.

The MBA also reported the refinance share of mortgage activity increased to 30.7% of total applications, up from 30.3% the previous week, while the adjustable-rate mortgage (ARM) share of activity remained unchanged at 7.3% of total applications.

“The mortgage market began 2023 on a positive note, with a decline in mortgage rates leading to an uptick in refinance applications,” said MBA President and CEO Bob Broeksmit. “Purchase activity was down again on a weekly and annual basis. MBA expects mortgage rates to move lower over the course of the year, which should bring more homebuyers back into the market.”

Jobs numbers are on the rebound as the U.S. Department of Labor (DOL) reports that the advance seasonally adjusted insured unemployment rate was 1.1% for the week ending December 31, a decrease of 0.1 percentage point from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending December 31 was 1,634,000, a decrease of 63,000 from the previous week's revised level.

“Counterbalancing these trends, the labor market remains resilient, with a shortage of workers still a principal concern for many companies,” added Realtor.com Manager of Economic Research George Ratiu. “Many employees are finding they retain leverage, especially when changing jobs, and earning noticeable pay increases.”

And pay increases are key as many still struggle with affordability factors preventing them from jumping back into the market early on in 2023. Realtor.com, in its Monthly Housing Market Trends Report, reported that in December, the U.S. median listing price was $400,000, up 8.4% year-over-year, marking the first time since December 2021 that the annual growth rate has fallen below double-digits.

“With capital market volatility expected to continue, mortgage rates will maintain a seesaw trajectory over the short term, likely staying within the 6%-7% range we have seen over the past five months. For buyers who find a home to purchase, shopping for a mortgage with multiple lenders to secure the lowest rate and fees could result not only in a lower monthly payment, but also in tens of thousands of dollars saved over the life of the loan. This is especially important considering that at today’s rate, the monthly payment for a median-priced home is $1,990, not including taxes and insurance, a 51% increase from last January.”

And while prices were up year-over-year, one positive reported by Realtor.com was the nation’s rise in housing supply. There were 54.7% more homes for sale in December 2022 compared to the same time in 2021, meaning that there were 244,000 more homes available to buy year-over-year. While the number of homes for sale is increasing, it is still 38.2% lower than it was before the pandemic in 2017-2019, meaning that there are still fewer homes available to buy on a typical day than there were a few years ago.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news