The U.S. and other countries around the world should prepare for regulators to tighten up on lending standards in the coming year—and that's not the only change that's coming.

The U.S. and other countries around the world should prepare for regulators to tighten up on lending standards in the coming year—and that's not the only change that's coming.

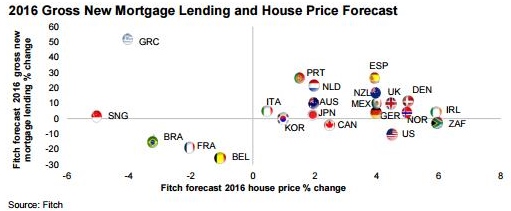

Fitch Ratings' analysts released their annual Global Housing and Mortgage Outlook report Wednesday, explaining that housing and mortgage markets will be stable or improve in 2016 in most of the 22 countries covered in the study. However, in six countries the outlook has improved (all in Europe), while in three countries the outlook has deteriorated (Brazil, South Africa, and Singapore). This outlook report includes more changes than in 2015, which shows "shifts in relative performance and greater disparity of conditions globally."

"While most markets are seen to be stabilizing or improving, a combination of macro-prudential controls and affordability constraints will constrain growth prospects," Fitch Ratings said in the report. "Low mortgage rates, GDP growth, improving employment and price rises will support the mortgage performance of many markets."

Fitch Ratings found that since housing is becoming more costly, regulators are taking steps to "cool the housing markets." This will restrain mortgage lending growth as "financial sector regulation and housing policy continue to affect the amount and composition of mortgage lending."

Fitch Ratings found that since housing is becoming more costly, regulators are taking steps to "cool the housing markets." This will restrain mortgage lending growth as "financial sector regulation and housing policy continue to affect the amount and composition of mortgage lending."

Fitch predicts that home prices will increase at a smaller rate in most countries, but the pace of the increases will likely be unchanged or decline from last year. Home prices are projected to rise 4 to 5 percent in the U.S. this year, led by positive economic momentum.

According to Fitch Ratings, home ownership is at a 25-year low in the U.S. and is still declining in many major mortgage markets. "Affordability constraints, mortgage availability, and consumer preferences, all have a bearing on home ownership rates–although improving funding conditions could act as a mitigant," Fitch Ratings said.

As far as rate hikes in the future are concerned, Fitch Ratings said, "we do not expect performance in the mostly fixed-rate U.S. market to deteriorate significantly. While such macro-prudential controls might help contain long-term risks related to certain sectors, they have generally not offset the impact of low interest rates. With monetary tightening underway or expected in some regions, the near-term impact of possible rate rises will be generally muted. However, they may affect performance where policy rates are already fairly high and the macroeconomic backdrop is less supportive, such as some emerging markets."

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news