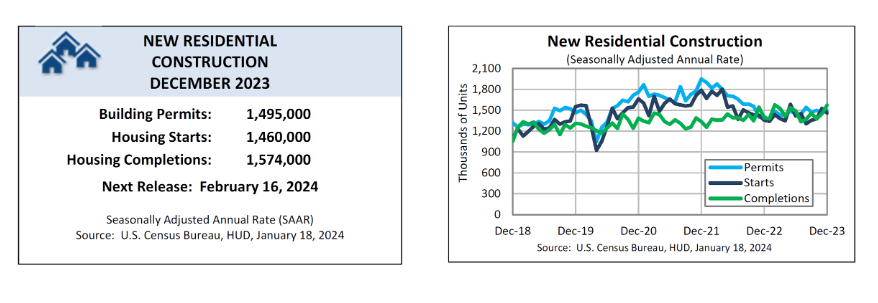

According to new data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD) for December 2023, privately‐owned housing completions were at a seasonally adjusted annual rate of 1,574,000—8.7% above the revised November 2023 estimate of 1,448,000, and 13.2% above the December 2022 rate of 1,390,000.

According to new data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD) for December 2023, privately‐owned housing completions were at a seasonally adjusted annual rate of 1,574,000—8.7% above the revised November 2023 estimate of 1,448,000, and 13.2% above the December 2022 rate of 1,390,000.

Single‐family housing completions in December 2023 were at a rate of 1,056,000—8.4% above the revised November rate of 974,000. The December rate for units in buildings with five units or more was 509,000.

“Single-family completions increased 8.4% compared with last month and 6.1% from one year ago,” said First American Deputy Chief Economist Odeta Kushi. “That's more supply added to the housing stock–good news for a housing market in need of more homes.”

An estimated 1,452,500 housing units were completed in 2023, which was 4.5% above the 2022 figure of 1,390,500.

“The jump in single-family permits and the upward trend in single-family housing starts alongside improving builder sentiment is an encouraging sign for the housing market,” added Kushi. “While headwinds remain, notably ongoing affordability constraints, the green shoots of a housing recovery have emerged alongside lower mortgage rates.”

The latest National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), found that the recent slide in mortgage rates has helped end a four-month decline in builder confidence, along with recent economic data signal improving housing conditions heading into the new year. The Index found builder confidence in the market for newly built single-family homes rose three points to 37 in December, reversing the trend of the previous four months.

“With mortgage rates down roughly 50-basis points over the past month, builders are reporting an uptick in traffic as some prospective buyers who previously felt priced out of the market are taking a second look,” said NAHB Chairman Alicia Huey. “With the nation facing a considerable housing shortage, boosting new home production is the best way to ease the affordability crisis, expand housing inventory, and lower inflation.”

Privately‐owned housing units authorized by building permits in December 2023 were at a seasonally adjusted annual rate of 1,495,000—1.9% above the revised November rate of 1,467,000, and 6.1% above the December 2022 rate of 1,409,000. Single‐family authorizations in December were at a rate of 994,000, which was 1.7% above the revised November figure of 977,000. Authorizations of units in buildings with five units or more were at a rate of 449,000 in December. An estimated 1,469,800 housing units were authorized by building permits in 2023, which was 11.7% below the 2022 figure of 1,665,100.

“Single-family permits, a leading indicator of future starts, reached the highest level since May 2022,” said Kushi. “This is consistent with the latest builder survey, which showed an uptick in builder sentiment and future sales expectations.”

Privately‐owned housing starts in December were at a seasonally adjusted annual rate of 1,460,000—4.3% below the revised November estimate of 1,525,000, but 7.6% above the December 2022 rate of 1,357,000. Single‐family housing starts in December 2023 were at a rate of 1,027,000—8.6% below the revised November 2023 figure of 1,124,000. The December rate for units in buildings with five units or more was 417,000. An estimated 1,413,100 housing units were started in 2023—9% below 2022’s figure of 1,552,600.

“Among the homebuilder sentiment index’s components, sales expectations in the next six months surged by 12 points into positive territory, reaching the highest level since July 2023,” said Kushi. “Lower mortgage rates are enticing buyers off the sidelines and fueling builder optimism. Additionally, a limited supply of existing homes continues to prompt a shift towards new home purchases.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news