According to the Joint Center for Housing Studies at Harvard University’s (JCHS) 2024 America’s Rental Housing report, which examines the state of rental housing in the U.S., including affordability and policy challenges, the JCHS found six major key findings which are as follows:

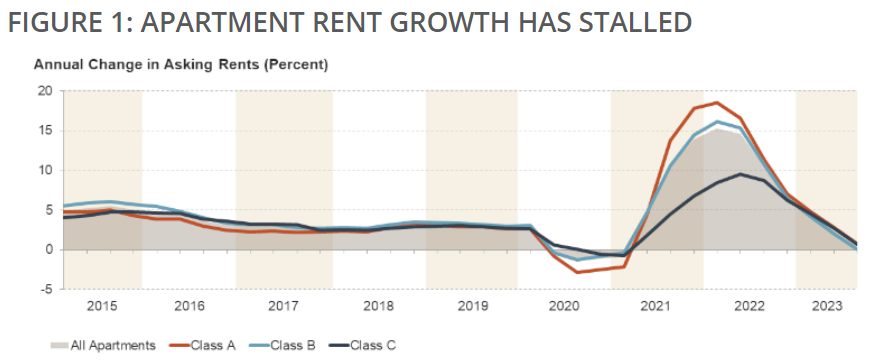

The first finding is that rental markets are softening across the country. After a pandemic fueled 2021 and 2022, apartment rent peaked by increasing at a rate of 15% annually in the first quarter of 2022 before decelerating. By the third quarter of 2023 rents were increasing at a rate of of just 0.4% year-over-year.

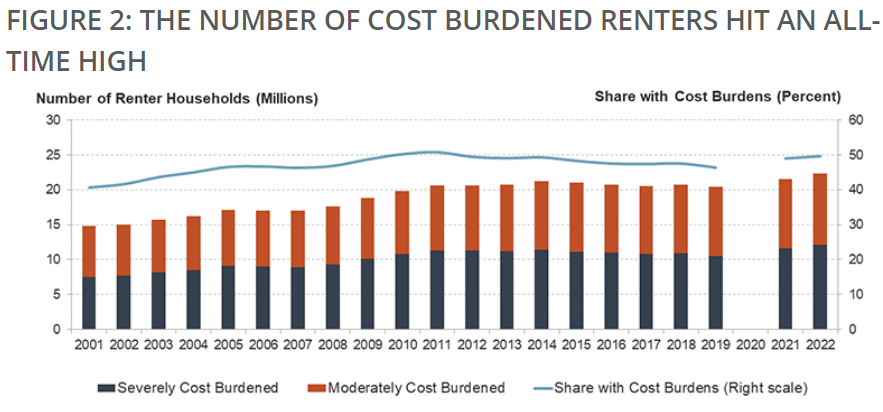

Second, affordability is wore than ever before. While markets are cooling, rents are still well above pre-pandemic levels meaning affordability conditions are the worst on record. In 2022, the number of cost-burdened renter households hit a new high of 22.4 million (Figure 2). This marked an increase of 2 million households since 2019 and pushed up the share of cost-burdened renter households to 50 percent, a 3.5 percentage point jump in just three years.

Moreso, the country continues to lose out on affordable, or low-cost rental housing, opting for upscale or luxury units that seem to be all the rage at the moment.

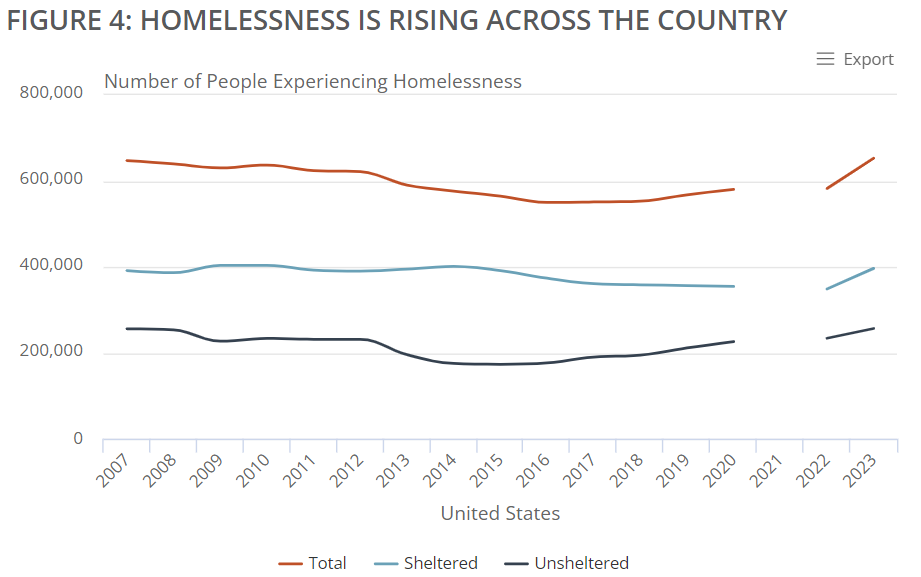

Third, housing instability is rising. Pandemic-era moratoriums and income support kept people housed, but as they ended many renter households were found to be vulnerable to housing instability. At the end of 2022, evictions neared pre-pandemic levels and remained elevated through the middle of 2023, when about 12% of renter households reported that they were still behind on rent.

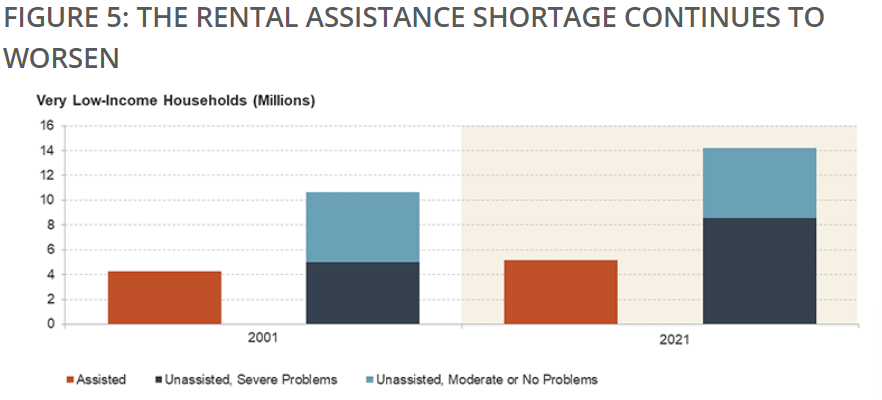

Fourth, rental assistance falls well short of the needs of renters. Despite detoriorating housing affordability and stability, rental assistance has not expanded to meet the growing needs of the masses. The number of very low-income renter households making no more than 50% of area median income grew by 4.4 million from 2001 to 2021, but the number of assisted households in this income range increased by just 910,000. This left 14 million income-eligible households to fend for themselves in an increasingly unaffordable market. Of those not receiving assistance, 8.5 million experienced worst case housing needs, meaning they spent more than half of their income on housing and/or lived in severely inadequate housing. A full 60% of unassisted households had worst case needs in 2021, up from 47% in 2001.

Fifth, the rental stock has significant investment needs. Rental stock is doing nothing but aging, with a median age of 44 years old, up from 34 years 20 years ago, meaning major work must be done on these units to make them habitable and up to code. The JCHS found that nearly 4 million renter households live in substandard conditions and need significant repairs. The Federal Reserve Bank of Philadelphia estimated it would cost $51.5 billion to address the repair needs of the occupied rental stock.

With the updates that are necessary, now is the time to think about energy efficiency; the Inflation Reduction Act included about $9 billion for household rebates and tax credits for approved upgrades as well as $1 billion to make the HUD-assisted stock more energy and water efficient. Additional federal resources are also needed to make resiliency improvements for the 18 million occupied rental units in areas with at least moderate annual economic losses from environmental hazards (Figure 6).

And finally, sixth, high interest rates are dampening rental market activity.

While renters don’t necessarily pay interest rates, their landlords do, and that cost must be passed on. In addition, the high interest rate environment over the last year has increased the cost of debt to build or acquire multifamily properties. In this environment, deals are less profitable, which has depressed both multifamily lending and apartment transactions.

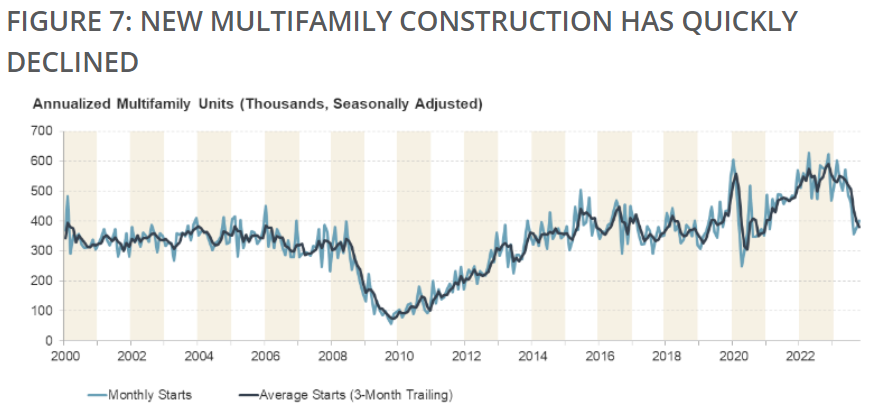

More concerning, according to the JCHS, is the swift slowdown in multifamily construction. Though starts are the highest seen is around two decades, they hit a seasonally adjusted annual rate of 571,000 units in May, but that number has since dropped. By October, starts were down 30% year over year. While there are a record-high number of units currently under construction, continued market cooling and high interest rates could lead to further declines in multifamily starts, creating supply challenges down the road.

Click here to read the report in its entirety.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news