When deciding whether or not to buy or rent a home, purchasing a home is typically more favorable in many of today's housing markets, depending on how long a buyer plans to stay, but one generation still struggles with the buy vs. rent decision.

When deciding whether or not to buy or rent a home, purchasing a home is typically more favorable in many of today's housing markets, depending on how long a buyer plans to stay, but one generation still struggles with the buy vs. rent decision.

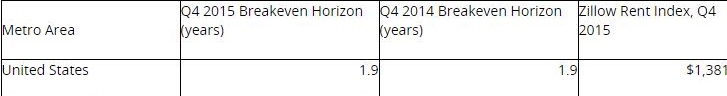

After buying a home, the break even point of the purchase becomes the next important factor to consider. Zillow's Breakeven Horizon analysis for the fourth quarter of 2015 found that buyers break even 1.9 years faster than renters on the same home in 70 percent of housing markets.

Zillow says that homebuyers' ability to break even on a home purchase in less than two years is due to " low interest rates, healthy home value forecasts, and the relatively fast pace of rents in recent years."

"On average in the U.S., you don't need to plan on living in a home for even two years to make purchasing the home more financially advantageous than renting it over the same time period," Zillow noted.

In some cities such as Washington (4.5 years), Los Angeles (4.1 years), and San Diego (3.4 years) buyers would need to stay in a home for at least three years to break even, according to Zillow. Dallas and Indianapolis have the shortest break even points at 1.3 years.

"Financially, it's still a better deal to buy a home than rent it, assuming you're planning to stay in the home for at least a couple years," Zillow said.

The millennial generation (under 35 years) struggle with the decision to buy a home because of job mobility, Zillow reports. On average, this generation works at the same place for an average of three years. It may not make sense for them to buy a home if this is case, even if the mortgage is more affordable.

"Even with record-high rents in job centers like San Jose, Boston and Washington. putting off a home purchase might be the best financial decision for a young person who has saved enough for a down payment, depending on how long they intend to stay in their jobs and homes," said Svenja Gudell, Zillow Chief Economist. "Young workers face a lot of hurdles on the way to homeownership, including saving for a down payment in the first place and deciding where and when to settle down. The latest Breakeven Horizon gives young people another data point to consider when they're making this important financial decision."

Zillow continued, "In general, rents are flattening across the country and expected to continue to stabilize, a factor that could lengthen the Breakeven Horizon as homes continue to appreciate."

Click here to read the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news