Asking prices rose dramatically in January as renting prices cooled off somewhat, according to the latest data in ""Trulia's"":http://www.trulia.com/ ""Price and Rent monitors"":http://trends.truliablog.com/2013/02/trulia-price-rent-monitors-jan-2013/.

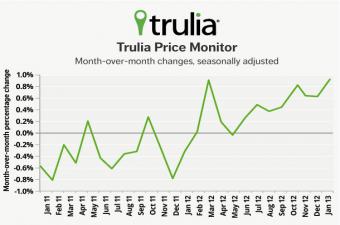

[IMAGE]The company's Price Monitor showed a 0.3 percent quarter-over-quarter rise in January (without seasonal adjustment), turning on its head the typical wintertime trend. On a seasonally adjusted basis, prices increased 2.2 percent quarterly.

Moreover, prices rose 0.9 percent month-over-month, the highest monthly gain since the price recovery began. Year-over-year, prices were up 5.9 percent from January 2012 (6.5 percent excluding foreclosures).

While January's numbers signal a strong price recovery, Trulia chief economist Jed Kolko warned that the month's gains could disappear as rapidly as they came on.

""In many local markets today, dramatic price gains can mask serious red flags,"" Kolko said. ""Strong job growth, low vacancy rate, and low foreclosure inventory--not huge price gains--are signs of a healthy housing market. Without strong underlying market fundamentals, price rebounds might be here today, but gone tomorrow.""

[COLUMN_BREAK]The company pointed to examples of ""booming"" markets such as San Francisco, California; Seattle, Washington; and Denver, Colorado; as examples of areas where prices are supported by strong job growth and are unthreatened by future foreclosures.

While they're currently benefitting from investor interest, ""rebounding"" markets like Phoenix, Arizona, and Las Vegas, Nevada, remain at risk from slow employment growth, high vacancies, and future foreclosures, Trulia said.

Meanwhile, ""struggling"" markets like Newark, New Jersey; Chicago, Illinois; and Albuquerque, New Mexico, suffer from weak fundamentals and slow price gains.

With more newly constructed multi-unit buildings coming to complete, rent gains fell behind asking price gains at the national level for the first time since the price recovery began last spring.

In January, rents rose 4.1 percent year-over-year on the national level, slowing down from 4.7 percent halfway through 2012.

Regionally, rent improvements cooled the most in San Francisco, where rents rose only 2.4 percent compared to 11.5 percent in July 2012. According to the Census Bureau, construction activity in San Francisco has been well above normal for the last year, with most of it happening in multi-unit buildings.

""Rent gains are slowing down because of more supply, not less demand,"" Kolko said. ""Many of the multi-unit buildings that have been under construction over the past two years are now coming onto the market. Renters in San Francisco, Seattle, and Denver are starting to get a touch of relief, even though rising prices might put homeownership out of their reach.""

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news