Future U.S. households will be more diverse, with Hispanics, Asians, African-Americans, and other minorities set to bolster up homeownership numbers in the coming decades.

Future U.S. households will be more diverse, with Hispanics, Asians, African-Americans, and other minorities set to bolster up homeownership numbers in the coming decades.

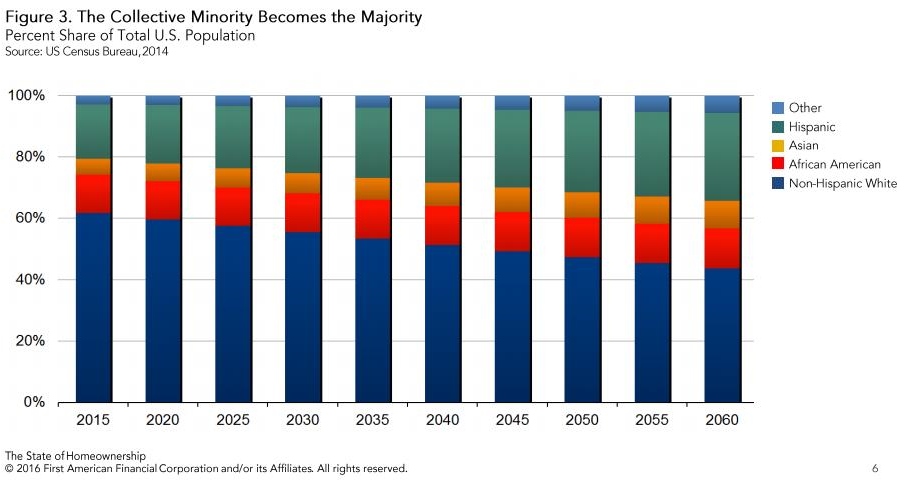

A whitepaper from First American's Chief Economist Mark Fleming showed that minority household numbers will see substantial growth in the next 45 years, with a large portion of the increase stemming from the Hispanic population.

According to First American, the U.S. population will be mostly minorities by 2045, and the fastest growing ethnic group will be Hispanics. This group will make up one-quarter of the total population, double the size of African-Americans.

Minority population growth is expected to also drive household formation growth and homeownership demand, Fleming said.

Minority population growth is expected to also drive household formation growth and homeownership demand, Fleming said.

"Just as non-Hispanic white Americans in the past have aged into their prime home-owning years, minority households will do the same, Fleming stated. "Today, large segments of the minority population, primarily Hispanic, are too young to be expected to pursue homeownership, yet their time will come."

Since the housing crisis, minority borrowers have had trouble getting a mortgage loan or been completely locked out of the housing market due to affordability problems. Now, eight years into the recovery, minorities are still a disproportionate part of the housing economy.

Zillow's recent analysis of mortgage access and homeownership by race showed that eased credit access is allowing more people to be eligible for mortgage loans, especially among middle-income blacks and Hispanics, but despite the uptick, they still lag behind in the housing market recovery.

Another report from the Urban Institute showed that clear signs of recovery have been recorded in the housing market, but minority borrowers do not seem to be linked to this recovery.

"A number of reforms can be undertaken to encourage lending to creditworthy borrowers who would have qualified before the housing boom," Urban Institute said. "A return to 2005 and 2006 lending practices would be ill-fated, but the pendulum has unquestionably swung too far. Today’s tight standards have locked out many prospective borrowers from homeownership, disproportionately preventing African-American and Hispanic families from building wealth and benefiting from the recovery."

Click here to view First American's whitepaper.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news