Mortgage loan defects, which can lead to fraudulence and misrepresentation in loan applications, are quickly leaving the industry due to companies making a sound investment in regulatory compliance technology.

Mortgage loan defects, which can lead to fraudulence and misrepresentation in loan applications, are quickly leaving the industry due to companies making a sound investment in regulatory compliance technology.

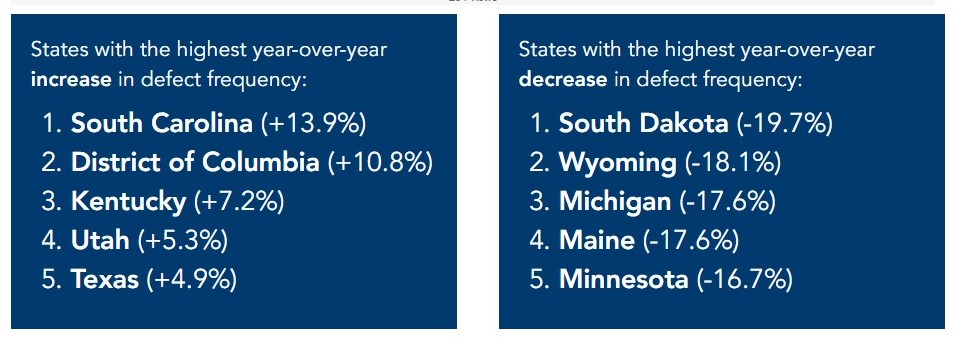

First American Financial Corporation's Loan Application Defect Index released Thursday declined for the seventh consecutive month by 1.3 percent in February 2016 compared to January and is down 5.1 percent year-over-year. The defect index now stands at 76, the lowest it has been since inception.

According to First American, the index value is based on the frequency with which defect indicators are identified, and it moves higher as greater numbers of defect indicators are identified. An increase in the index indicates a rising level of loan application defects. The index, nationally and in all markets, is benchmarked to a value of 100 in January 2011. Therefore, all index values can be interpreted as the percentage change in defect frequency relative to the defect frequency identified nationally in January 2011.

"Defect and fraud risk in loan applications is an impediment to sustainable credit expansion and potentially limits access to the American Dream for those who could benefit most." -Mark Fleming.

The report said that it is difficult to know what a "normal" level of defect risk is, but the 76 value is significantly lower than the three years between 2011 and 2013, when it was consistently above a value of 90. It is also down 26.5 percent from the all-time high in October 2013 and has declined 3.8 percent over the last three months.

"The continued decline in loan application and mortgage defect risk is indicative of the benefits the industry is accruing from investments in technology and improved production standards,” said Mark Fleming, Chief Economist at First American. “The investments to improve compliance are producing real benefits in the form of higher quality loan manufacturing processes with fewer defects and less misrepresentation.”

Refinance transaction defects fell 1.5 percent month-over-month, and is now 9.7 percent lower than a year ago, according to the report. Meanwhile, the index for purchase transactions was unchanged month-over-month, and is down 4.5 percent compared to a year ago.

"We are excited about the further clarification to the market by the Federal Housing Finance Agency that the GSEs will use an independent dispute resolution (IDR) process to resolve repurchase disputes as a result of loan application defects and fraud," Fleming stated."Based on the improving defect and fraud risk profile of recent loan applications, we expect the need for the IDR process to decline in the coming years as well."

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news