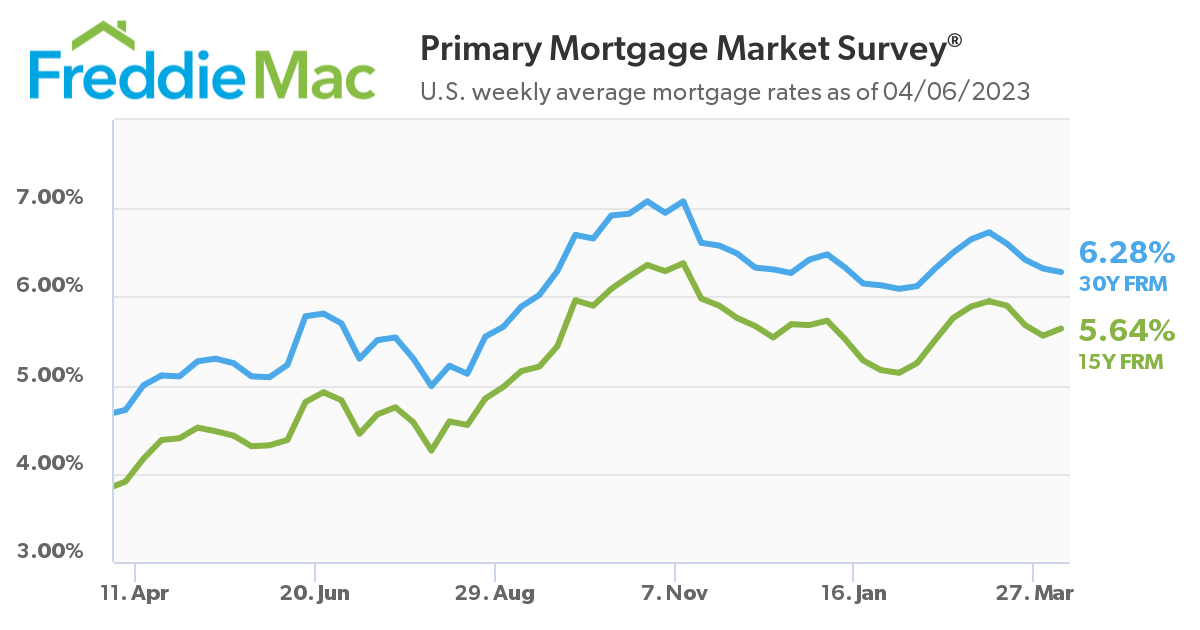

The fixed-rate mortgage (FRM) continues to tumble closer to the 6% mark, falling for the fourth consecutive week, as Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows the 30-year FRM averaging 6.28%, down slightly from last weeks’ average of 6.32%. A year ago at this time, the 30-year FRM averaged 4.72%.

The fixed-rate mortgage (FRM) continues to tumble closer to the 6% mark, falling for the fourth consecutive week, as Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows the 30-year FRM averaging 6.28%, down slightly from last weeks’ average of 6.32%. A year ago at this time, the 30-year FRM averaged 4.72%.

“Mortgage rates continue to trend down entering the traditional spring homebuying season,” said Sam Khater, Freddie Mac’s Chief Economist. “Unfortunately, those in the market to buy are facing a number of challenges, not the least of which is the low inventory of homes for sale, especially for aspiring first-time homebuyers.”

Also this week, the 15-year FRM averaged 5.64%, up from last week when it averaged 5.56%. A year ago at this time, the 15-year FRM averaged 3.91%.

“The fallout from the regional bank collapses has led to tightening lending conditions, though not on residential mortgages,” explained Lawrence Yun, Chief Economist for the National Association of Realtors (NAR). “That is because nearly all mortgages have government guarantees, assuring an eager appetite to provide VA, FHA, and nearly all conforming mortgages to those homebuyers willing to stay within budget.”

Despite the FRM sliding for the fourth straight week, buyers are not necessarily coming out in droves as the spring homebuying season gets underway, as the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 31, 2023 found mortgage application volume decreasing 4.1% week-over-week.

“This spring season is positioned to look different from the white-hot springs of 2021 and 2022,” noted Robert D. Broeksmit, CMB, President and CEO of the Mortgage Bankers Association (MBA). “The current market is seeing lower demand and fewer fresh listings as buyers and sellers weigh whether to dip a toe in or wait until conditions improve. Each gain in affordability is accompanied by new buyer activity, and while buyers and sellers can’t control mortgage rates, lower home prices can drum up demand by making a home purchase more feasible. As those buyers who are still in the market look for well-priced new listings, sellers can ensure attention by getting to know their local market and listing a well-maintained home for an attractive price. This year’s Best Time to Sell is approaching, as the week of April 16-22 is historically the best week of the year to list, and provides the best combination of conditions for a quick sale at an above-average price.”

As Broeksmit notes, nationally, homeowners who list the week of April 16-22, 2023 on average hit the sweet spot in terms of the best combination of higher prices, fewer homes to compete against, faster sales time, and strong homebuyer demand. A recent survey from Realtor.com and HarrisX found that 60% of home sellers took up to three months to get their home ready to list, so for homeowners who have been making preparations, listing during that crucial April week could yield $48,000 more for their home than they would have at the start of the year.

"Many home shoppers kick off their search in the early spring and they often beat the majority of home sellers to the punch," said Realtor.com Chief Economist Danielle Hale. "For this reason, sellers who list on the earlier side will get more buyer attention and therefore be more likely to sell quickly and for a higher price."

Redfin reports that the nation’s housing supply remains an obstacle for many, as new listings fell 21.8% year-over-year nationwide during the four weeks ending April 2, one of the biggest drops since the start of the pandemic, contributing to an unseasonal early-spring decline in the total number of homes for sale. Redfin found that many are staying put because they are unwilling to give up their low mortgage rate. Although average 30-year mortgage rates posted their fourth-straight decline this week, dropping to 6.28%, that’s more than double the sub-3% rates common in 2021.

Yun notes the solution to scarce supply may lie in apartment construction and a flooding of the market of new available units.

“Though week-to-week rate changes can move up and down, the longer-term prospect on rates is for further improvement, with a clear possibility of going under 6% by the year’s end,” adds Yun. “This is because, with so much apartment construction, the new empty units steadily hitting the market will limit rent growth and calm overall consumer price inflation. The Federal Reserve can therefore stop tightening. With lower rates, more homebuyers will steadily appear. That is why it is critical to ensure more housing supply to help meet the recovering demand.”

A recent Redfin analysis found that buyers are snapping up the homes that do hit the market extremely fast. Of the homes going under contract, nearly half are doing so within two weeks. That’s up from about one-quarter at the start of the year, an unusually quick winter increase. It would take 2.8 months for today’s supply of for-sale homes to sell at homebuyers’ current consumption rate, the shortest time since September. That’s a sharp drop from the three-year high of 4.5 months in late January and it marks the fastest winter decline in months of supply since at least 2015, in percentage terms. It’s up from a near-record-low of 1.9 months a year ago.

“Shiny new listings are getting multiple offers and selling fast. The caveat is that they have to be priced correctly from the beginning,” said Redfin Agent Stephanie Collins. “One of my buyers recently made an offer on a move-in ready home in a popular area. The home was priced right in line with the market at $520,000; it received eight offers and went for $560,000 to a competing buyer. That same client just had an offer $35,000 over asking price accepted in the same neighborhood. Sellers are hesitant, partly because it’s not spring 2022 anymore. I’m reminding potential sellers that buyers are out there, and some homes have bidding wars—they just need to price a bit lower than they would have a year ago.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news