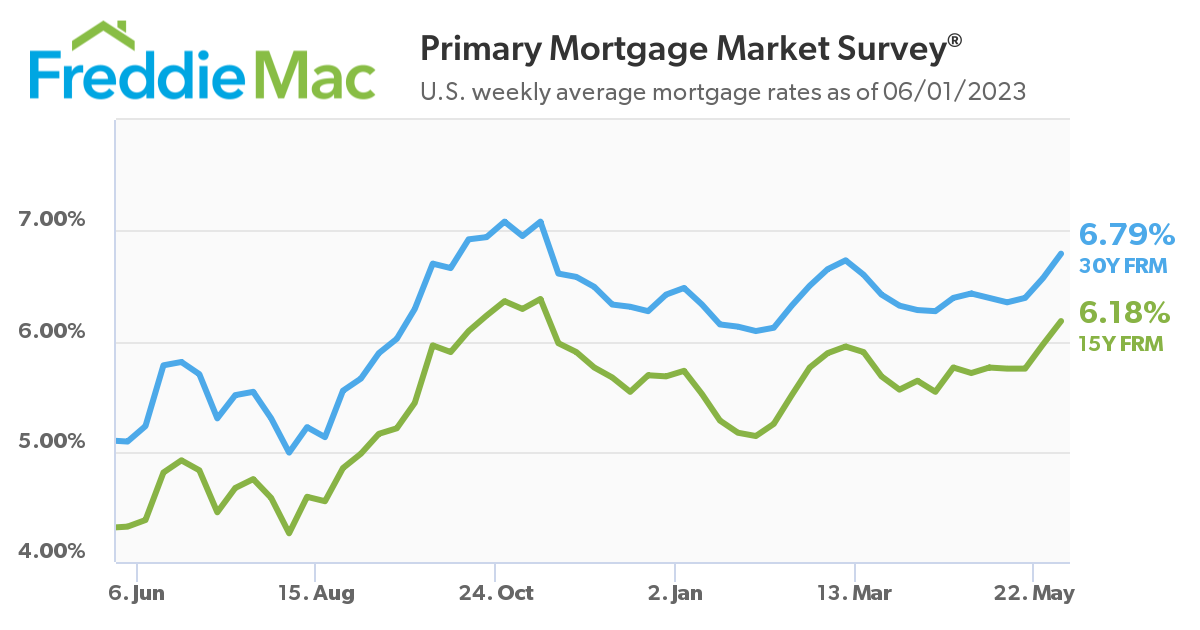

Freddie Mac has reported in its latest Primary Mortgage Market Survey (PMMS) that the 30-year fixed-rate mortgage (FRM) rose by 0.22 percentage points to 6.79% as of June 1, 2023, up from last week’s average of 6.57%. A year ago at this time, the 30-year FRM averaged 5.09%.

Freddie Mac has reported in its latest Primary Mortgage Market Survey (PMMS) that the 30-year fixed-rate mortgage (FRM) rose by 0.22 percentage points to 6.79% as of June 1, 2023, up from last week’s average of 6.57%. A year ago at this time, the 30-year FRM averaged 5.09%.

“Mortgage rates jumped this week, as a buoyant economy has prompted the market to price-in the likelihood of another Federal Reserve rate hike,” said Sam Khater, Freddie Mac’s Chief Economist. “Although there has been a steady flow of purchase demand around rates in the low- to mid-6% range, that demand is likely to weaken as rates approach 7%.”

Also this week, the 15-year FRM averaged 6.18%, up from last week when it averaged 5.97%. A year ago at this time, the 15-year FRM averaged 4.32%.

“The fear of a debt default continued to spread last week, which may have pushed the mortgage rate higher,” added Realtor.com Economist Jiayi Xu. “The fear of debt default affects mortgage rates through government-backed bonds. Investors lend money to the government through these bonds for a fixed term, earning interest. If the U.S. defaults on its debt, bond investments become riskier, resulting in increased yields and potentially higher mortgage rates.”

Late Thursday evening, the U.S. Senate voted 63-36 on bipartisan legislation suspending the nation’s debt limit and imposing new spending caps. The measure now moves onto the desk of President Biden where it awaits his signature.

“However, it is important to note that the successful passage of the debt ceiling deal does not provide an absolute safeguard against negative financial and economic consequences,” noted Xu. “Once the deal is reached, the U.S. government is expected to quickly increase issuance of Treasury bills, which has the potential to cause short-term liquidity challenges at banks, as businesses and households may reallocate their funds towards higher-yielding, and relatively safer government debt. In order to keep attracting depositors, banks might be compelled to raise interest rates, thereby squeezing profit margins. This could lead to further rate increases across various loan products offered by banks, including both business loans and personal loans.”

And as mortgage rates continue to inch toward the 7% mark, the Mortgage Bankers Association (MBA) reported that overall mortgage application volume fell for the third straight week, dropping 3.7% week-over-week for the week ending May 26, 2023.

“Mortgage applications declined for the third straight week, as higher rates, ongoing economic uncertainty, and declining affordability continue to dampen borrower demand,” said MBA President and CEO Bob Broeksmit. “The lack of homes for sale remains a headwind for the housing market this year, leading to elevated home prices, and households deciding to delay buying a home.”

The National Association of Home Builders (NAHB) reports that more Americans are turning to new home construction as existing inventory remains low and mortgage rates begin to stabilize. Sales of newly built, single-family homes increased in April, reaching the highest level since March 2022.

“Buyers are purchasing new homes so they can start investing in homeownership now instead of waiting for an existing home to come on the market,” said NAHB Chairman Alicia Huey. “Builders want to meet buyer demand; however, high construction costs and labor shortages remain persistent challenges for the residential construction industry.”

The NAHB notes that limited existing inventory has placed a renewed emphasis on new construction. In addition, new home construction is taking on an increased role in the marketplace because many homeowners with loans well below current mortgage rates are electing to stay put. Current interest rates have more than doubled from 2021. As a result, the supply of existing homes is incredibly low.

“As mortgage rates remain elevated, there has been a decline in prices of existing home sales over the past three months,” said Xu. “As a result, we may see a potential decrease in asking prices during the upcoming summer season. It is important to consider what falling home prices could mean for the housing market. While a decline in home prices would be welcome to first time home buyers who lack existing equity to leverage, it could potentially erode some of the equity of current homeowners and pose risks to the financial system However, thanks to today's near-record high home equity levels, even in the event of a substantial 10% decline in home values from their level at the end of the fourth quarter, whether occurring suddenly or over two years with a climbing mortgage debt–this is an incredibly unlikely scenario. Home equity as a share of total real estate value would still exceed 60%, offering a significant cushion for existing homeowners in aggregate.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news