When it comes to assessing lender risk associated with a potential homebuyer, the credit score is a crucial tool. And the average American understands and accepts the importance of their credit score when it comes to loan approval and terms — right?

When it comes to assessing lender risk associated with a potential homebuyer, the credit score is a crucial tool. And the average American understands and accepts the importance of their credit score when it comes to loan approval and terms — right?

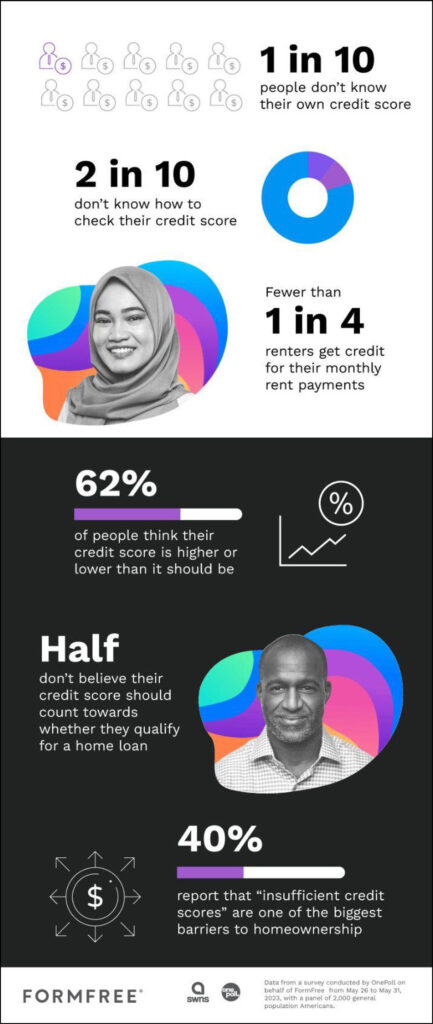

Not necessarily. A new survey from Formfree, which aims to empower borrowers, challenges that assumption, revealing that one in 10 Americans have no idea what their credit score is and one in five Americans do not know how to even check their credit score. Many have altogether given up on the idea of owning a home due to their credit score.

FormFree’s CEO Brent Chandler says the information collected in this survey is a wake-up call and an opportunity for mortgage lenders to improve their assessment of loan applicants’ ability to pay by considering consumers’ overall cash flow instead of solely relying on traditional credit scoring models.

“Only 28% of consumers view these models as transparent, while a significant 40% express a preference for a more open home financing process where lenders compete to offer the best terms,” Chandler says. “It’s time to embrace a more holistic approach that benefits both consumers and lenders alike.”

Of the 2,000 survey respondents, 80% of whom (1,612) identified as current homeowners, only one in four respondents thinks their credit score is an accurate reflection of their financial status.

About one in nine respondents (12%) feel their credit score is lower than it should be, and another 50% actually feel their credit score is higher than it should be, including slightly more homeowners (51%) than non-homeowners (46%).

The survey also revealed that only half of Americans believe their credit score should count toward whether or not they qualify for a home loan.

While 49% said that their credit score should be considered, another 53% would prefer that their ability to pay their bills on time should also be factored in.

The study reveals that many have resigned themselves to never buying their own house. Only 50% of non-homeowners said they were confident that they’ll one day be able to afford a house.

Respondents collectively determined that a credit score between 670 and 769 would be needed to secure a mortgage; 20% of them put their current score at somewhere under 669.

Forty percent cited “insufficient credit scores” as one of the biggest barriers to homeownership for the average American, just under “difficulty qualifying for a mortgage loan” (42%) and “insufficient savings for a down payment” (43%).

Chandler elaborated on the notion that credit scores, considering their weight, do not take enough information into account.

“It is astonishingly rare for credit bureaus to receive comprehensive reports on consumers’ payment history from landlords or utility companies. At a time when the average monthly rent is higher than the average mortgage payment in many U.S. cities, only 24% of renters are getting credit for managing their housing expenses,” Chandler said.

He concluded that “this lack of data fails to provide a fair assessment of individuals’ financial management skills and undermines the accuracy of credit evaluations when used without deeper cash-flow analytics.”

The full report and methodology is available at formfree.com.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news