While nationwide housing supply remains scarce, there's a clear correlation between a lack of affordable housing and high rates of homelessness in America's biggest cities, according to new research from Home Bay.

The report analyzed the 50 most-populous U.S. metros to determine the connection between home values and homelessness rates.

Cities with High Home Values Have More Homelessness

Metro areas with home values higher than the typical U.S. home ($301,466) have homeless rates 2.5 times higher than areas with lower-than-average home values.

The 28 metros with higher-than-average home values have an average homeless rate of 207 per 100,000 people. Meanwhile, the 22 metros with lower-than-average home values have an average homeless rate of 79 per 100,000 people.

High prices are an indicator of high demand, and high demand comes from scarcity, such as a low supply of affordable housing.

Although most Americans believe the main causes of homelessness are substance use or mental health challenges, some researchers put more emphasis on the overall cost of housing. Home Bay’s findings are consistent with that thesis.

The cities with the highest rates of homelessness per 100,000 people are:

- San Jose, California (636.8)

- San Francisco (508.8)

- Los Angeles (501)

- Sacramento, California (415.7)

- Seattle (408.9)

- New York (340.7)

- San Diego (256.4)

- Las Vegas (246.2)

- Portland, Oregon (240.3)

- Denver (231.6)

- Hartford, Connecticut (192)

- Phoenix (182.5)

These 12 metros have a combined average homelessness rate of 347 per 100,000 people—almost 2 times higher than the national average (176 per 100,000 people).

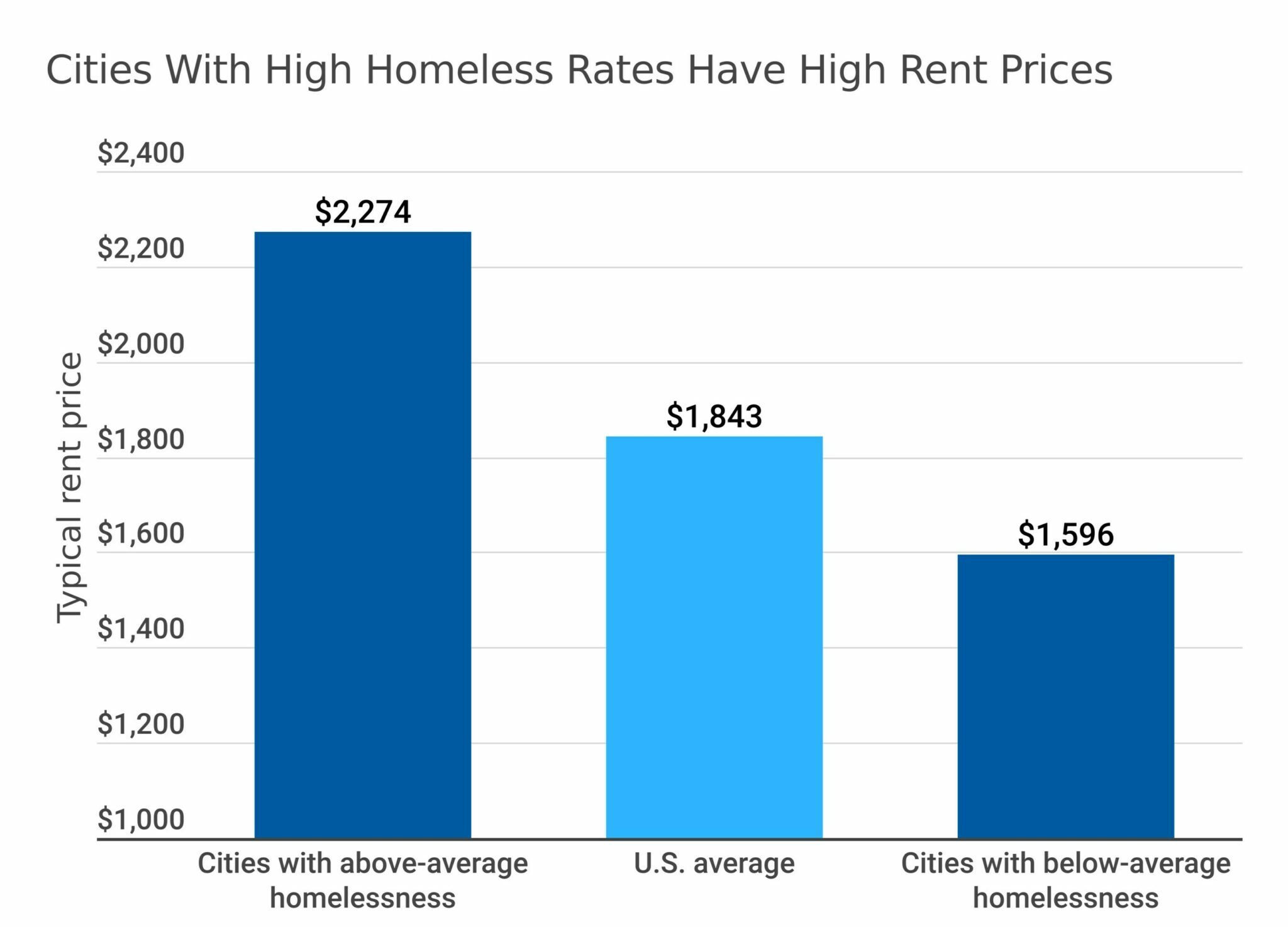

Meanwhile, the typical home value in these metros is 118% higher than the typical value in cities with lower-than-average homelessness—$670,000 vs. $308,000. These cities also have typical monthly rent values almost $700 higher than the national average—$2,274 vs. $1,596.

San Jose, California, has both the highest rate of homelessness and the highest home prices of any major U.S. metro. Home values in San Jose are 4.5 times the national average, at $1.39 million, and the homelessness rate is a whopping 3.5 times the national average—an estimated 636.8 per 100,000 residents.

The 10 metros with the lowest homeless rates per 100,000 residents are:

- Atlanta (32.8)

- Pittsburgh (37.4)

- Chicago (40.7)

- Houston (43.3)

- Cincinnati (47.8)

- Detroit (51)

- Richmond, Virginia (52.6)

- Milwaukee (53.1)

- Charlotte, North Carolina (65.2)

- Buffalo, New York (73.6)

The five cities with the lowest homeless rates also have home values 15% lower than the U.S. average ($255,860 vs. $301,466).

Surprisingly, poverty rates are not a good indicator of homeless rates. New Orleans has the highest poverty rate (18.4%) of any city we examined but has a homeless rate half the national average (96 per 100,000 people).

This may indicate that, because of a low cost of living, residents can better afford housing despite lower incomes.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news