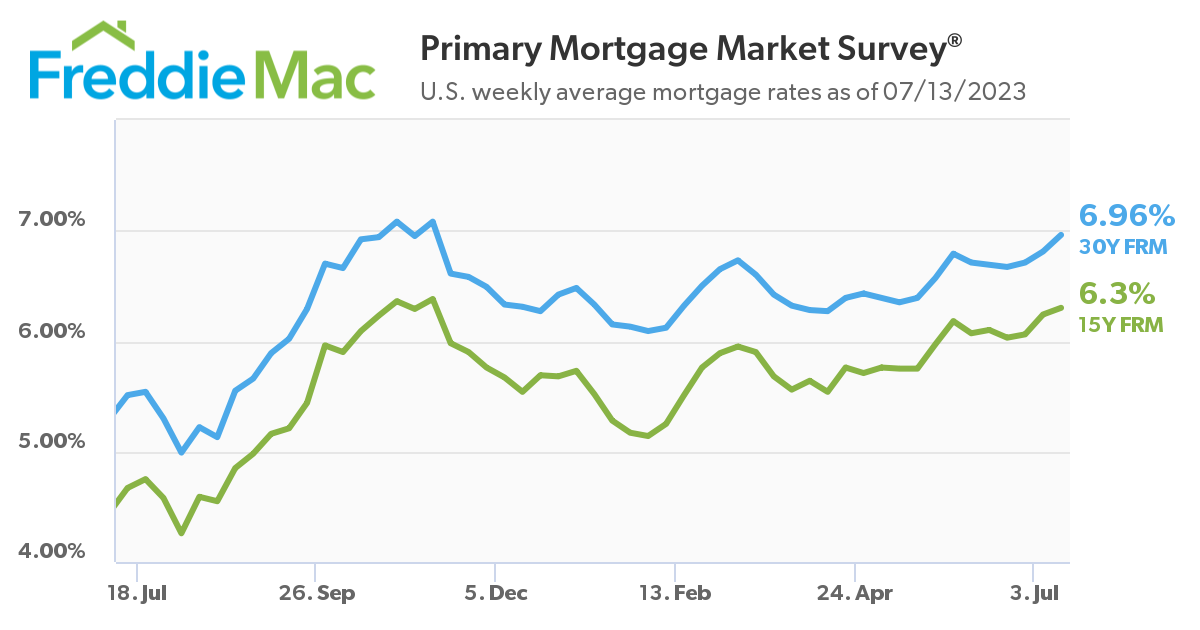

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) for the week ending July 13, 2023, shows that the 30-year fixed-rate mortgage (FRM) steadily nearing the 7%-mark, averaging 6.96%, up 15 basis points over last week’s average of 6.81%. A year ago at this time, the 30-year FRM averaged 5.51%.

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) for the week ending July 13, 2023, shows that the 30-year fixed-rate mortgage (FRM) steadily nearing the 7%-mark, averaging 6.96%, up 15 basis points over last week’s average of 6.81%. A year ago at this time, the 30-year FRM averaged 5.51%.

Also this week, the 15-year FRM averaged 6.30%, up from last week when it averaged 6.24%. A year ago at this time, the 15-year FRM averaged 4.67%.

“Mortgage rates increased to their highest level since November 2022, the last time rates broke 7%,” said Sam Khater, Freddie Mac’s Chief Economist. “Incoming data suggest that inflation is softening, falling to its lowest annual rate in more than two years. However, increases in housing costs, which account for a large share of inflation, remain stubbornly high, mainly due to low inventory relative to demand.”

The U.S. Bureau of Labor Statistics (BLS) reported yesterday that inflation is cooling, as Federal Reserve continues its taming of the fed funds rate. The BLS reported that the Consumer Price Index (CPI) rose 3% in the year through June 2023, less than the 4% increase in the year through May, and just a third of its near 9% peak recorded last summer.

“The Freddie Mac fixed rate for a 30-year mortgage continued to rise for a third week in a row, increasing by 0.15 percentage points to 6.96% this week,” added Realtor.com Economist Jiayi Xu. “Meanwhile, the headline inflation rate continued to cool in June, rising 0.2% from May and up 3.0% from a year ago, the smallest annual increase since March 2021. The core inflation rate, excluding volatile food and energy prices, slid to 4.8%, registering the slowest annual growth since October 2021. More importantly, the 0.2% monthly increase in core inflation aligns with a 1.9% annual rate of change if sustained, the lowest since February 2021. Looking ahead, we may continue to expect the inflation slowdown as the growth in the shelter index, the largest contributor to inflation growth, passed its peak in April and has since been on a downward trend.”

As mortgage rates shifted upward, the Mortgage Bankers Association (MBA) reported that an uptick in FHA and VA apps pushed overall mortgage application volume upward week-over-week, rising 0.9% over the previous week.

“The increase was led by small gains in FHA and VA purchase applications,” noted MBA President and CEO Robert D. Broeksmit. “MBA still expects mortgage rates to decline to around 6% by the end of the year, which should bring more buyers into the market.”

The U.S. Department of Labor (DOL) reports that for the week ending July 8, the advance figure for seasonally adjusted initial unemployment claims was 237,000, a decrease of 12,000 from the previous week's revised level. The advance seasonally adjusted insured unemployment rate was 1.2% for the week ending July 1, unchanged from the previous week's unrevised rate.

“While the improvement in inflation is encouraging, the level itself is still well above the 2% target,” said Xu. “In addition, the strong job market will continue to drive demand in the economy, fuel price increases and contribute to higher inflation. As a result, it is still highly likely that an additional rate hike will occur later in July. Nevertheless, today's encouraging inflation data could be used as a basis for another ‘wait-and-see’ approach in the upcoming FOMC meeting, which may help reverse the recent rise in mortgage rates. This, in turn, would create a more favorable environment for those looking to purchase a home in the coming fall season.”

Despite all the forces at play in the homeownership game, a recent study from the National Association of Realtors (NAR) found that a lack of inventory is providing a major hurdle for those on the path the homeownership. Amid a significant shortage of housing supply in 2022, 32% of Realtors named a lack of inventory as the most important factor limiting potential clients from making a purchase, according to the NAR 2023 Member Profile.

“The strong labor market data indicates that households continue to be in a good economic position and can approach various purchases, including housing, with some confidence,” added Xu. “Nevertheless, elevated mortgage rates and still-high housing prices continue to present significant challenges for home buyers, slowing home purchases and putting pressures on home and rental prices. While both buyers and sellers have pulled back their activities from the pandemic-era frenzy, buyers have adapted more quickly to the higher mortgage rate environment as we started to see a declining number of homes for sale on a yearly basis starting in late June. Looking ahead, we expect the existing home for-sale inventory will experience a modest drop of 5% for the year as a whole. Fortunately for buyers, new homes remain an option, as builders are continuing to add homes with a somewhat greater focus on affordable price points.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news