According to a new study from the Joint Center for Housing Studies, immigrants make up a growing share of the U.S. population and by 2040, foreign-born households will constitute the primary source of new housing demand.

The report examines both the unique barriers and opportunities that immigrants face as they seek to buy a home. A New JCHS working paper, “Immigrants’ Access to Homeownership in the United States: A Review of Barriers, Discrimination, and Opportunities,” helps fill that gap by reviewing existing scholarship on immigrant homeownership.

In 2021, over one in seven U.S. households—an estimated 16%—were headed by a foreign-born resident. The highest shares of immigrants had moved from Mexico, followed by India, China, the Philippines, and Cuba.

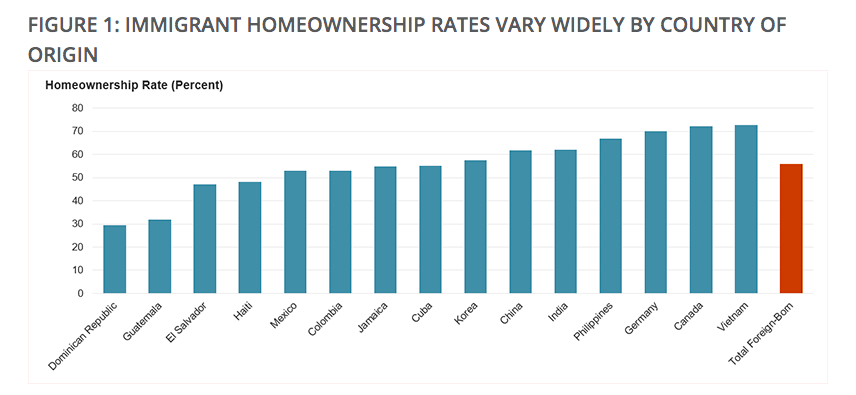

Homeownership rates varied sharply between different groups of immigrants.

In 2021, the homeownership rates for the 10 largest groups of immigrants ranged from a high of 73% of households from Vietnam, to a low of 29% of households from the Dominican Republic.

Immigrants Face Unique Barriers in Becoming Homeowners

General factors such as age and income influence immigrants’ ability to become homeowners as does the amount of time they have been in the country.

Only 16% of Hispanic immigrant households who lived in the United States for five years or less owned a home in 2000, compared to 61% of Hispanic immigrant households who had been in the country for 21 years or more.

The duration of residence relates to the capacity to surmount other barriers to homeownership over time, including shifting into a more secure legal status, moving away from lower-opportunity, segregated neighborhoods, gaining better employment, and building savings and credit history in the United States.

Immigrants, particularly immigrants of color and those who are undocumented, face unique barriers when trying to buy a home.

Legal status can complicate immigrants’ paths to homeownership, as those who are undocumented or have temporary visa status often have less secure and well-paying jobs, find it hard to access the banking system, and lack a sense of security in the United States.

While contemporary discussions often focus on undocumented versus "legal" immigrants, immigrants experience many gradations of legal status, including within their own households, that make it harder to become homeowners.

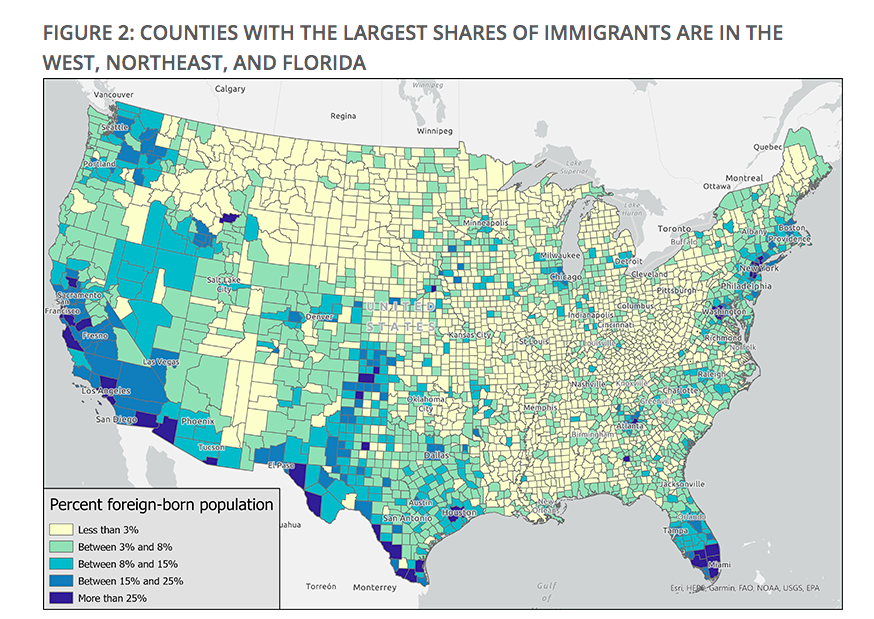

The locations where immigrants have settled can present distinct challenges due to local variations in housing costs and available housing stock. Most immigrants first settle in high-cost urban areas such as New York City and Los Angeles, but since the 1990s, many immigrants have moved to new destinations in rural areas, Sunbelt cities, and suburbs.

While many immigrants still live in traditional immigrant gateways, like the New York and Miami areas, immigrants also make up a larger share of the population in suburban and rural counties across the southwest, including in Texas, New Mexico, and Nevada.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news