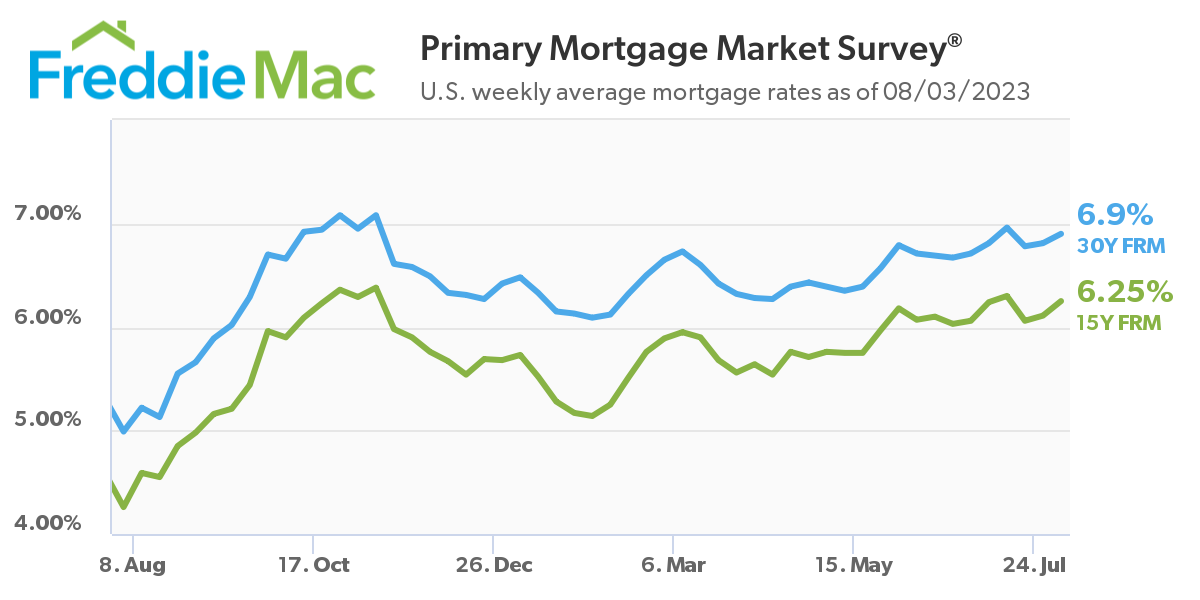

Mortgage rates rose once again this week, as Freddie Mac reported in its latest Primary Mortgage Market Survey (PMMS) for the week ending August 3, 2023, the 30-year fixed-rate mortgage (FRM) averaged 6.90%, nine basis points higher than last week’s average of 6.81%. A year ago at this time, the 30-year FRM averaged 4.99%.

Mortgage rates rose once again this week, as Freddie Mac reported in its latest Primary Mortgage Market Survey (PMMS) for the week ending August 3, 2023, the 30-year fixed-rate mortgage (FRM) averaged 6.90%, nine basis points higher than last week’s average of 6.81%. A year ago at this time, the 30-year FRM averaged 4.99%.

“The combination of upbeat economic data, and the U.S. government credit rating downgrade caused mortgage rates to rise this week,” said Sam Khater, Freddie Mac’s Chief Economist. “Despite higher rates and lower purchase demand, home prices have increased due to very low unsold inventory.”

Earlier this week, Fitch Ratings downgraded Fannie Mae's and Freddie Mac's Long-Term Issuer Default Ratings (IDR) and senior unsecured debt ratings to 'AA+' from 'AAA' and downgraded their respective Government Support Ratings (GSR) to 'aa+' from 'aaa.’ As government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac benefit from implicit government support. The GSEs' respective Long-Term IDRs and GSRs are directly linked to the U.S. sovereign's Long-Term IDRs based on Fitch's view of the U.S. government's direct financial support. Fitch notes that the downgrade of Fannie Mae's and Freddie Mac's Long-Term IDRs and GSRs is consistent with the recent action taken on the U.S. and is not being driven by fundamental credit, capital, or liquidity deterioration at the firms.

Also this week, the 15-year FRM averaged 6.25%, up from last week when it averaged 6.11%. A year ago at this time, the 15-year FRM averaged 4.26%.

“On Wednesday, the U.S. Treasury announced it would sell off more than $100 billion of long-term securities, driving 10-year treasury yields to the highest level since November 2022,” explained Realtor.com Economic Data Analyst Hannah Jones. “This development, along with upcoming employment and inflation data, will determine how much mortgage rates may rise in the short term. Should employment and inflation pick up steam, mortgage rates are likely to continue climbing, as markets anticipate further monetary tightening.

Last week, the nominal interest rate set by the Federal Reserve’s Federal Open Market Committee (FOMC) was raised by 25 basis points and now stands at 5.25-5.50%.

The most aggressive series of rate hikes in history ended in June, when the FOMC held off on raising rates due to a litany of positive factors which consisted of 10 straight rate hikes over 15 months. Since the post-pandemic rate hikes began, the FOMC raised rates in March 2022 (+25 points), May 2022 (+50 points), June 2022 (+75 points), August 2022 (+75 points), September (+75 points), November 2022 (+75 points), December 2022 (+50 points), February 2023 (+50 points), March 2023 (+25 points), May 2023 (+25 points) and June ( +0 points)–equivalent to a rise of five percentage points over the last year.

“Last week, the FOMC raised the federal funds rate by the expected 25-basis points,” added Jones. “The Committee’s statement emphasized that incoming economic data will guide future rate hike choices. Home buyers continue to feel the effects of tighter policy, which keeps a floor under mortgage rates. Still-high home prices and elevated mortgage rates have eaten into purchasing power for many buyers, leading to both fewer home sales and fewer listings. However, many markets, especially more affordable locales, continue to see high demand and rapid price growth as home shoppers flock to areas, such as those featured in the Summer’s Emerging Housing Markets, where homeownership is still within reach.”

Realtor.com recently ranked the nation’s top emerging housing markets, highlighting the markets that offer shoppers a lower cost of living, including for homes, and thriving local economies. Rounding out the top 10 are:

- Lafayette-West Lafayette, Indiana, where the median price of a home in June 2023 was $355,000

- Fort Wayne, Indiana, where the median price of a home in June 2023 was $350,000

- Elkhart-Goshen, Indiana, where the median price of a home in June 2023 was $285,000

- Bloomington, Illinois, where the median price of a home in June 2023 was $331,000

- Sioux City, Iowa-Nebraska-South Dakota, where the median price of a home in June 2023 was $342,000

- Columbus, Ohio, where the median price of a home in June 2023 was $399,000

- Topeka, Kansas, where the median price of a home in June 2023 was $298,000

- Johnson City, Tennessee, where the median price of a home in June 2023 was $422,000

- South Bend-Mishawaka, Indiana-Michigan, where the median price of a home in June 2023 was $292,000

- Kingsport-Bristol-Bristol, Tennessee-Virginia, where the median price of a home in June 2023 was $342,000

“Today’s housing market is grappling with low for-sale inventory amid sustained, though historically low, buyer demand,” added Jones. “Active inventory fell compared to the previous year in July as many homeowners held off on listing their home for sale, largely in response to today’s high mortgage rates. The drop in for-sale inventory was met with the typical seasonal pick-up in buyer demand, despite affordability constraints, which propped up home prices. In the second quarter of 2023, homeowner vacancy fell to a historical low of 0.7% as many homeowners stayed put and home shoppers snapped up available inventory, leaving fewer homes vacant. The housing market continues to face more than a decade of underbuilding, and the resulting gap in home supply is being exacerbated by the lower level of existing homes for sale.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news