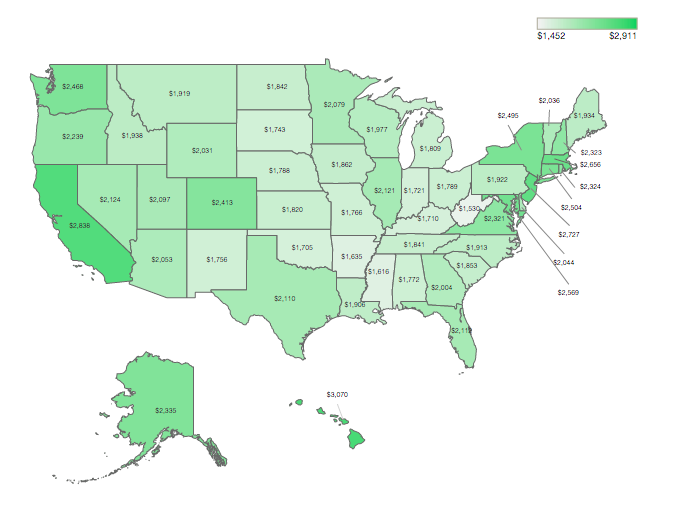

According to doxo’s 2023 State by State Bill Pay Market report, the average U.S. household spends $24,557 annually on the most essential household bills—which is 35% of the U.S. household median income of $70,784—and roughly $2,046 per month.

As many U.S. households continue to struggle with the increased cost of living, those living in Hawaii, California, New Jersey, Massachusetts, and Maryland may be feeling more pressure as these states top the list as the most expensive, while West Virginia, Mississippi, Arkansas, Oklahoma, and Kentucky are listed as the most affordable.

The doxo 2023 State by State Bill Pay Market report examines the estimated $3.87 trillion U.S. consumer bill pay market, which reflects bill payment activity across more than 97% U.S. zip codes. The report reveals the most and least expensive states for Americans to live based on average spend per month on actual household bill payments.

Top 10 Most Expensive States for Household Bills:

- Hawaii

- California

- New Jersey

- Massachusetts

- Maryland

- Connecticut

- New York

- Washington

- Colorado

- Alaska

Top 10 Least Expensive States for Household Bills:

- Alabama

- Missouri

- New Mexico

- South Dakota

- Indiana

- Kentucky

- Oklahoma

- Arkansas

- Mississippi

- West Virginia

This unique view of relative expenses, and how much of household income is required to cover bills in each state, is relevant given continued strains on household budgets due to inflation.

A recent doxoINSIGHTS report found that three in four consumers—an estimated 73%—say that inflation is currently impacting their ability to pay their household bills.

Some 86% of consumers said they are also worried about the impact that inflation will have on their financial health in the future, with 72% saying it will take six months or more until their household’s financial health improves.

“As consumers navigate their household bills in today’s volatile marketplace, bill payers may feel left in the dark, not fully understanding how much they are truly paying each month,” said Liz Powell, Senior Director of INSIGHTS at doxo.

The report also showed that Hawaiians spend an average of $3,070 each month on the ten most common household bills, which is 50% above the national average.

Meanwhile, households in West Virginia spend an average of $1,530 across the top ten categories, an estimated 25.2% below the average nationwide.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news