The typical home that sold in a high-opportunity U.S. neighborhood—defined as one where children who grew up in low-earning households went on to become higher-earning adults than the typical person who grew up in their metro at the same time—sold for a whopping $470,000 last year, approximately 38.2% more than the typical home that sold in a low-opportunity neighborhood, which sold for an estimated $340,000, according to a new report from Redfin.

Research showed that people in high-opportunity neighborhoods are more likely than those in low-opportunity neighborhoods to live among highly rated schools, professional networking opportunities, large numbers of college graduates, and low rates of poverty and crime.

High-opportunity neighborhoods also have larger concentrations of two-parent households, along with high levels of income inequality and segregation—otherwise meaning, they tend to be wealthy and white.

“It’s prohibitively expensive for many families—particularly those of color—to access the neighborhoods that offer children the best shot at financial success,” said Redfin Deputy Chief Economist Taylor Marr. “Where you grow up lays the groundwork for your future. Kids raised in low-opportunity neighborhoods have a lower chance of getting a good education and well-paying job, growing a robust professional network, building wealth through home equity and staying out of harm’s way. That can perpetuate a cycle of segregation and wealth inequality that can last for generations, with their children and grandchildren often grappling with the same disadvantages.”

High-Opportunity Neighborhoods Have More Homes for Sale, But Those Homes Are Less Affordable—Especially for Families of Color

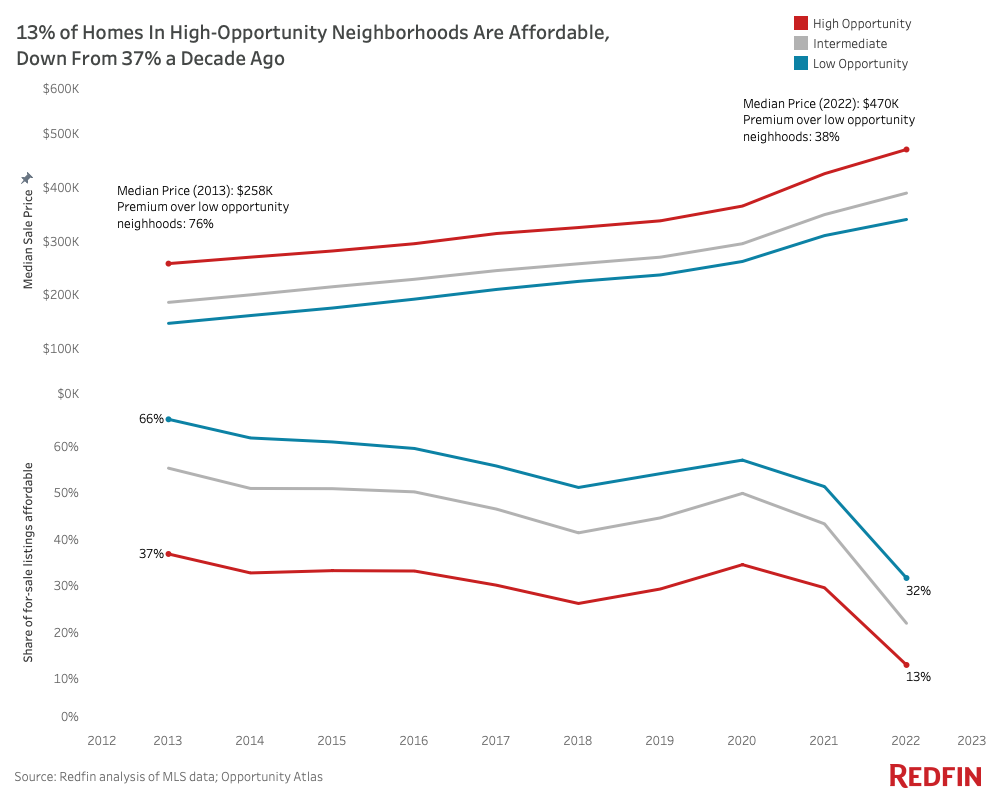

The report showed that approximately 39.5% of U.S. homes for sale are located in high-opportunity neighborhoods and are rarely affordable. Just 13% of homes for sale in high-opportunity neighborhoods last year were deemed affordable on their metro area’s median income, compared with 31.7% in low-opportunity neighborhoods.

While affordability has fallen across the board due to surging home prices, the median sale price in high-opportunity neighborhoods has grown 100% since 2012, while the median sale price in low-opportunity neighborhoods has jumped 174%.

While racial disparities in housing persist nationwide, it is undoubted that white families have it easier when gaining access to these areas than many families of color. Data found that only 4.2% of homes for sale in high-opportunity neighborhoods were affordable for the typical Black household in 2022. The share was nearly five times higher (19.1%) for the typical white household.

The Price Premium for Opportunity Remains Highest in Segregated Midwestern and Southern Metros

In Detroit, the median home sale price in high-opportunity neighborhoods was $240,000 in 2022. That’s 269% higher than the $65,00 median sale price in Detroit’s low-opportunity neighborhoods—the largest premium of the metros Redfin analyzed. Next came Memphis, TN, where high-opportunity neighborhoods held a 187% premium. Rounding out the top five are Akron, OH (169%), Milwaukee (149%), and Birmingham, AL (143%).

Many of the metros where high-opportunity neighborhoods carry hefty home-price premiums also grapple with relatively high levels of segregation. Milwaukee and Detroit both rank among the five most segregated metros based on 2020 Census data, while Memphis and Birmingham are also near the top of the list.

New York was the only metro where it was 6.7% less expensive to live in a high-opportunity neighborhood. The median sale price of high-opportunity neighborhoods in New York was $695,000, compared with $745,000 in low-opportunity neighborhoods.

In Detroit, High-Opportunity Neighborhoods are Nearly Four Times More Expensive and Predominantly White

Detroit’s high-opportunity neighborhoods overlap with the metro’s predominantly white, suburban areas, while low-opportunity neighborhoods overlap with predominantly nonwhite parts of the urban core.

Plymouth, a city of about 10,000 located a short drive west of Detroit, is one example of a high-opportunity neighborhood in the Detroit metro area.

“Plymouth screams suburbia. It has a quaint little downtown, cute restaurants and coffee shops, highly-rated high schools and an ice-sculpture festival every winter,” said Kate McNeill, Redfin’s Market Manager in Detroit. “It stands in contrast to some neighborhoods closer to downtown, where there has been less development despite increasing home prices in recent years. Take Highland Park, a majority Black area that has seen its population decline by 24% in the past decade or so. Much of that is due to disinvestment and a lack of city services. When you walk around Highland Park, many homes have been boarded up and abandoned.”

Subsidizing Affordable Housing and Reforming Zoning Laws

While low-income families are often concentrated in low-opportunity neighborhoods, recent research has shown this is rarely a function of choice. Oftentimes, they end up in low-opportunity areas because there are barriers in the home-search process that prevent them from moving to a high-opportunity neighborhood.

“Many families reported that they had limited time and resources to search for housing, as they were facing challenges such as domestic violence, mental health conditions, or holding multiple jobs while caring for children as single parents,” wrote the researchers, led by Columbia University’s Peter Bergman and Raj Chetty. “Redesigning affordable housing policies to provide customized assistance in housing search could reduce residential segregation and increase upward mobility substantially.”

While affordable housing remains scarce across the U.S., the price premium of high-opportunity neighborhoods has shrunk over time, but that’s not because these areas have become more affordable—it’s because many low-opportunity neighborhoods continue to be subjects of gentrification and have become less affordable.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news