Housing starts gained in July, even as permits stayed flat and completions dropped, according to the July 2016 residential construction report by the U.S. Census Bureau and HUD.

Housing starts gained in July, even as permits stayed flat and completions dropped, according to the July 2016 residential construction report by the U.S. Census Bureau and HUD.

Privately-owned housing starts in July were at a seasonally adjusted rate of 1,211,000. This is 2.1 percent above June’s estimated 1,186,000 and 5.6 percent last July’s rate of 1,147,000. Single-family housing starts in July came in at a rate of 770,000, or 0.5 percent above June’s 766,000. The July rate for units in buildings with five units or more was 433,000.

Privately-owned housing units authorized by building permits in July, however, were at a seasonally adjusted annual rate of 1.152 million, just short of June’s 1,153 million. While flat month-to-month, the number is almost a full percent higher than a year ago. Meanwhile, however, single-family authorizations in July were at a rate of 711,000, which is 3.7 percent below June’s 738,000.

“Analysts had only been expecting a 1 percent decline in starts, but they were up 2 percent on a seasonally adjusted basis from the revised rate in June,” realtor.com chief economist Jonathan Smoke said. “Like permits, the seasonally adjusted rate was the best since February, and the non-adjusted actual estimate for the month was the highest since October 2007.”

Completions also suffered in July. Privately-owned housing completions in July were 1,026,000, which is 8.3 percent below June’s 1.12 million. It is, however, 3.2 percent above last July’s rate of 994,000. There were 743,000 single-family housing completions just short of the June rate of 746,000. The July rate for units in buildings with five units or more was 275,000.

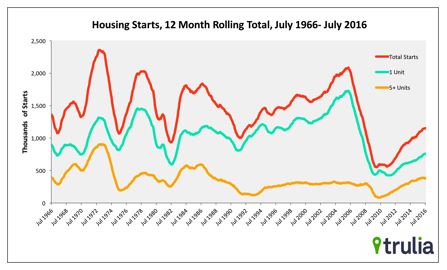

“July represents the fourth straight month where the 12-month rolling total was flat or less than the previous month,” said Ralph McLaughlin, chief economist at Trulia. “Still, the total was the most starts in a 12-month period since May 2008.”

McLaughlin also said that the new starts should be welcome news to buyers in tight markets.

McLaughlin also said that the new starts should be welcome news to buyers in tight markets.

“Single-family starts are still growing at double-digit rates. Supply-constrained homebuyers should rest assured that relief is on the way,” he said.

Tian Liu, chief economist at Genworth Mortgage Insurance in Raleigh, echoed that upbeat perspective.

“This is a strong report, and we are particularly pleased with the single-family segment,” Liu said. “We believe that growth in housing starts will be led by single-family homes. Single-family homes have experienced a slower recovery in the past few years, and remain under-supplied today. We expect supply of single-family homes to catch up over the next few years.”

However, McLaughlin said, the number of construction jobs per housing starts hit a 10-year low in July, likely due to persistent labor shortages.

“The wave of single-family starts this year still isn’t showing signs of rising the tide for construction jobs,” he said.

“New construction is failing to keep up with household formation, meaning that the low vacancies in rentals and the tight supply of homes for sale will continue to be a key theme for housing in the months ahead,” Smoke said. “Single-family is continuing to show gains, but the gains in permits are weaker than the gains in starts. Builders are starting what they already permitted earlier this year but are not bullish about demand this fall and winter.”

Smoke continued, “The seasonally adjusted rate of permitting was not statistically significant, essentially unchanged from last month at the highest level of permitting since February. On a year-to-date basis, permits in multi-family have declined 16 percent, while single-family permits are up 7 percent. On a year-to-date basis, permits are up in every region but the Northeast where a massive 61 percent decline in multi-family is the cause of that region’s year-to-date declines.”

Click here to view the entire report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news