According to the August National Student Housing Report from Yardi Matrix, the student housing sector continues to outperform as the Fall 2023 school year approaches.

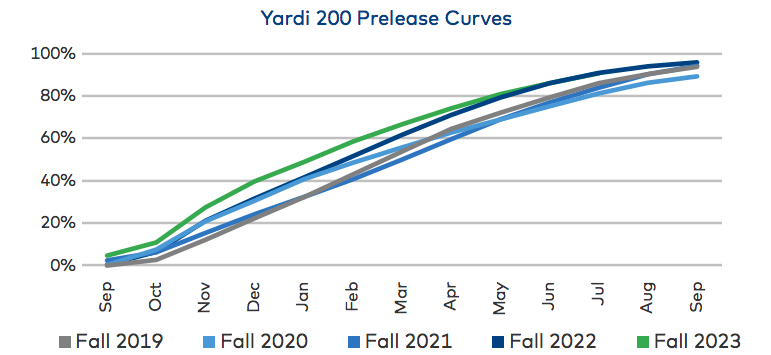

The report revealed that as of July, 90.1% of beds at Yardi 200 universities were preleased for the upcoming fall term, a 4.6% increase from the prior month and about even with last year.

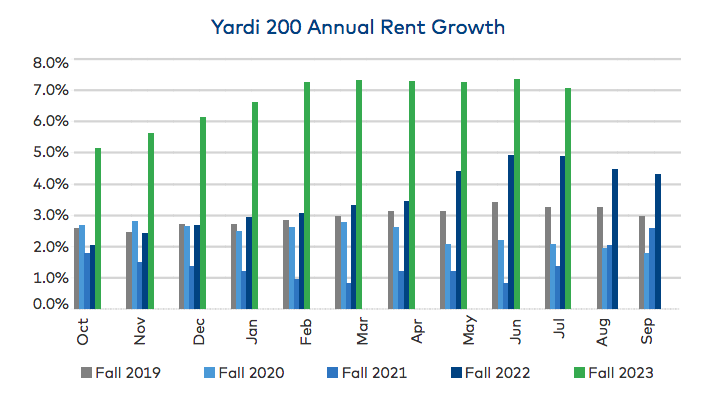

Preleasing was near a record high for July, and year-over-year rent growth throughout the leasing season has been ahead of last year. The sector is equipped to handle economic challenges, with solid occupancy and rent growth for the 2023-2024 school year and counter-cyclical demand.

"Preleasing has slowed recently from rapid growth at the beginning of the leasing season. Month-over-month rent growth has also decelerated," states the report. Despite the drop, fall occupancy is projected to match last year at around 96%, while rent growth remains impressive at 7.1% year-over-year.

Despite solid fundamentals nationally, there are a handful of schools that are underperforming on preleasing and rent growth due to a variety of factors, including weak enrollment growth and new supply. Some 35 universities in the Yardi 200 were 5% or more behind last year’s preleasing pace, and 33 schools experienced rent declines year-over-year in July.

Interest rate increases have also taken their toll on investment sales. The number of beds sold in the first half of 2023 was down 73.1% year-over-year, while the price per bed was down 10.0% vs. last year, to $66,823 per bed.

Rent growth varied at the university level, with 38 schools in the Yardi 200 posting double-digit rent growth and 33 schools showing rent declines. Most top schools for rent growth also had strong preleasing. The top six schools with four or more properties were on average 99.9% preleased with 20.1% rent growth, while the bottom six were 75.1% preleased with a 6.7% rent decline.

Yardi Matrix projects approximately 40,000 new beds will be delivered in Fall 2023 at Yardi 200 universities, compared to 27,000 delivered last fall. Solid preleasing and rent growth suggests that much of the supply has already been absorbed.

Reports on national student housing performance, with insight on preleasing and rental rates, are now being delivered on a monthly basis.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news