The millennial generation has recently dominated the demand side of the housing market, according to a new report from First American. However, research also showed that Generation Z is on the cusp of aging into their prime homebuying years.

While potential first-time homebuyers, mostly millennials and older Gen Zers, jumped on the historically low mortgage rates available in 2020 and 2021, those looking to shift from renting to homeownership in 2023 face mortgage rates that are nearly 4 percentage points higher than the low point in Q4 of 2020, limiting their purchasing power. As potential first-time homebuyers consider homeownership, First American experts suggest they should carefully weigh the costs of renting against the costs of owning a home, which vary greatly by market.

"Once you factor in house price appreciation, or depreciation in some markets, to the cost of homeownership, the decision to rent or buy will depend on local real estate market dynamics, which will determine if a home is likely to cost more or less in the near future," said First American Economist Ksenia Potapov.

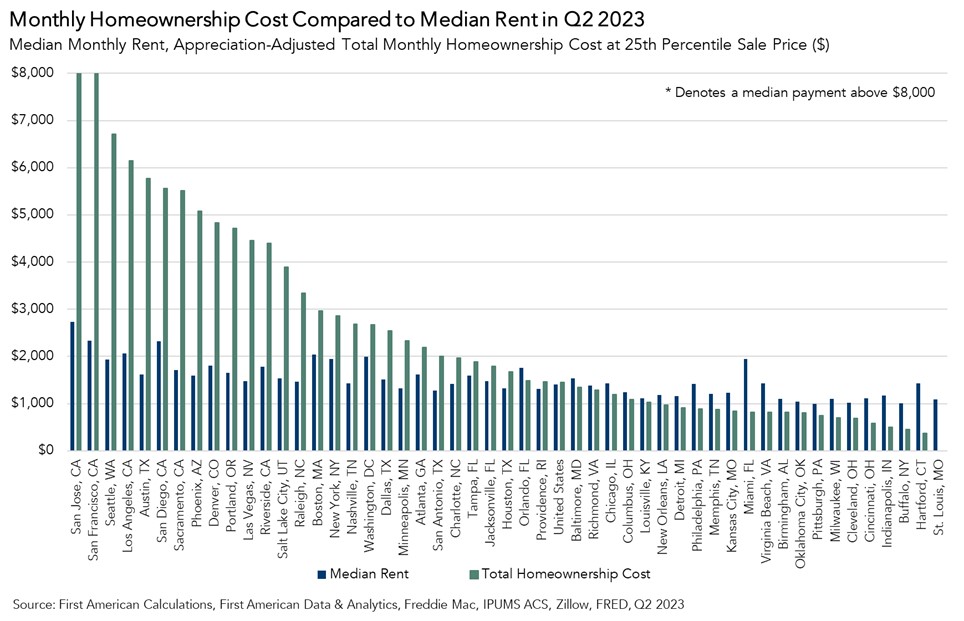

One year ago, in Q2 of 2022, it was cheaper to own a home than to rent nationally and in all 50 of the top U.S. markets thanks to near-record low mortgage rates and rapid house price appreciation. A year later, substantial increases in mortgage rates, coupled with declining house prices in some markets, tipped the scales in the opposite direction. In Q2 of 2023, it was cheaper to rent than to own nationally and in 27 of the top 50 U.S. markets.

The Affordability Shift from Homeownership to Renting

What goes into the monthly cost of renting or owning? The cost of renting is simply the amount of rent paid every month. The monthly cost of owning a home includes taxes, repairs, homeowner’s insurance, and the monthly mortgage principal and interest payments.

Potapov continued that rising house prices increase the cost of buying a home, all else being equal, for the potential homebuyer. However, rising home prices provide the homeowner with the benefit of equity accumulation. On the other hand, declining house price appreciation results in a loss of equity and is considered a significant cost for the homeowner.

Nationally, house price appreciation was 2% year-over-year in Q2 of 2023, according to the First American Data & Analytics Real House Price Index. However, house price appreciation was not uniform across markets, with house prices declining up to 9% in some markets while increasing as much as 14% in others. As a result, the difference in the monthly cost of renting and owning varied significantly from market to market.

Diverging Affordability

In many large markets, the monthly cost of homeownership far outpaced the cost of rent in Q2 of 2023. In Seattle, for example, the median rent was approximately $1,930, and the homeownership cost was $6,720. Along with the upfront costs of homeownership, house price appreciation plays a critical role in the financial decision to rent or own.

Last year, house price appreciation was positive across the top 50 U.S. markets, but in the second quarter of 2023, house prices declined in 15 markets, adding to the monthly ownership costs in those markets. In Seattle, house price depreciation added approximately $2,500 to the monthly cost of ownership. While this cost is not an explicit part of the homeowner’s mortgage payment every month, the decline in equity still informs a potential first-time homebuyer’s behavior. Which posed the question: why buy a home now when you may be able to buy it for less in the future?

Conversely, in many Midwestern and Southern cities, such as Birmingham, AL, and Cleveland, it was cheaper to own than rent. In Cleveland, the monthly cost of rent in the second quarter of 2023 was $1,020, while the monthly cost of homeownership was approximately $1,740 before accounting for house price appreciation. Annual house price appreciation in Cleveland was 4.4% in Q2 of 2023, making the equity-adjusted monthly homeownership cost $690—$330 less than the monthly cost of renting.

As younger generations consider their housing options, the greater opportunity to transition to homeownership in these more affordable markets may become more attractive to potential first-time homebuyers.

"In other words, buy the home now because it will likely cost you more to buy it in the future," said Potapov.

What’s the Outlook for Generation Z?

According to the study and given current dynamics, more young households may choose to rent in the near term as the cost to own, excluding house price appreciation, has unequivocally increased.

Yet, once potential homebuyers factor in house price appreciation—or depreciation in some markets, to the cost of homeownership—the decision to rent or buy will depend on local real estate market dynamics, which will determine if a home is likely to cost more or less in the near future.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news