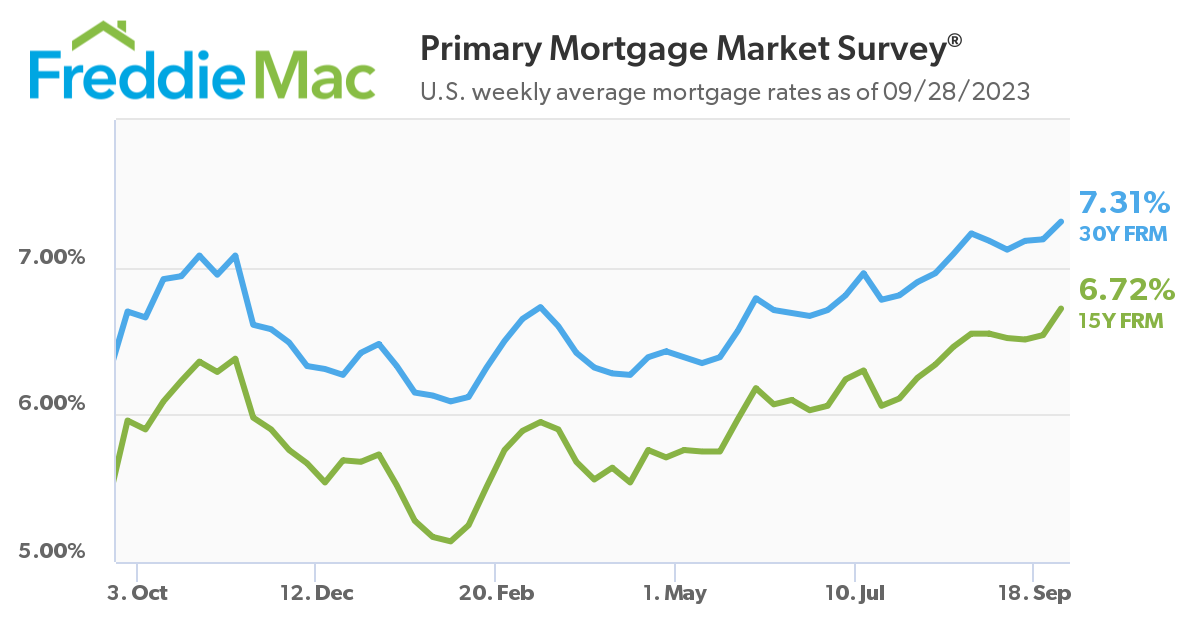

According to Freddie Mac’s latest Primary Mortgage Market Survey (PMMS), the 30-year fixed-rate mortgage (FRM) averaged 7.31% for the week ending September 28, 2023, up from last week when it averaged 7.19%. A year ago at this time, the 30-year FRM averaged 6.70%.

According to Freddie Mac’s latest Primary Mortgage Market Survey (PMMS), the 30-year fixed-rate mortgage (FRM) averaged 7.31% for the week ending September 28, 2023, up from last week when it averaged 7.19%. A year ago at this time, the 30-year FRM averaged 6.70%.

Also this week, the 15-year FRM averaged 6.72%, up from last week when it averaged 6.54%. A year ago at this time, the 15-year FRM averaged 5.96%.

“The 30-year fixed-rate mortgage has hit the highest level since the year 2000,” said Sam Khater, Freddie Mac’s Chief Economist. “However, unlike the turn of the millennium, house prices today are rising alongside mortgage rates, primarily due to low inventory. These headwinds are causing both buyers and sellers to hold out for better circumstances.”

With the rise in rates, the Mortgage Bankers Association (MBA) reported overall app volume scaling back week-over-week, falling 1.3% from one week earlier, according to the MBA’s Weekly Mortgage Applications Survey for the week ending September 22, 2023. Purchase mortgage applications were 27% lower than the same week just one year ago.

“Mortgage applications continued their downward trend last week, as mortgage rates reached their highest levels in nearly 23 years,” added MBA President and CEO Bob Broeksmit. “Rates over 7% and low for-sale inventory continue to create affordability challenges for prospective buyers. Until rates start to come back down, we anticipate housing market activity will remain slow.”

Despite a rate environment where the fixed-rate is at a 23-year high, Realtor.com predicts that approximately 4.2 million homes will change hands this year according to its “Best Time to Buy” report, which identifies key factors people use when considering buying a home, mortgage rates withstanding. Realtor.com has predicted that the homebuying stars will dramatically align during the week of Oct. 1, meaning those in the market should view this week as a window of opportunity to make the most of their purchasing power.

“With mortgage rates continuing to exceed 7%, we’ll soon see whether the month-to-month uptick in newly listed homes comes from sellers who are capitulating to current rate conditions or nervous that they needed to act before mortgage rates climbed even higher,” said Danielle Hale, Chief Economist at Realtor.com. “Weekly trends suggest that this may be a much-needed acceptance of higher rates, which may indicate some sticking power to the trend. This is an added improvement over and above the fact that homebuyers who have been waiting for their opportunity can count on the seasonal stars lining up in the first week of October. Mortgage rates will continue to be a wildcard, but predictable buying and selling trends suggest that this particular week offers an advantage across a variety of housing indicators. In particular, home prices tend to fall relative to summer highs, fewer buyers are contending for homes, yet housing inventory remains higher than a typical week.”

Still saddled by a number of factors, homebuyer affordability continued to slip in August, as the national median payment applied for by purchase applicants increased to $2,170 from $2,162 in July, according to the Mortgage Bankers Association's (MBA) latest Purchase Applications Payment Index (PAPI), which measures how new monthly mortgage payments vary across time–relative to income–using data from MBA’s Weekly Applications Survey (WAS).

“Prospective homebuyers’ budgets continue to be impacted by the combination of high home prices and mortgage rates that remain higher than 7%,“ said Edward Seiler, MBA’s Associate VP, Housing Economics, and Executive Director, Research Institute for Housing America (RIHA). “If mortgage rates shift lower in 2024 as we anticipate, the combination of rising inventory levels and lower rates should lead to stronger demand for buying a home.”

Hale added, “Still, the big picture trends in the housing market tend toward not enough homes for sale, a condition that is driving more shoppers to consider new homes and pushing up home prices. This combination of higher prices and higher mortgage rates contrasts with easing rents, shifting the monthly cost trade-offs for potential first-time homebuyers. Buying a starter home is more expensive than renting in all but three major U.S. markets studied, which explains why buyer demand is likely to remain relatively low."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news