Austin, Texas, a modern-day tech hub, college town, and the capital of Texas,—a shining beacon of conglomeration nestled in the Hill Country—has been a desirable place to move to for many years, but recently picked up steam after the markets re-opened after the initial hit of COVID-19 in March 2020.

Austin, Texas, a modern-day tech hub, college town, and the capital of Texas,—a shining beacon of conglomeration nestled in the Hill Country—has been a desirable place to move to for many years, but recently picked up steam after the markets re-opened after the initial hit of COVID-19 in March 2020.

The momentum that the Austin real estate market picked up has continued until recently, as home prices continue to hit new highs and mortgage rates push 8% in some cases.

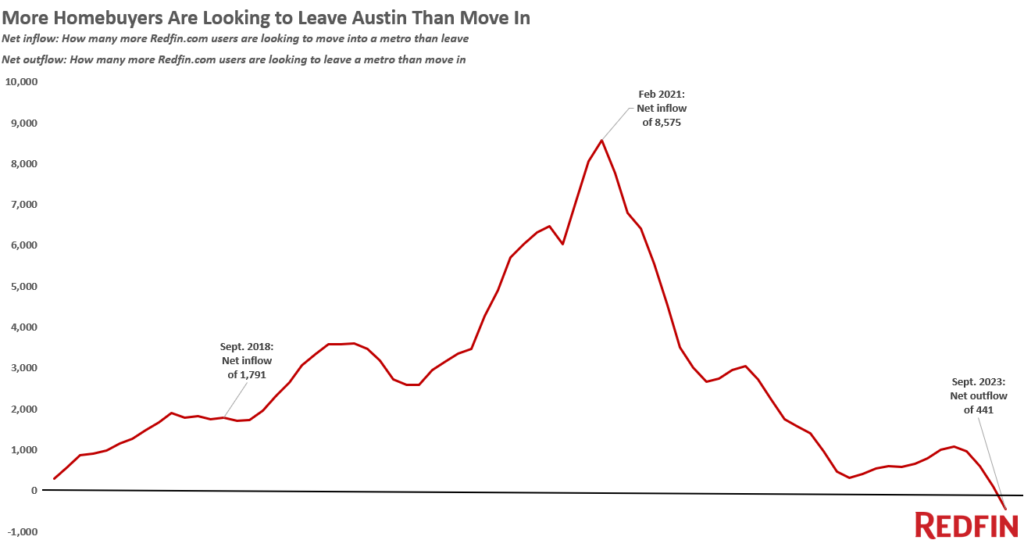

According to a new report from Redfin, this is the first time that Austin (which is also where Redfin is headquartered) has not had a net inflow if people into the Capital since 2017, when Redfin began keeping track of this metric.

More-and-more homebuyers are looking to leave Austin during the third quarter of 2023 due to a multitude of reasons, including returning home, or to be closer to family, or back where they lived previously. Mainly due to the advent and adoption semi-permanent or permanent remote work policies, Austin was the number-one U.S. migration destination in the beginning of 2021.

But current housing factors have changed that status. Key reasons why Austin has fallen from real estate grace, as highlighted by Redfin, include:

- Rising home prices. By mid-2022, when Austin home prices peaked, prices were up more than 75% from before the pandemic. Austin prices have since declined from that peak, but homes are still much more expensive than before the pandemic. The gap between Austin’s home prices and those of where homebuyers commonly move from, like Los Angeles and San Francisco, is smaller than it used to be.

- Monthly mortgage payments have doubled since before the pandemic. Soaring mortgage rates exacerbated Austin’s affordability problems, making monthly housing payments even more expensive than they already were with increasing prices. Today’s typical monthly payment for Austin’s median-priced home ($455,000) at this week’s average mortgage rate (7.63%) is $3,890, nearly double 2019’s typical payment of $2,136 (median sale price of $320,000; average mortgage rate of 3.94%).

- Some homebuyers who moved to Austin are leaving. Austin Redfin agents report that some formerly remote workers moved back to their home city after being called back to the office, and a few others are moving back after trying Austin and realizing it’s not a long-term fit. Some others are likely leaving Austin to be closer to major job hubs as the labor market starts slowing.

Slowing migration is good news for Austin locals looking to buy. Austin’s median home price is down about 5% year over year, the biggest decline in the U.S., and it’s down nearly 20% from its pandemic peak. “I’m telling buyers that this is the first time in years they can get a deal on a house, even with high mortgage rates,” said Austin Redfin Premier Agent Carmen Gioia. “It’s probably a better time to buy down than waiting for mortgage rates to drop, because once that happens, competition will escalate and prices will shoot up. Right now, buyers are able to take their sweet time, negotiate with sellers, and buy a home without getting into a wild bidding war.”

Click here to see Redfin’s full take on the subject.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news