While mortgage rates continue to hover above 8%, new listings of homes for sale rose 0.3% from a year earlier during the four weeks ending October 22—a small uptick but the first increase since July 2022, according to a new report from Redfin.

More homeowners are putting their homes on the market as mortgage rates remain elevated near 8%. Some sellers are accepting that rates are unlikely to meaningfully decline anytime soon and finally parting with their relatively low rates, while others are nervous that tepid demand could cause home prices to fall if they wait any longer. Researched also showed that new listings were falling fast at this time last year as mortgage rates rose.

Homebuyers are welcoming even a small uptick in listings after nearly a year and a half of declines. Although many homebuyers are staying on the sidelines, with mortgage-purchase applications down 2% week over week to their lowest level in nearly 30 years, some house hunters are out there. Pending home sales posted their smallest annual decline in a year and a half.

“Some people are selling right now because they’re concerned home values will go down, though that’s definitely not a foregone conclusion,” said Ali Mafi, a Redfin Premier agent in San Francisco. “Others are noticing an uptick in demand and testing the waters. My best advice for homeowners who are selling right now is to be realistic. Even though there are a few more buyers out there, this isn’t 2021. Price your home fairly so it will sell as fast as possible.”

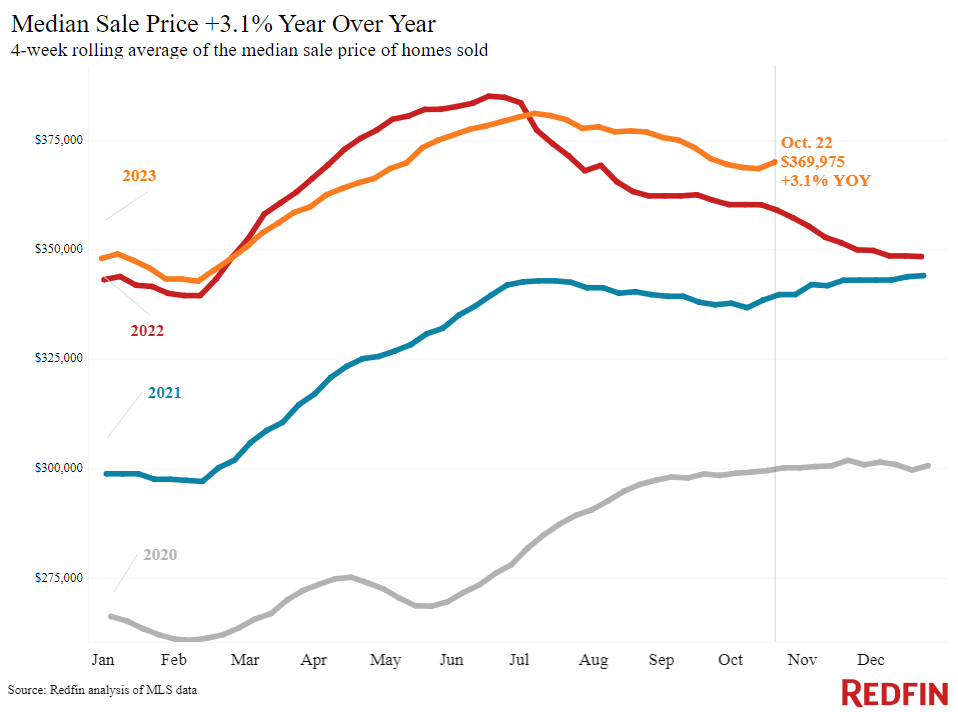

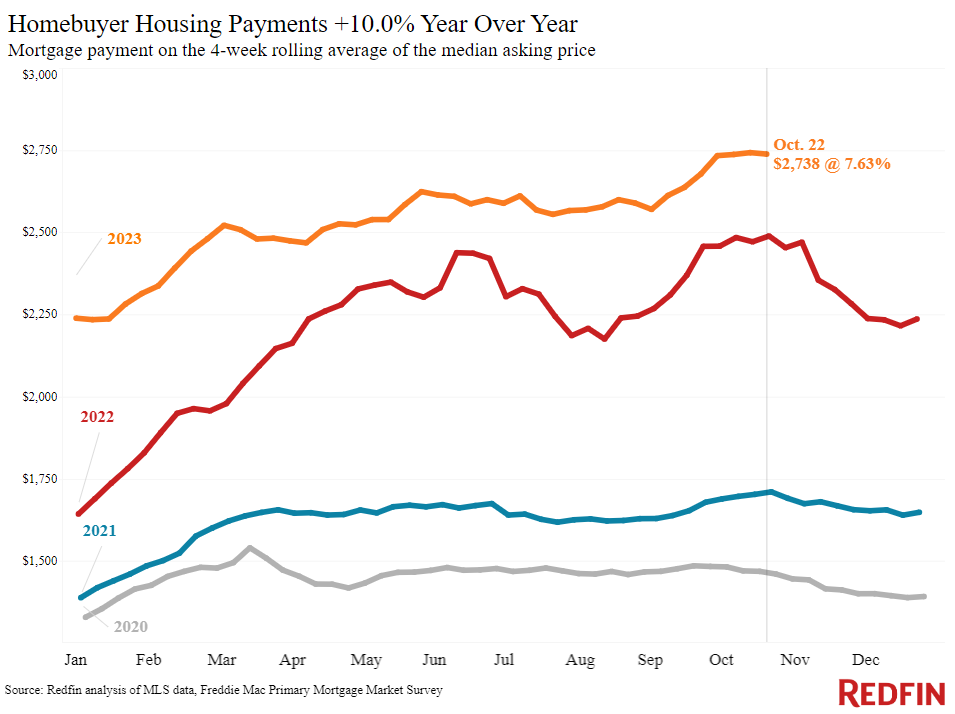

Homeuyers’ budgets continue to take a hit with prices rising in much of the country and persistently high mortgage rates.

Declining affordability has led to price adjustments. Roughly 7% of U.S. homes for sale had a price drop during the four weeks ending October 22, on average, the highest share on record.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news