With Halloween around the corner, the housing market this past year has been a frightening one for some home seekers.

While the ghostly holiday celebrating haunted houses and other spooky things, the holiday may prompt the scary thought of the difficulties of achieving the American Dream. But what aspects of homeownership frighten homebuyers most, and what cities are the scariest?

A new study from Point2Homes revealed that as the 30-year fixed-rate mortgage hit the highest levels in decades, home prices have been on the climb and are expected to continue to increase in 2024. The current for-sale inventory represents less than one year’s worth of supply, meaning this year has been tricky for many homebuyers.

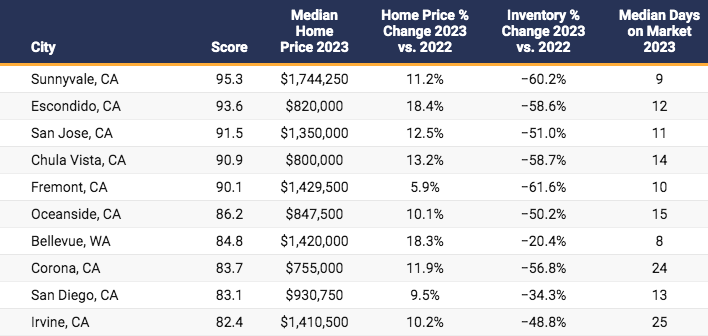

Point2 set out to determine the scariest housing markets, analyzing the 200 largest markets in the country across four metrics: median price, year-over-year (YoY) difference in home price, YoY difference in for-sale inventory, and fewest days on the market.

Top 10 Scariest Markets for 2023’s Homebuyer

- Sunnyvale, CA

- Escondido, CA

- San Jose, CA

- Chula Vista, CA

- Fremont, CA

- Oceanside, CA

- Bellevue, WA

- Corona, CA

- San Diego

- Irvine, CA

From surging home prices and scarce inventory to regrets about not purchasing a home yet and homes slipping through their fingers, here are the main takeaways on the bone-chilling horrors awaiting those seeking to secure their dream home amid fears of a housing market crash:

- Purchasing a home is tough everywhere, but data points to some cities accumulating the bulk of buyers’ fears in the past year; nine of the 10 scariest markets are in California, led not by LA or San Francisco but by Sunnyvale and Escondido.

- Prices have risen the most in markets known for being among the more affordable of the 200 largest: Compared to 2022, homebuyers in Louisville, KY, Tallahassee, FL, and Kansas City, KS, now deal with home prices that are more than 20% higher.

- Monster prices are a reality not just in established hyper-wealthy markets—like Manhattan or San Jose, CA—but also in emerging West Coast hubs, like Sunnyvale ($1.7 million), Bellevue, WA ($1.4 million), Glendale, CA ($1.3 million), and Torrance, CA ($1.1 million).

- For-sale inventory has reached near historic lows: 28 of the 200 largest U.S. markets have had their housing stock cut in half since 2022, with California’s Fremont and Sunnyvale now selling around 60% fewer homes compared to last year.

- Sky-high demand keeps homebuyers on their toes: homes fly off the market in just 10 days or less in 19 large cities; in Grand Rapids, MI, and Lakewood, CO, active listings last less than a week.

Move over LA and San Francisco; it’s Sunnyvale and Escondido’s turn. It's no secret that California is expensive. So much so that nine of the 10 scariest cities to buy a home in are all in the Golden State.

Meanwhile, prospective owners in Sunnyvale are smack in the middle of the Bermuda Triangle of housing: high home prices, low inventory, and listings are dwindling quick. For a while now, Sunnyvale has emerged as a luxury market, holding its own with its Silicon Valley sister, San Jose.

Close in terms of keeping prospective buyers up at night is Escondido, one of San Diego County’s most sought-after spots. High prices aside, homebuyers now have about half the housing stock to pick from compared to last year, while homes in these three cities get sold in just 12 days or less.

At the other end of the spectrum, southeastern cities like Jackson, MS, Birmingham, AL, and New Orleans keep homebuyers’ dark thoughts at bay. What makes house hunting an easier pill to swallow in these and a few other housing markets in the Sun Belt are home prices below the $420,000 national average, year-over-year price declines, and, in many instances, a pool of homes for sale on the rise since 2022.

Petrifying Prices: $1.1M+ in Bellevue, WA, Manhattan, and much of California; Prices in Louisville, KY, up by 25% YoY

A primary factor in achieving homeownership that keep house hunters up at night is volatile home prices. With whopping price tags well beyond the $1.1 million mark, eight of the top 10 most expensive markets for homebuyers are in California.

Living in Sunnyvale, one of the most competitive housing markets in the country, comes with a median price of more than $1,740,000, following an 11% price hike since 2022. The situation is similar in nearby Fremont, where, despite a more optimistic 6% YoY decrease, the median price is closing in on $1,430,000. Home seekers in California are forced to deal with a concoction of prices increasing at breakneck speed, homes flying off the market, and shrinking inventory, making homeownership all the more difficult.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news