According to the Mortgage Bankers Association's (MBA) latest Purchase Applications Payment Index (PAPI), homebuyer affordability further declined in October 2023, with the national median payment applied for by purchase applicants increasing to $2,199 from $2,155 in September. This marked a $143 year-over-year rise, or a 9.3% increase.

According to the Mortgage Bankers Association's (MBA) latest Purchase Applications Payment Index (PAPI), homebuyer affordability further declined in October 2023, with the national median payment applied for by purchase applicants increasing to $2,199 from $2,155 in September. This marked a $143 year-over-year rise, or a 9.3% increase.

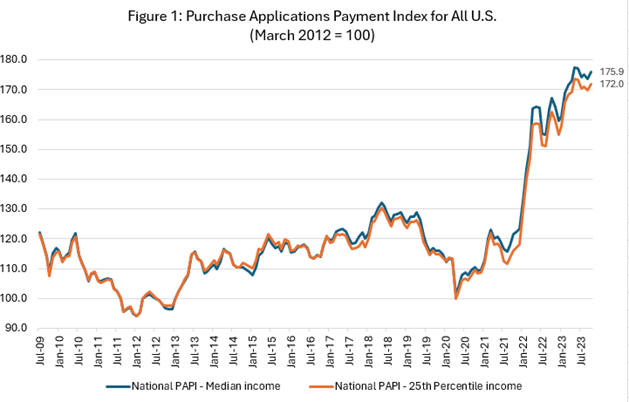

The MBA’s PAPI measures how new monthly mortgage payments vary across time–relative to income–using data from the MBA’s Weekly Applications Survey (WAS).

“Homebuyer affordability conditions declined further in October, with the jump in mortgage rates during the month dissuading would-be buyers from entering the housing market,” said Edward Seiler Ph.D., MBA’s Associate VP, Housing Economics, and Executive Director, Research Institute for Housing America. “MBA expects affordability conditions to remain challenging to close out 2023 before a slight improvement by early next year.”

For the month of October, Freddie Mac’s Primary Mortgage Market Survey (PMMS) found the average 30-year, fixed-rate mortgage at 7.62% over a four-week span.

An increase in MBA’s PAPI–indicative of declining borrower affordability conditions–means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI–indicative of improving borrower affordability conditions–occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

The national PAPI (see below) increased 1.2% to 175.9 in October from 173.8 in September. With this increase, the PAPI is 1.5 points away from its record high in May 2023. Median earnings were up 3.9% compared to one year ago, and while payments increased 9.3%, the strong earnings growth means that the PAPI is up 5.2% on an annual basis. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased to $1,466 in October from $1,437 in September.

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey increased from $2,640 in September to $2,672 in October.

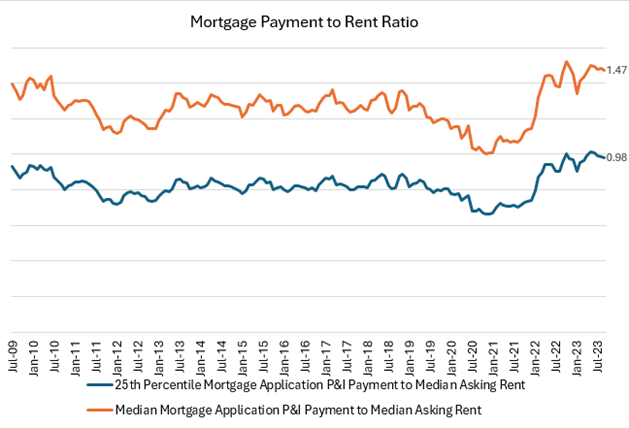

MBA’s national mortgage payment to rent ratio (MPRR) decreased from 1.50 at the end of the second quarter (June 2023) to 1.47 at the end of the third quarter (September 2023), meaning mortgage payments for home purchases have decreased relative to rents (see below). The Census Bureau’s Housing Vacancies Survey (HVS) national median asking rent in second-quarter 2023 increased 1.2% on a quarterly basis to $1,462 ($1,445 in second-quarter 2023). The 25th percentile mortgage application payment to median asking rent ratio decreased slightly to 0.98 in September (1.00 in June 2023).

By loan type, the national median mortgage payment for FHA loan applicants was $1,955 in October, up from $1,920 in September, and up from $1,666 year-over-year. The national median mortgage payment for conventional loan applicants was $2,208, up from $2,180 in September, and up from $2,047 year-over-year.

The top five states reporting the highest PAPI were:

- Nevada (274.4)

- Idaho (272.2)

- Arizona (246.7)

- California (230.4)

- Florida (229.7)

The top five states reporting the lowest PAPI included:

- Louisiana (127.9)

- New York (129.7)

- Connecticut (130.1)

- Oklahoma (133.4)

- West Virginia (134.3)

Homebuyer affordability decreased slightly for Black households, with the national PAPI increasing from 174.8 in September to 176.9 in October. Homebuyer affordability decreased slightly for Hispanic households, with the national PAPI increasing from 161.9 in September to 163.9 in October. Homebuyer affordability decreased slightly for White households, with the national PAPI increasing from 176.2 in September to 178.4 in October.

Next month’s PAPI may paint a different picture, as mortgage rates declined more than 50 basis points over the past six weeks, having settled at 7.22% to close the month, according to Freddie Mac’s latest PMMS.

And to close out the month of November, the MBA reported a 0.3% week-over-week rise in overall mortgage applications.

“The steady decline in mortgage rates over the past month has fueled an uptick in mortgage demand,” said MBA President and CEO Bob Broeksmit. “Although application activity remains below year-ago levels, applications have increased for four consecutive weeks. In addition to helping to improve affordability for homebuyers, a continued decline in mortgage rates could also convince some homeowners to sell, which would increase the low supply of existing homes on the market.”

And as Joel Kan, MBA’s VP and Deputy Chief Economist, points out, “Rates have declined more than 50 basis points over the past six weeks, which has helped to spur a small increase in purchase applications, but activity last week was still around 20 percent lower than a year ago. The purchase market remains depressed because of the ongoing, low supply of existing homes on the market. Similarly, refinance activity will likely be muted for some time, even with the recent decline in rates, as many borrowers locked in much lower rates in 2020 and 2021.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news