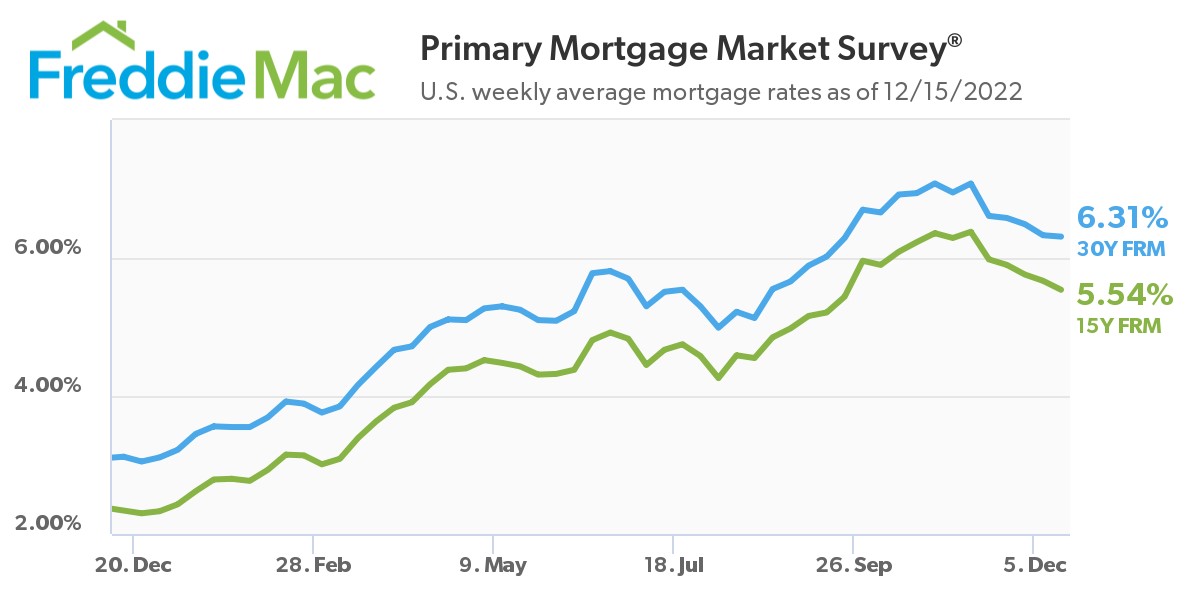

On the heels of news the Federal Reserve boosted the funds rate for the seventh time in 2022 to curb inflation, Freddie Mac reports that the 30-year, fixed-rate mortgage (FRM) dropped yet again, falling from an average of 6.33% last week to 6.31% (as of December 15, 2022). A year ago at this time, the 30-year FRM averaged nearly exact half that total at 3.12%

On the heels of news the Federal Reserve boosted the funds rate for the seventh time in 2022 to curb inflation, Freddie Mac reports that the 30-year, fixed-rate mortgage (FRM) dropped yet again, falling from an average of 6.33% last week to 6.31% (as of December 15, 2022). A year ago at this time, the 30-year FRM averaged nearly exact half that total at 3.12%

“Mortgage rates continued their downward trajectory this week, as softer inflation data and a modest shift in the Federal Reserve’s monetary policy reverberated through the economy,” said Sam Khater, Freddie Mac’s Chief Economist. “The good news for the housing market is that recent declines in rates have led to a stabilization in purchase demand. The bad news is that demand remains very weak in the face of affordability hurdles that are still quite high.”

Also this week, Freddie Mac reported the 15-year FRM averaging 5.54%, down from last week when it averaged 5.67%. A year ago at this time, the 15-year FRM averaged nearly half that total when it stood at just 2.34%.

The continued dip in rates served as a green light for potential buyers to slowly get back into buying mode, as the Mortgage Bankers Association (MBA) reported that overall mortgage app volume was on the rise last week, up 3.2% week-over-week. The steady decline in rates also provided a boost to the refi market, as the MBA reported the refinance share of mortgage activity increased to 29.4% of total applications, up slightly from 28.7% the previous week. The adjustable-rate mortgage (ARM) share of activity also saw a slight increase, as ARM activity increased slightly from 7.6% to 7.7% of total applications.

“For homebuyers and homeowners, the retreat in mortgage rates of the past several weeks has been a welcome development,” noted Realtor.com Manager of Economic Research George Ratiu. “As mortgage data highlight, applications for both purchases and refinances picked up last week. With more homes available for sale, and more of them sporting price cuts, some buyers are running the math and finding that the slide in rates is offering better options within their budgets.”

It's still unclear of the impact yesterday’s announcement by Federal Reserve Chair Jerome Powell to move the fed funds rate to between 4.25% and 4.5% will have on the housing market. Past rate hikes have impacted mortgage rates by driving them downward, only after a huge spike to over the 7% mark earlier in the year.

“Fed Chairman Jerome Powell mentioned in his remarks that—with prices still rising at a high rate—more increases are needed, and the central bank remains committed to rate hikes until the pace of inflation notches a noticeable slowdown,” said Hale. “For investors, the Fed’s tightening still presents the risk of pushing the economy into a recession in 2023. However, while most economic indicators continue to show signs of resilience, some are beginning to show signs of pressure. November’s retail sales declined from the prior month, as higher prices led consumers to pull back on purchases of cars, furniture, building materials, and gasoline.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news