Knightvest, a fully integrated real estate investment and management company, released the results of the company's first annual survey measuring multifamily renter sentiment.

The survey provides insights into the rent-versus-buy decision, the downstream effects of high mortgage interest rates, and differences in generational preferences around renting.

"The rent-versus-buy decision is increasingly nuanced given this dynamic macroeconomic environment, and it's interesting to see the data support what we're hearing anecdotally from residents: if you create communities built on quality, service and care, then apartments can become sought-after destinations where residents thrive through multiple seasons of their lives," said David Moore, Knightvest Founder and CEO.

Key Findings:

Most people choose to rent in the U.S.

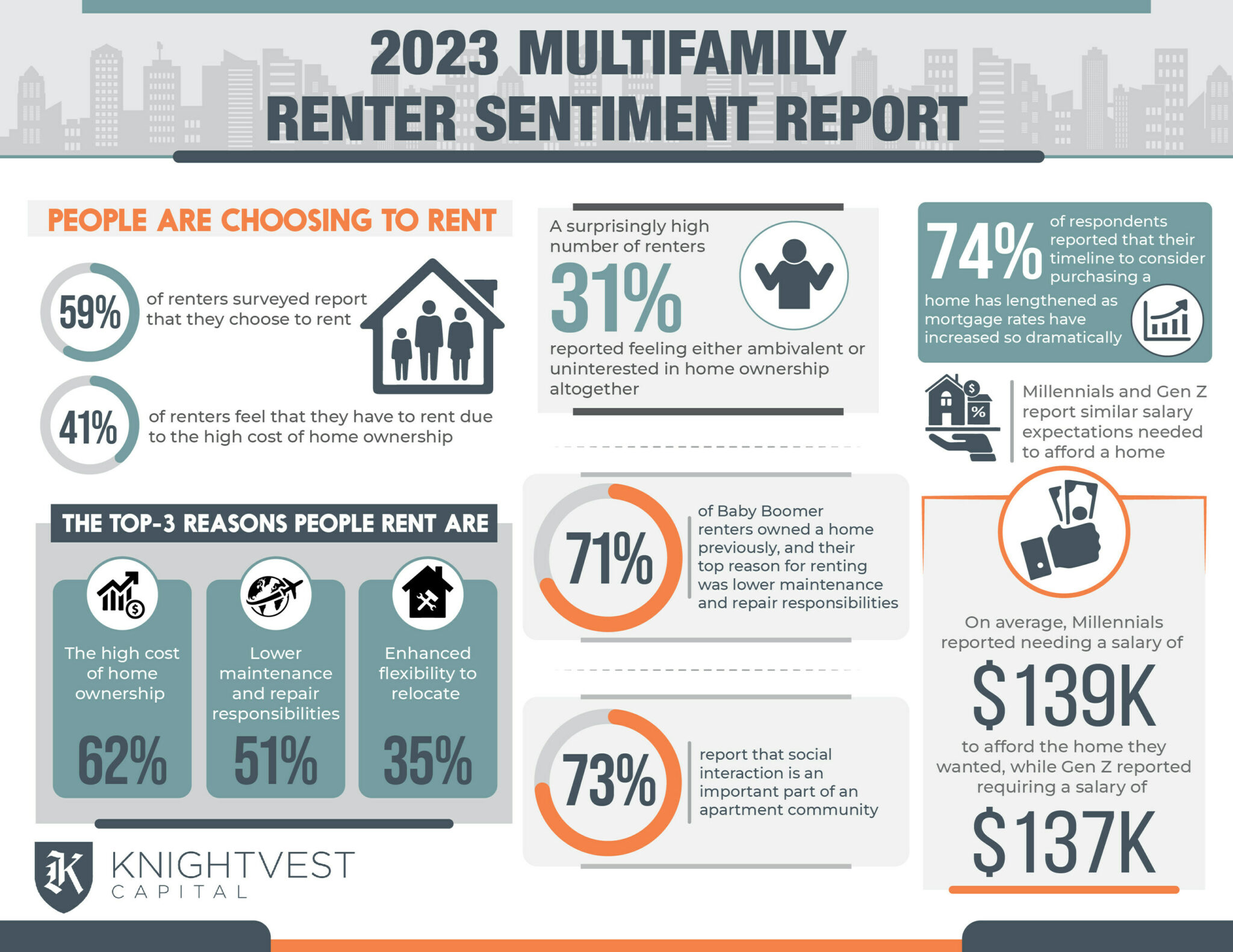

- Some 59% of renters surveyed report that they choose to rent, versus 41% who feel that they have to rent due to the high cost of home ownership.

- An estimated 51% of Millennial respondents and 54% of Gen Z respondents report that they have chosen to rent.

The top three reasons people rent are:

1. The high cost of home ownership (62%)

2. Lower maintenance and repair responsibilities (51%)

3. Enhanced flexibility to relocate (35%)

A surprisingly high number of renters (31%) reported feeling either ambivalent or uninterested in home ownership altogether.

Interestingly, roughly 29% of renters reported that they previously owned a home. Approximately 71% of baby boomers renters owned a home previously, and their top reason for renting was lower maintenance and repair responsibilities.

Overall, Gen Z respondents felt slightly more excited about the prospect of owning a home than Millennials (29% vs. 25%)

The increase in mortgage rates has delayed the homebuying decision by at least a few years.

- Some 74% of respondents reported that their timeline to consider purchasing a home has lengthened as mortgage rates have increased so dramatically.

- Of those, 79% report that their timeline has lengthened by at least a few years or indefinitely.

- Millennials and Gen Z report similar salary expectations needed to afford a home.

- On average, Millennials reported needing a salary of $139K to afford the home they wanted, while Gen Z reported requiring a salary of $137K.

Social interactions are an important part of an apartment community.

- An estimated 73% report that social interaction is an important part of an apartment community.

- Baby boomer respondents report valuing social interaction more than Millennials do (78% versus 71%).

"As we head into 2024, this data underscores the enduring demand for apartments and reveals insights that will continue to shape the real estate landscape for years to come," said Moore. "At Knightvest, we remain focused on executing our strategy to renovate and reposition apartment communities to create compelling, modern living environments at an extraordinary value. With people staying in apartments longer, this work has never been more important than it is today."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news