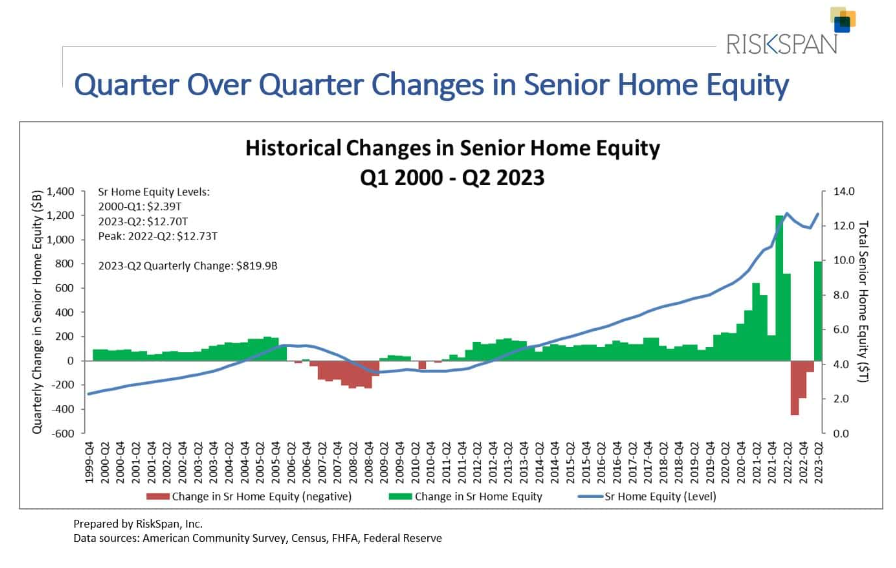

Homeowners 62 and older saw their housing wealth increase by $820 billion in the second quarter of 2023 to $12.69 trillion, according to the latest quarterly release of the NRMLA/RiskSpan Reverse Mortgage Market Index.

Homeowners 62 and older saw their housing wealth increase by $820 billion in the second quarter of 2023 to $12.69 trillion, according to the latest quarterly release of the NRMLA/RiskSpan Reverse Mortgage Market Index.

The NRMLA/RiskSpan Reverse Mortgage Market Index (RMMI) rebounded to 444.16, nearing its peak in Q2 of 2022. Senior home values reached an all-time pinnacle at $14.998 trillion, while mortgage debt surged to $2.3 trillion.

In its analysis, RiskSpan says a parallel trend can be observed in the S&P’s National Home Price Index, which reached an all-time high in June 2022, experienced a decline until January 2023, and has since made a substantial recovery.

“Inflation is still a concern, and some economists are still predicting a possible mini recession in 2024, so this is welcome news to see home equity levels are rebounding somewhat,” says NRMLA President Steve Irwin. “The strategic use of home equity can play an important role in helping to offset the impact of these economically challenging times and is something that every homeowner should consider when developing or updating their retirement plan.”

In Q1, NRMLA reported that homeowners 62 and older saw their housing wealth fall by 1.7% or $196 billion in Q1 of 2023 to $11.62 trillion, as the NRMLA/RiskSpan Reverse Mortgage Market Index (RMMI) fell for a second consecutive quarter to 406.52 in Q1 2023. The decline in the RMMI was attributed to several factors, but primarily a decline in senior home values, which fell 1.3% or $185 billion.

Homeowners 62 and older saw their housing wealth grow by 1.95% or $226 billion in Q3 of 2022 to a record $11.81 trillion from Q2 2022, according to NRMLA. NRMLA’s RiskSpan Reverse Mortgage Market Index (RMMI) rose in Q3 2022 to 413.22, another all-time high since the Index was first published in 2000. The increase in older homeowners’ wealth was mainly driven by an estimated 1.95% or $268 billion increase in home values, offset by a 1.93% or $42 billion increase in senior-held mortgage debt.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news