Freddie Mac's Primary Mortgage Market Survey shows the average interest rate for the 30-year fixed-rate mortgage (FRM) climbing to 4.35 percent (0.7 point) for the week ending November 14.

Read More »Third-Quarter Refinancers to Save $6B Over Next Year

According to the results of Freddie Mac's latest quarterly refinance analysis, the average interest rate reduction among those who refinanced in Q3 was about 1.8 percentage points, representing a savings of about 30 percent ($3,500 over 12 months on a $200,000 loan). For borrowers who refinanced last quarter, the estimated interest savings over the next year will be about $6 billion. For those who refinanced through the Home Affordable Refinance Program (HARP), the average rate reduction in Q3 was 1.9 percent points.

Read More »Mortgage Rates Ease to Close October

Softening trends in the housing market brought fixed mortgage rates to their lowest level since June last week, according to data from Freddie Mac.

Read More »Ongoing Taper Speculation Knocks Mortgage Rates Down

Continued speculation surrounding the Federal Reserve├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós bond purchase program drove long-term mortgages rates down this week, according to reports from Freddie Mac and Bankrate.com. Frank Nothaft, VP and chief economist at Freddie Mac, noted the decrease in fixed rates was likely the result of disappointing numbers for new home sales in July. While Bankrate also pointed to new home sales as a factor in this week's rate movements, developments abroad may have figured in, as well.

Read More »Fixed Rates Soar Leading Up to FOMC Minutes

Fixed mortgage rates jumped this week as markets awaited the release of minutes from the Federal Open Market Committee's (FOMC) July meeting, which contained hints of when the Federal Reserve might start reducing its bond purchases. According to Freddie Mac's Primary Mortgage Market Survey, the 30-year fixed-rate mortgage (FRM) averaged 4.58 percent (0.8 point) for the week ending August 22, up from last week's 4.40 percent. Meanwhile, Bankrate.com reported a two-year high for the 30-year fixed average in its own weekly survey.

Read More »Fixed Rates See Quiet Week as Markets Calm

Having spent the last several months bouncing around, average fixed mortgage rates were little changed over the last week as market speculation settled.

Read More »Fixed-Rate Loans Overwhelmingly Popular with Refinancers

Freddie Mac found that among refinances in the second quarter, 79 percent of homeowners with adjustable-rate mortgages (ARMs) switched to fixed-rate loans.

Read More »FHFA: Mortgage Rates, Loan Values Increase in March

Mortgage rates, loan values, loan terms, and loan-to-price ratios all rose in March, according to a report released by the Federal Housing Finance Agency (FHFA).

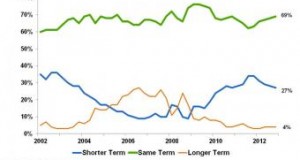

Read More »Freddie Mac: 27% of Q4 Refinancers Shortened Loan Terms

Data released by Freddie Mac shows more than a quarter of borrowers who refinanced in Q4 2012 chose to shorten their loan terms.

Read More »FHFA Mortgage Rates Index Finishes 2012 with Final Decline

After steadily dropping throughout the year, mortgage rates closed out 2012 with one final monthly decline, according to the Federal Housing Finance Agency's (FHFA) December index. The contract rate on the composite of all mortgage loans (both fixed- and adjustable-rate) was 3.28 percent in December, down from 3.36 percent in November. The effective interest rate, which reflects the amortization of initial fees and charges, was 3.42 percent, down from 3.49 percent the previous month.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news