The minutes from the July 28-29, 2015 Federal Open Market Committee (FOMC) meeting released Wednesday confirmed that the economy is still unprepared for a hike in the federal funds rate, but the increase is imminent.

Read More »Personal Income, Spending Pick Up Steam in August

The Bureau of Economic Analysis (BEA) reported Monday that personal consumption expenditures increased $57.5 billion—0.5 percent—month-over-month in August. The increase in spending followed a meager revised increase of less than 0.1 percent for July. Spending was helped by a 0.3 percent pickup in personal income, totaling an increase of $47.3 billion.

Read More »FOMC Votes No Change in Asset Purchases

Analysts holding out for a sign that the Federal Reserve may soon taper its asset purchasing program will have to continue waiting. The Fed released on Wednesday the latest Federal Open Market Committee (FOMC) statement, revealing a generally cautious attitude as the economy struggles against headwinds. On the subject of housing, the FOMC noted growth has slowed in recent months; however, unlike the September statement, October's release does not cite rising mortgage rates as a concern.

Read More »Second-Quarter GDP Maintains 2.5% Growth Rate

The nation's economy grew at an annual rate of 2.5 percent in the second quarter, the Bureau of Economic Analysis (BEA) revealed Thursday. Economists had expected the report--the third in the series of monthly GDP reports by the BEA--to show the economy had grown at a 2.8 percent annual rate, which would have been faster than the 2.5 percent growth rate BEA reported a month ago.

Read More »FOMC Votes No Change in Policy, Foresees Slower Growth

While noting improvement in economic activity and labor market conditions, the Federal Open Market Committee voted Wednesday to continue its policy of near-zero interest rates and its $85-billion-per-month bond-buying program. At the same time, the Federal Reserve's own economic projections suggested the economy might not grow this year as fast as it expected just three months ago.

Read More »Slow Wage Growth Holds Down March Personal Income

Restrained by slow wage growth, personal income rose a disappointing $30.9 billion (0.2 percent) in March--half of what economists expected--as spending rose $21.0 billion or 0.2 percent, the Bureau of Economic Analysis reported Monday. Economists had expected income to improve 0.4 percent in February and spending to increase 0.1 percent. Personal income had improved $15.2 billion in February, largely on the strength of an $80 billion increase in dividend payments. Dividend payments in March increased by $4.5 billion over February.

Read More »Mortgage Rates Turn Down Amid Eurozone Woes

After spiking last week, mortgage rates took a dive this week as tension broke out in Europe over the financial crisis in the island country of Cyprus.

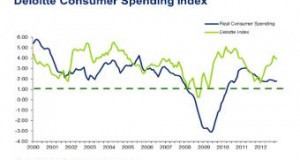

Read More »Deloitte Consumer Spending Index Falls in January

Deloitte's Consumer Spending Index declined for the third straight month in January, the company reported. The index, which tracks consumer cash flow as an indicator of future spending, fell to 3.87 from a previous reading of 3.93. Patricia Buckley, director of economic policy and analysis at Deloitte and author of the monthly index, explained the decrease is "primarily due to slowing increases of new home prices," though gradual improvements in initial unemployment claims and real wages may reverse the downward trend in the future.

Read More »Consumer Sentiment Improves in January

Consumer confidence picked up somewhat in January, but the recent payroll tax hike put a ceiling on any major gains.

Read More »Bloomberg BNA Outlook Predicts Moderate Economic Growth in 2013

A strengthening private sector should give the economy a boost in the second half of 2013 after a slow start, according to Bloomberg BNA's annual Economic Outlook. The forecast--a consensus projection from economists at 21 leading financial, consulting, and academic organizations across the country--calls for a temporary slowdown in economic growth in the first half of the year as the country feels the impacts of the payroll tax hike and other major shifts in federal fiscal policy.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news