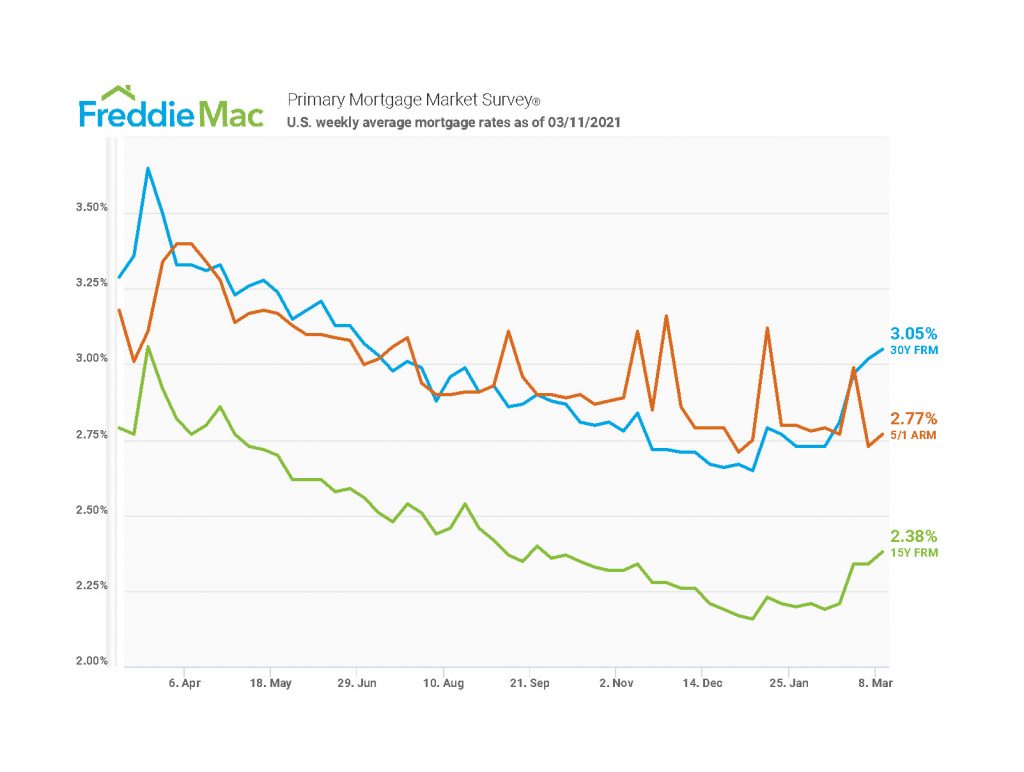

Mortgage rates continue to climb, as the 30-year fixed-rate mortgage (FRM) averaged 3.05% for the week ending March 11, 2021, the highest point since July of 2020. Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows fixed rates up a slight 0.03% over last week, when the FRM eclipsed the 3.0% mark for the first time in 2021. A year ago at this time, the 30-year FRM averaged 3.36%.

Mortgage rates continue to climb, as the 30-year fixed-rate mortgage (FRM) averaged 3.05% for the week ending March 11, 2021, the highest point since July of 2020. Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows fixed rates up a slight 0.03% over last week, when the FRM eclipsed the 3.0% mark for the first time in 2021. A year ago at this time, the 30-year FRM averaged 3.36%.

“As the economy improves given labor market optimism, continued vaccination roll-out and additional stimulus pending, mortgage interest rates increased this week,” said Sam Khater, Freddie Mac’s Chief Economist. “But even as rates rise modestly, the housing market remains healthy on the cusp of spring homebuying season. Homebuyer demand is strong and, for homeowners who have not refinanced, but are looking to do so, they have not yet lost the opportunity.”

A strong spring homebuying season nears as competition is fierce in a market tight on housing supply with sellers yielding record-high profits. Yet another bright spot this week was the U.S. Department of Labor’s unemployment claims, which found for the week ending March 6, seasonally-adjusted initial unemployment claims at 712,000, a decline of 42,000 claims from the previous week's total.

“Investors welcomed the Congressional $1.9 trillion stimulus bill passage with growing optimism, signaling a boost to consumer spending and economic growth, and translating into further pullback from the bond market, leading to higher rates,” said realtor.com Senior Economist George Ratiu. “The upward march of bond rates over the past few weeks is a clear signal that the two-pronged approach of more vaccines and large fiscal stimulus is accelerating the timelines for business re-openings, and fueling optimism about the economy. A return toward normal is a much-needed and welcome development for real estate markets grappling with very tight inventory and listing prices that have already exceeded 2020’s summer peak before the spring season even started.”

Also this week, Freddie Mac reported the 15-year FRM at 2.38%, with an average 0.6 point, up from last week when it averaged 2.34%. A year ago at this time, the 15-year FRM averaged 2.77%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.77%, with an average 0.3 point, up from last week when it averaged 2.73%. A year ago at this time, the five-year ARM averaged 3.01%.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news