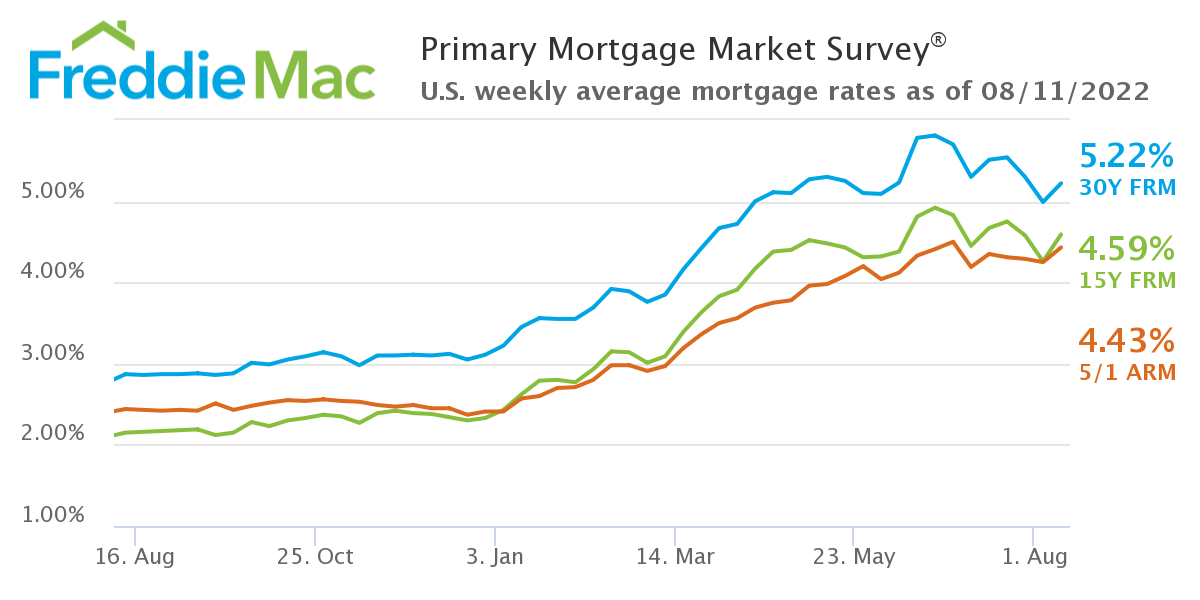

And the mortgage pendulum swings once again this week, this time in the direction of higher rates, as Freddie Mac reports in its latest Primary Mortgage Market Survey (PMMS), the 30-year fixed-rate mortgage (FRM) was up over last week, averaging 5.22% with an average 0.7 point as of August 11—up from last week when it averaged 4.99%. A year ago at this time, the 30-year FRM averaged 2.87%.

And the mortgage pendulum swings once again this week, this time in the direction of higher rates, as Freddie Mac reports in its latest Primary Mortgage Market Survey (PMMS), the 30-year fixed-rate mortgage (FRM) was up over last week, averaging 5.22% with an average 0.7 point as of August 11—up from last week when it averaged 4.99%. A year ago at this time, the 30-year FRM averaged 2.87%.

“The 30-year fixed-rate went back up to well over five percent this week, a reminder that recent volatility remains persistent,” said Sam Khater, Freddie Mac’s Chief Economist. “Although rates continue to fluctuate, recent data suggest that the housing market is stabilizing as it transitions from the surge of activity during the pandemic to a more balanced market. Declines in purchase demand continue to diminish while supply remains fairly tight across most markets. The consequence is that house prices likely will continue to rise, but at a slower pace for the rest of the summer.”

And despite the rise once again in rates, the housing market continues to correct itself, as last week’s dip in rates to a four-month low below the 5%-mark drove overall mortgage applications up slightly, according the Mortgage Bankers Association’s (MBA) latest Weekly Mortgage Applications Survey.

“Real estate markets continue on the path toward rebalancing. The inventory of homes for sale increased solidly in July, moving toward levels not seen since mid-2020,” said Realtor.com Manager of Economic Research George Ratiu. “With more available properties and less competition, more homeowners are beginning to adjust to the new reality and resorting to price cuts to incentivize buyers. The share of listed homes with price reductions reached 19% in July, closing in on levels we haven’t seen since 2017. Moreover, median prices retreated from June’s record-high, as the pace of growth moderated. These shifts point toward a welcome change for buyers who are still in the market. The upcoming fall season may offer an even better window of opportunity, as long as the inventory landscape continues improving, as we’ve seen in recent months.”

Realtor.com’s Monthly Housing Trends Report for July found that July’s housing inventory grew for the third consecutive month, rising by a record 30.7% year-over-year. And while there has been an upward push in the nation’s housing inventory and hints at stabilization in the market, many are still hesitant to dip their toes into market at this time.

Fannie Mae’s latest Home Purchase Sentiment Index (HPSI)—a measure of consumer feelings on the housing market—fell two points in June to 62.8, its second-lowest reading in a decade. The HPSI found consumers expressed pessimism about homebuying conditions, with just 17% reporting that now was a “good time to buy.”

“With home price growth slowing, and projected to slow further, we believe consumer reaction to current housing conditions is likely to be increasingly mixed: Some homeowners may opt to list their homes sooner to take advantage of perceived high prices, while some potential homebuyers may choose to postpone their purchase decision believing that home prices may drop,” said Douglas G. Duncan, Fannie Mae SVP and Chief Economist. “Overall, this month’s HPSI results appear to confirm our forecast for moderating home sales over the coming year.”

Also this week, Freddie Mac reported the 15-year FRM averaging 4.59% with an average 0.7 point, up from last week when it averaged 4.26%. A year ago at this time, the 15-year FRM averaged 2.15 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.43% with an average 0.0 point, up from last week when it averaged 4.25%. A year ago at this time, the five-year ARM averaged 2.44%.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news