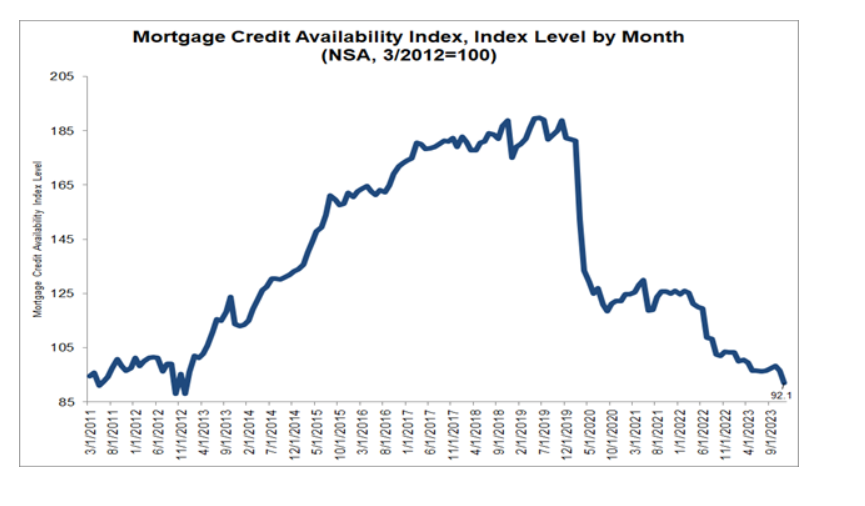

Mortgage credit availability decreased by 4.6% to 92.1 in December 2023, according to the latest Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

Mortgage credit availability decreased by 4.6% to 92.1 in December 2023, according to the latest Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

A decline in the MCAI indicates that lending standards are tightening, while increases in the MCAI are indicative of loosening credit. The Index was benchmarked to 100 in March 2012.

By loan type, the Conventional MCAI decreased 3.2%, while the Government MCAI decreased by 5.9%. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 1.7%, and the Conforming MCAI fell by 5.9%.

“Credit availability declined in December to the lowest level since 2012, as ongoing industry consolidation is resulting in more loan programs being removed from the marketplace,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “Both conventional and government indices experienced decreases. The decrease in the government index was driven by lower investor demand for renovation loans and streamline refinance loans.”

As 2023 closed, the 30-year, fixed-rate mortgage (FRM) was on the decline, falling the final two months of the year after edging toward the 8% mark at the outset of Q4.

The MBA’s Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI, and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

The Total MCAI has an expanded historical series that gives perspective on credit availability going back approximately 10-years (expanded historical series does not include Conventional, Government, Conforming, or Jumbo MCAI). The expanded historical series covers 2004 through 2010 and was created to provide historical context to the current series by showing how credit availability has changed over the last 10 years–including the housing crisis and ensuing recession. Data prior to March 31, 2011 was generated using less frequent and less complete data measured at six-month intervals and interpolated in the months between for charting purposes. Methodology on the expanded historical series from 2004 to 2010 has not been updated.

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for more than 95 lenders/investors are combined by MBA using data made available via ICE Mortgage Technology and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news