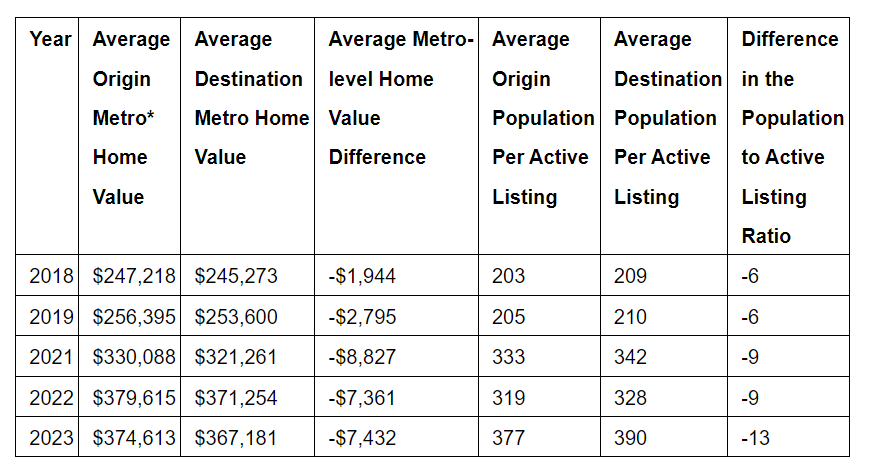

Households that moved across state lines in 2023 relocated to markets where homes cost on average $7,500 less than where they came from, a new Zillow study of United Van Lines data shows. That's down a bit from $8,900 at the peak of the pandemic housing market in 2021, but up from a savings of just $2,800 in 2019.

Households that moved across state lines in 2023 relocated to markets where homes cost on average $7,500 less than where they came from, a new Zillow study of United Van Lines data shows. That's down a bit from $8,900 at the peak of the pandemic housing market in 2021, but up from a savings of just $2,800 in 2019.

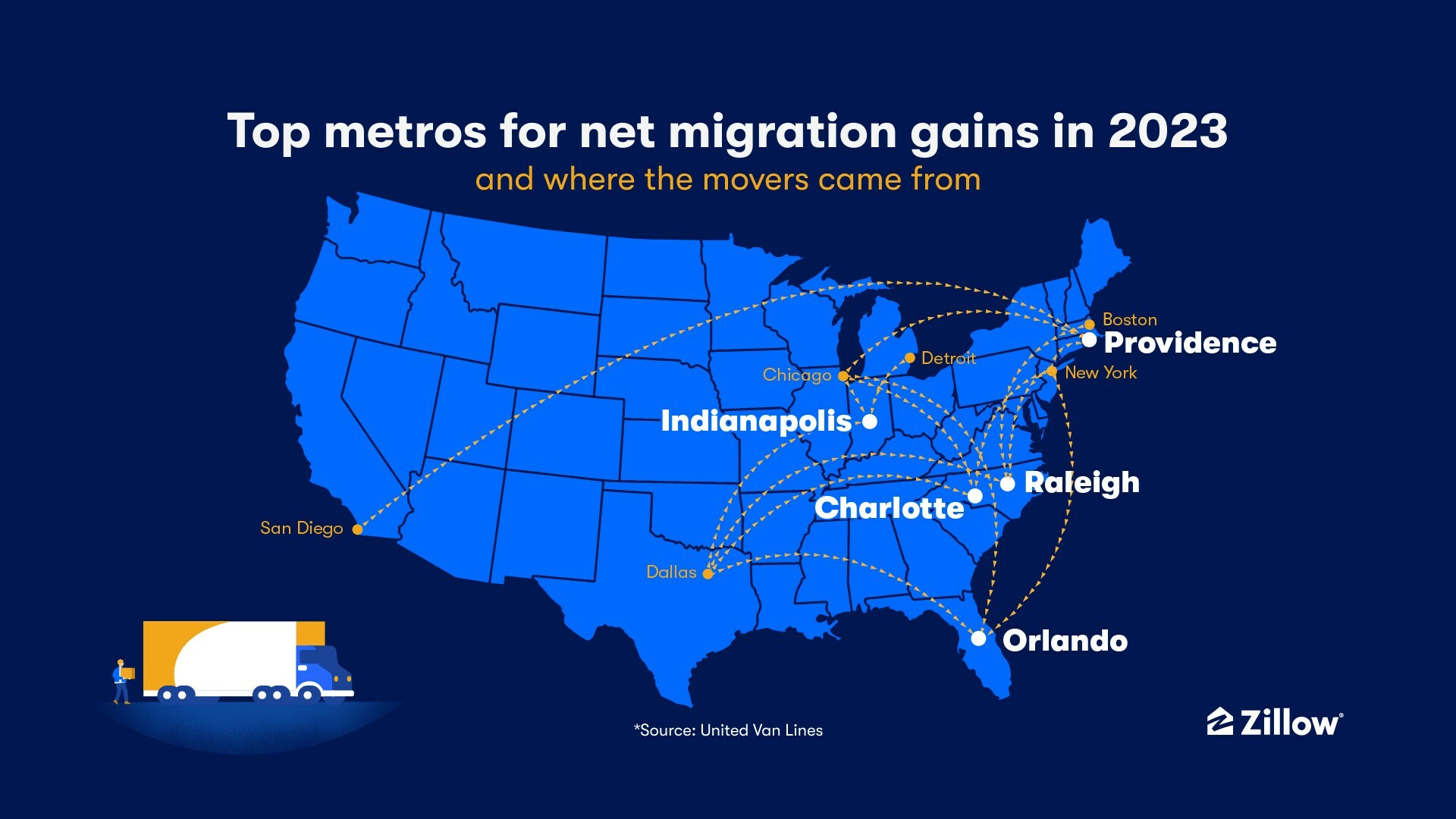

The five metro areas that saw the largest net migration gains according to the United Van Lines data were relatively affordable markets in the South, Midwest and Northeast. Although housing affordability has always played a key role in explaining migration patterns, the increase in house prices during the pandemic and the subsequent jump in mortgage rates appears to have intensified the search for more tolerable monthly payments.

"Affordability is one of the biggest considerations for home buyers and sellers, and clearly plays a major role in deciding where to put down roots," said Zillow Senior Economist Orphe Divounguy. "Housing costs hit record highs last year, and made both buying and selling difficult, even for homeowners sitting on massive equity. Finding a less expensive area where dollars aren't quite so stretched was a smart move for a lot of people."

Affordability may improve slightly in 2024, but it has declined significantly over the past four years. The share of median household income needed to pay rent has risen from less than 27% in November 2019 to nearly 30% in November 2023. The share of income needed for a monthly mortgage payment on a typical home purchase has risen even more dramatically, from about 23% to nearly 39% over the same period. In many places, especially the West Coast, costs are so high that a family making the median household income won't even qualify for a mortgage.

United Van Lines customers have higher average household incomes than movers overall, but migration flows in the U.S. Census Bureau's American Community Survey reveal a similar pattern. In 2021, the average interstate mover moved to a metro area where homes would save them about $10,000 when compared to where they came from; that's in comparison to savings of a little less than $700 in 2019, before the pandemic.

Among the 50 largest metros by population, those with the highest net in-migration from United Van Lines customers in 2023 were Charlotte, Providence, Indianapolis, Orlando, and Raleigh.

Of those five metros, four ranked among Zillow's 10 hottest markets of 2024. This index is driven by expected home value growth, how fast home sellers are entering into contracts with buyers, job growth per new home permitted and growth in owner-occupied households.

Metros with the highest net number of residents relocating were Chicago, San Diego, Cincinnati, Detroit, and Boston.

United Van Lines customers are also, increasingly, moving to markets with less potential competition for homes. Movers relocated to destination metros with an average of six fewer competitors per listing in 2019. That difference grew to 13 in 2023.

Metros with more United Van Lines outbound moves than inbound moves tended to experience less growth in their working-age population in the same year, and lower growth in home values in the year that immediately followed.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news