Have you ever wondered what the total value of homes are in a given area?

According to a new study, LendingTree analyzed data from the latest U.S. Census Bureau American Community Survey to take a look at how much money American homes are worth collectively. Specifically, Census data was used to examine the total value of owner-occupied housing units in each of the 50 largest U.S. metropolitan areas.

LendingTree experts found that owner-occupied housing units in the nation’s largest metros are valued at more than a whopping $23 trillion total.

Report Highlights:

- The exact total value of owner-occupied housing units in the nation’s 50 largest metros is $23.48 trillion. This figure grew by about 38% between 2019 and 2022, from $17.02 trillion.

- Real estate value in the nation’s 50 largest metros makes up the bulk of that value across the country. The total value of all owner-occupied homes in the U.S. is $36.60 trillion. This means the value of homes in the nation’s largest metros accounts for 64.1% of the total value of homes across the U.S.

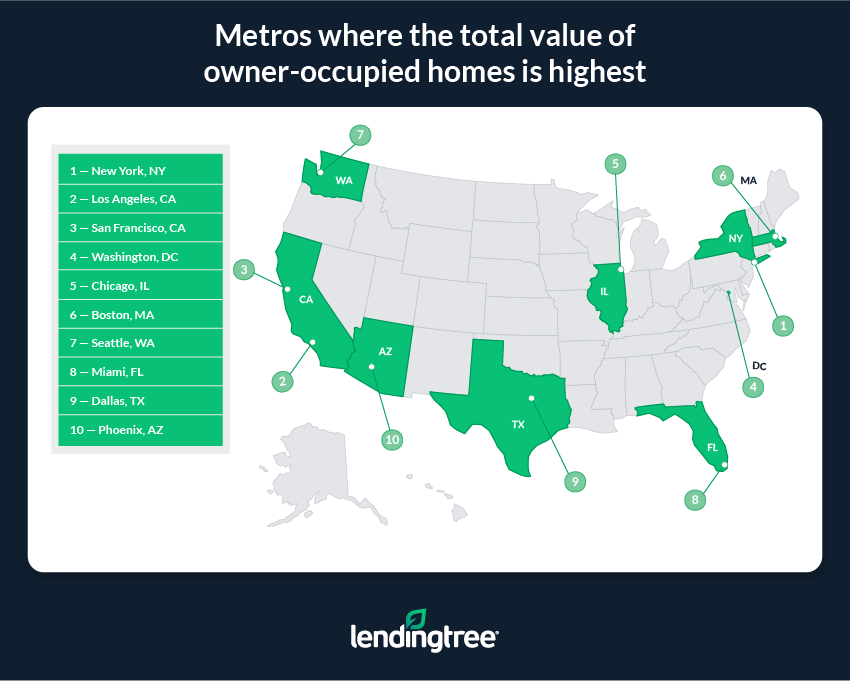

- Based on the total value of owner-occupied homes within them, New York, Los Angeles, and San Francisco are the most valuable metros in the U.S. The total value of homes in the New York metro area is $2.75 trillion, while the total values in Los Angeles and San Francisco are $2.31 trillion and $1.39 trillion, respectively. At $1.01 trillion, the Washington, D.C., metro is the only other where the total value of owner-occupied homes is over $1 trillion.

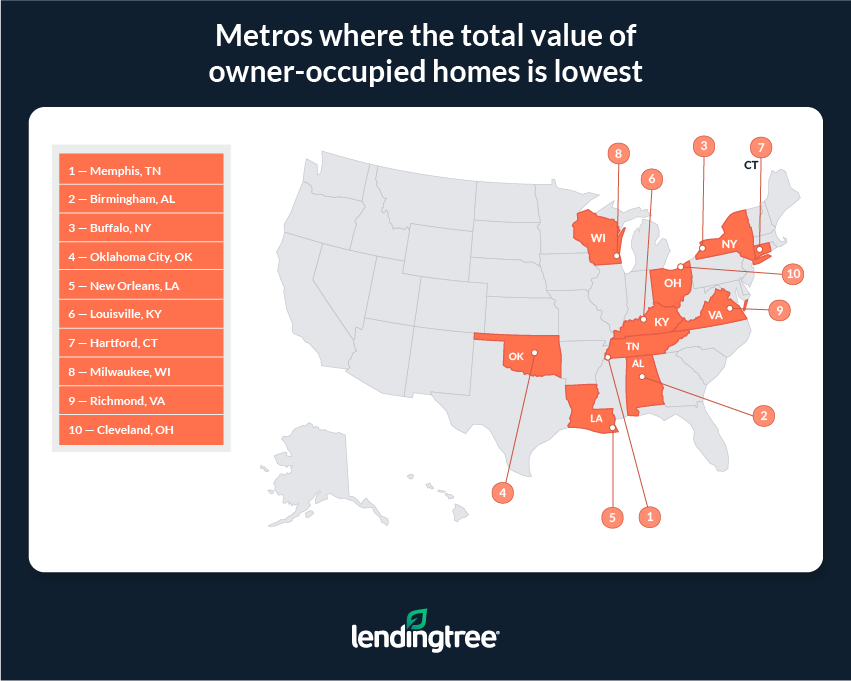

- On the whole, real estate is less valuable in Memphis, Tenn., Birmingham, Alabama, and Buffalo, N.Y. With respective values of $88.4 billion, $90.4 billion, and $93.1 billion, respectively, the total values of owner-occupied homes in these three areas are still steep. However, they’re relatively modest compared to many others. Oklahoma City, where the total value of owner-occupied housing units is $96.2 billion, is the only other metro where homeowners are sitting on less than $100 billion in aggregate real estate value.

- Collectively, owner-occupied housing units with a mortgage are worth more than those without a mortgage. Across the nation’s 50 largest metros, the total value of homes with a mortgage is $15.83 trillion—8.18 trillion higher than the total value of homes without a mortgage. There are various reasons why this is the case—chief among them is that there are more than 13 million more owner-occupied homes with a mortgage in these metros than owner-occupied homes without one.

Top 10 metros where the total value of owner-occupied homes is highest:

- New York

- Los Angeles

- San Fransisco

- Washington, D.C.

- Chicago

- Boston

- Seattle

- Miami

- Dallas

- Phoenix

Top 10 metros where the total value of owner-occupied homes is lowest:

- Memphis, TN

- Birmingham, AL

- Buffalo, NY

- Oklahoma City

- New Orleans

- Louisville, KY

- Hartford, CT

- Milwaukee

- Richmond, VA

- Cleveland

According to the report, the total value of housing in the U.S. is enormous and has grown rapidly over the past few years.

The total value of owner-occupied housing units in the U.S. rose by about 39.7% (more than $10 trillion) between 2019 and 2022—from $26.21 trillion to $36.60 trillion. In comparison, the increase between 2016 and 2019 was 19.5%.

A key reason for this dramatic rise stems from the record-low mortgage rates during the height of the COVID-19 pandemic. In 2020 and 2021, the average rate on a 30-year, fixed-rate mortgage tended to hover around 3.00%. Rates at that level made borrowing cheaper and drastically reduced the cost of a mortgage, providing a great incentive for people to buy, even at inflated prices.

Though rates have since risen, supply chains and labor shortages have improved and mortgage demand has fallen, the home price gains seen during the height of the pandemic have stuck around.

Overall, Americans still collectively own a large amount of total real estate value, even in the face of the slow-moving housing market of the latter half of 2022 and today.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news