As Americans settle into the New Year, what can they expect from the housing market?

According to a new report from Redfin, pending U.S. home sales posted their smallest year-over-year decline in two years (-3%) during the four weeks ending January 7.

Additionally, mortgage-purchase applications are up 3% from December, and Redfin’s Homebuyer Demand Index is up 5% from a month ago.

Redfin agents report that as the new year kicks off, more sellers are listing and more buyers are going on tours and applying for mortgages as rates remain in the mid-6% range, down from 8% in October. Buyers are motivated by lower mortgage payments—the median U.S. housing payment is down $327 (-12%) from October’s all-time high—and sellers are motivated by increased demand and the lock-in effect easing.

There are 9% more new listings than there were a year ago, and while the total number of listings is down 3% annually, that’s the smallest decline since June.

"More buyers are out there touring this week; they feel optimistic now that rates have come down a bit," said Heather Mahmood-Corley, Phoenix Redfin Premier Agent. "I'm advising house hunters to start making offers now because the market feels pretty balanced. Interest rates are lower, and there are more listings, but there's not much competition yet."

Leading Indicators of Homebuying Demand and Activity:

- The daily average 30-year fixed mortgage rate was 6.78% as of January 10, up slightly from 6.72% a week earlier and up from 6.14%, according to the report.

- The weekly average 30-year fixed mortgage rate was 6.62% for the week ending January 4, nearing the lowest level since May but up from 6.48%, according to Freddie Mac.

- Mortgage-purchase applications (seasonally adjusted) were up 6% from a week earlier and up 3% from a month earlier as of the week ending January 5, but down 16%, according to the Mortgage Bankers Association.

- The Redfin Homebuyer Demand Index (seasonally adjusted) was up 5% from a month earlier as of the week ending January 7, but down 9%.

- Google searches for “home for sale” were up 10% from a month earlier as of January 8, but down 20%, according to Google Trends.

Key Housing Market Data (for the Four Weeks Ending January 7):

Key Housing Market Data (for the Four Weeks Ending January 7):

- The median sale price was $363,125, representing a 4.1% year-over-year (YoY) change, close to the biggest increase since October 2022.

- The median asking price was $364,725, representing a 4.9% YoY change.

- The median monthly mortgage payment was $2,399 at a 6.62% mortgage rate, reflecting a 7.4% YoY change and down $327 from the all-time high set during the four weeks ending October 22, near the lowest level in about a year.

- Pending sales were at 49,963, reflecting a -2.5% YoY change, the smallest decline since January 2022.

- New listings were at 44,682, reflecting a 9% YoY change.

- Active listings were at 775,467, reflecting a -2.9% YoY change, the smallest decline since June.

- Months of supply were 4.2 months, reflecting a +0.3 percentage point YoY change.

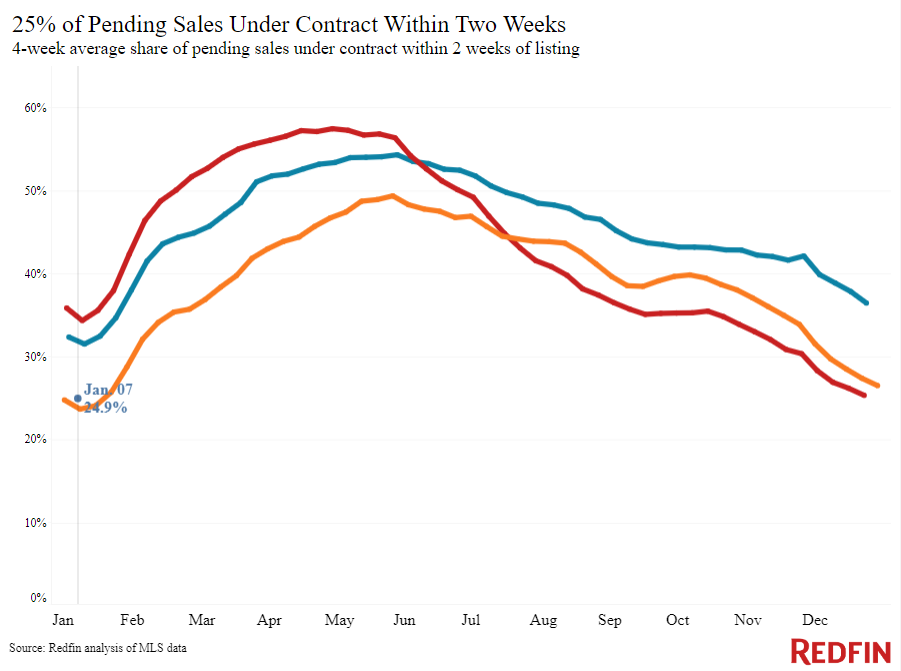

- The share of homes off the market in two weeks was 24.9%, up from 24% YoY.

- The median days on market were 42 days, reflecting a -2 day YoY change.

- The share of homes sold above the list price was 23.7%, up from 22% YoY.

- The share of homes with a price drop was 3.9%, representing a +0.4 percentage point YoY change.

- The average sale-to-list price ratio was 98.3%, representing a +0.4 percentage point YoY change.

"With activity picking up, I think prices will rise and bidding wars will become more common," said Mahmood-Corley.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news