New research conducted by the real estate experts at Agent Advice analyzed Zillow data has revealed the U.S. states where it’s easiest to sell your home, with the Hoosier state of Indiana coming out on top.

New research conducted by the real estate experts at Agent Advice analyzed Zillow data has revealed the U.S. states where it’s easiest to sell your home, with the Hoosier state of Indiana coming out on top.

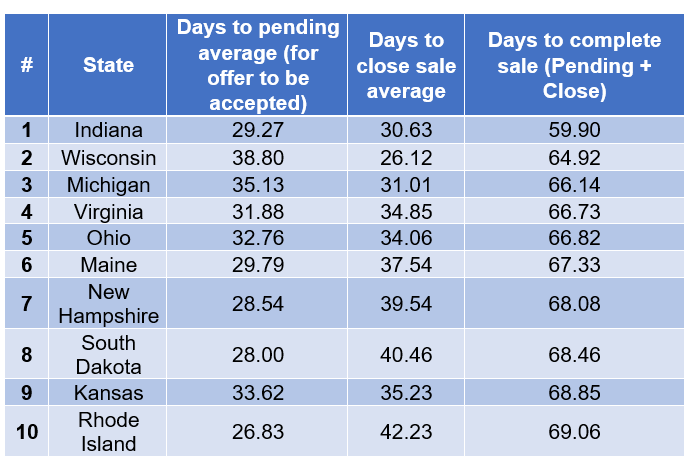

The study analyzed the average number of days it took for an offer to be accepted on a home in each state, and the average number of days it took to close a home sale.

The experts of Agent Advice found that in Indiana, it was easiest to sell a home, with homes on sale in the Hoosier State seeing an average of 29.27 days for an offer to be accepted, and a further 30.63 days on average to close the sale. This means that from start to finish, it took approximately 59.90 days on average to sell a home, the lowest of any U.S. state.

Coming in at second in the poll was the Badger State of Wisconsin, with an average of 64.92 days to sell a home from start to finish. It took, on average, 38.80 days for an offer to be accepted in the state, with 26.12 more days on average to close the sale.

Michigan ranked third place on the list, as homes sold in the Wolverine State took an average of 35.13 days for an offer to be accepted, followed by an average of 31.01 days to close the sale, adding up to an average of 66.14 days to sell a Michigan home from start to finish.

Taking fourth place was Virginia, where it took an average of 66.73 days to sell a home in the state, with an average of 31.88 days for an offer to be accepted, and 34.85 days on average to close the sale.

Rounding out the top five is the Buckeye State of Ohio, which followed closely behind Virginia with an average of 66.83 days to sell a home from start to finish. It took 32.76 days on average for an offer to be accepted, and another 34.06 days on average to close the sale.

“One thing that can be interpreted is that in the Midwest, it seems to be easiest to sell your home, with the top three being made up of Indiana, Wisconsin, and Michigan,” said Chris Heller, Co-Founder of Agent Advice. “The number of days is due to several reasons, demand to move to these states, a lack of supply for affordable housing, or a combination of both. Furthermore, some states seemingly have a big gap between how long it takes for a sale to be closed and how long it takes for an offer to be accepted, showing that conditions on the side of the estate agent may not be as feasible.”

In the number six spot was Maine where the average number of total days to close a home was 67.33 days, with 29.79 days on average for an offer to be accepted, and another 37.54 days on average to close the sale.

Occupying seventh on the list was another New England state, New Hampshire, where the average number of total days to close a home was 68.08 days, with 28.54 days on average for an offer to be accepted, and another 39.54 days on average to close the sale.

In the number eight spot was the home of Mount Rushmore, South Dakota, where the average number of total days to close a home was 68.46 days, with an even 28 days on average for an offer to be accepted, and another 40.46 days on average to close the sale.

Coming in ninth was the midwestern state of Kansas, where the average number of total days to close a home was 68.85 days, with 33.62 days on average for an offer to be accepted, and another 35.23 days on average to close the sale.

Rounding out the top 10 was yet another New England-based destination in Rhode Island, where the average number of total days to close a home was 69.06 days, with 26.83 days on average for an offer to be accepted, and another 42.23 days on average to close the sale.

For the study, Agent Advice broke down Zillow Housing Data, 2023, mean days to close (Raw, All Homes, Monthly); Zillow Housing Data, 2023, mean days to pending (Raw, All Homes, Monthly), from the 365-day span from October 2022 to October 2023.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news