In a week where mortgage rates fell to their lowest point since May 2023, the Mortgage Bankers Association (MBA) reports that a 3.7% week-over-week uptick in mortgage application volume (for the week ending January 19, 2024).

In a week where mortgage rates fell to their lowest point since May 2023, the Mortgage Bankers Association (MBA) reports that a 3.7% week-over-week uptick in mortgage application volume (for the week ending January 19, 2024).

The holiday adjusted Refinance Index decreased 7% from the previous week, and was 8% lower than the same week one year ago. The unadjusted Refinance Index decreased 16% from the previous week, and was 8% lower than the same week one year ago. The seasonally adjusted Purchase Index increased 8% from one week earlier. The unadjusted Purchase Index increased 3% compared with the previous week, and was 18% lower than the same week one year ago.

“Mortgage rates increased slightly last week, but there continues to be an upward trend in purchase activity. Conventional and FHA purchase applications drove most of the increase last week as some buyers moved to act early this season,” said Joel Kan, MBA’s VP and Deputy Chief Economist.

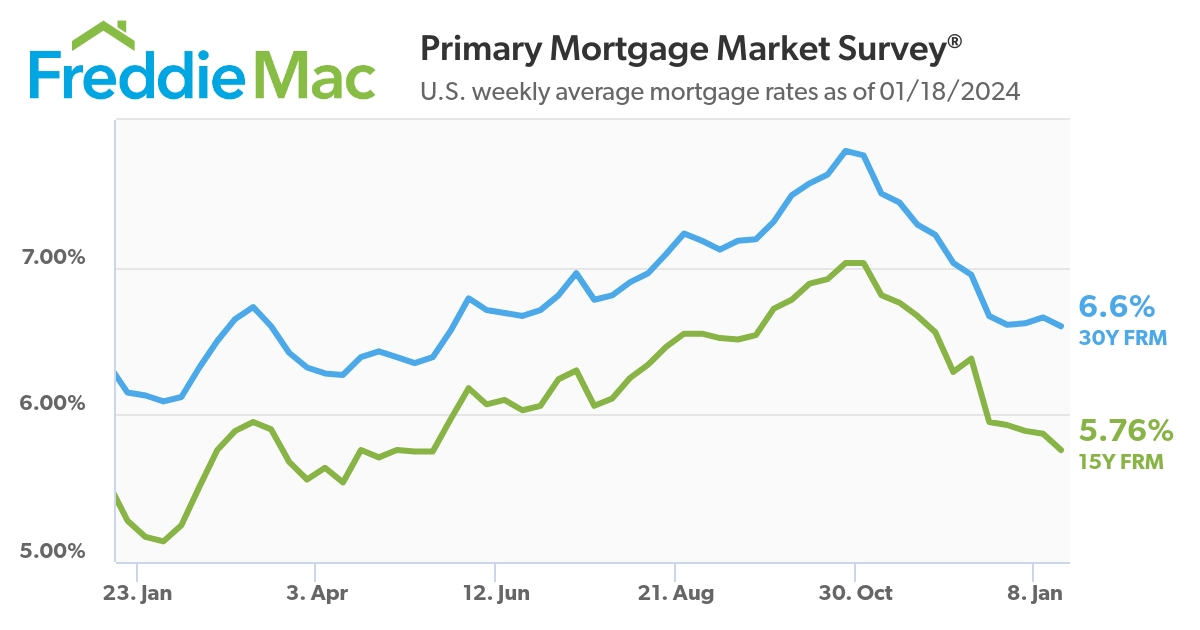

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) for the week ending January 18, 2024, shows the 30-year fixed-rate mortgage (FRM) averaged 6.60%, down from the previous week when it averaged 6.66%. A year ago at this time, the 30-year FRM averaged 6.15%.

Also this week, Freddie Mac reports the 15-year FRM at 5.76%, down from last week when it averaged 5.87%. A year ago at this time, the 15-year FRM averaged 5.28%.

“Mortgage rates decreased this week, reaching their lowest level since May of 2023,” said Sam Khater, Freddie Mac’s Chief Economist. “This is an encouraging development for the housing market, and in particular, first-time homebuyers who are sensitive to changes in housing affordability. However, as purchase demand continues to thaw, it will put more pressure on already depleted inventory for sale.”

The dip in rates was still not enough to push refi volume upward, as the MBA reported the refi share of mortgage activity decreased to 32.7% of total applications, down from 37.5% the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 6.3% of total applications.

“Refinance applications declined over the week and remained at low levels,” added Kan. “There is still little incentive for homeowners to refinance with rates at these levels.”

By loan type, the MBA found the FHA share of total applications decreased to 14.1% from 14.3% the week prior. The VA share of total applications decreased to 13.7% from 14.2% the week prior. The USDA share of total applications decreased to 0.4% from 0.5% the week prior.

One factor in favor of homebuyers to begin 2024, U.S. home prices climbed just 0.4% month-over-month in December, according to the Redfin Home Price Index (RHPI), representing the smallest increase since June 2023. The report also found that December represented the third straight month of slowing price growth, with prices rising approximately 6.6% year-over-year.

Home price growth may have slowed in December due to the nation’s housing shortage easing slightly, providing U.S. homebuyers with more options to choose from, as new listings rose 0.1% to the highest seasonally adjusted level since September 2022 Redfin found. But unfortunately, housing supply remains far below pre-pandemic levels, preventing home prices from dropping further as buyers compete for a limited share of homes for sale.

Good news for the nation’s housing inventory came from the National Association of Home Builders (NAHB), as builder confidence in the market for newly built single-family homes climbed seven points to 44 in January, according to the NAHB/Wells Fargo Housing Market Index (HMI). This second consecutive monthly increase in builder confidence closely tracks with a period of falling interest rates.

“Lower interest rates improved housing affordability conditions this past month, bringing some buyers back into the market after being sidelined in the fall by higher borrowing costs,” said NAHB Chairman Alicia Huey, a custom home builder and developer from Birmingham, Ala. “Single-family starts are expected to grow in 2024, adding much needed inventory to the market. However, builders will face growing challenges with building material cost and availability, as well as lot supply.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news