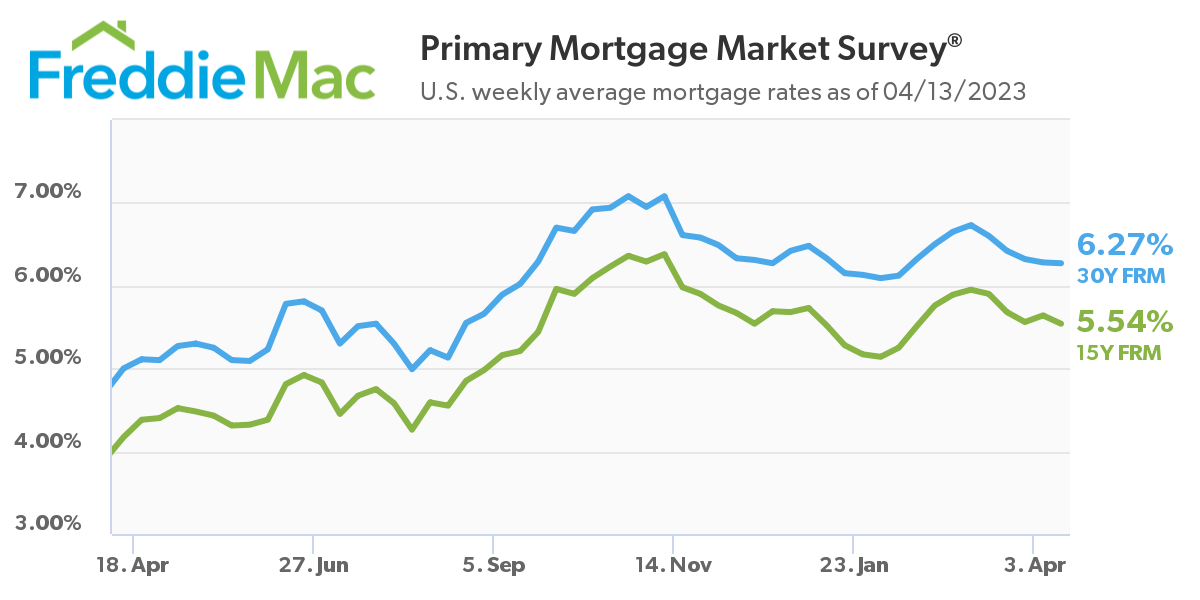

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) for the week ending April 13, 2023 has found that the 30-year fixed-rate mortgage (FRM) slipped for the fifth consecutive week, averaging 6.27%, down slightly from the average of 6.28% reported last week. A year ago at this time, the 30-year FRM averaged 5%.

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) for the week ending April 13, 2023 has found that the 30-year fixed-rate mortgage (FRM) slipped for the fifth consecutive week, averaging 6.27%, down slightly from the average of 6.28% reported last week. A year ago at this time, the 30-year FRM averaged 5%.

“Mortgage rates decreased for the fifth consecutive week,” said Sam Khater, Freddie Mac’s Chief Economist. “Incoming data suggest inflation remains well above the desired level, but showing signs of deceleration. These trends, coupled with tight labor markets, are creating increased optimism among prospective homebuyers as the housing market hits its peak in the spring and summer.”

Also this week, Freddie Mac reported the 15-year FRM averaged 5.54%, down from last week when it averaged 5.64%. A year ago at this time, the 15-year FRM averaged over a full percentage point lower at 4.17%.

The continued slide in rates is a welcomed sign for the spring homebuying season, as the Mortgage Bankers Association (MBA) reports that the overall mortgage application volume rose 5.3% week-over-week, a week after tailing off.

“Prospective homebuyers responded to lower rates last week, leading to an 8% jump in applications to buy a home,” added MBA President and CEO Robert D. Broeksmit, CMB. “The likelihood of even lower rates in the months ahead should lead to increased demand, despite recent signs of a slowing economy and tighter financial conditions.”

Just last week, the Bureau of Labor Statistics (BLS) reported that total nonfarm payroll employment rose by 236,000 in March, and the unemployment rate changed little at 3.5%, as employment continued to trend up in leisure and hospitality, government, professional and business services, and healthcare.

“Bond yields have bounced back from last week’s lows as recent data including last Friday’s jobs report signaled a moderating, but still relatively strong job market, suggesting that the decline in job openings registered in February’s Job Openings and Labor Turnover report may not have heralded a broader weakening in the labor market,” noted Realtor.com Chief Economist Danielle Hale. “This week’s inflation data, based on the consumer price index, much like a Rorschach test, left plenty of room for interpretation. On the one hand, the fact that inflation is still running at more than twice the target level, and core inflation–which includes goods and services excluding volatile food and energy–saw an uptick to 5.6% in March, highlights that the Fed still has more to do and may need to lift short-term rates again at its early May meeting. On the other hand, overall inflation slowed more notably, and even core inflation on a month-to-month basis eased somewhat, a sign that the Fed's tightening is having the desired effect. Even if the Fed needs to raise short-term rates a bit higher, we are very likely nearing the end of the tightening cycle. As long as the economy continues to see progress on inflation, that should help keep mortgage rates at the lower end of the 6% to 7% range that we've seen over the past few months. However, any surprises in the data will likely lead to some volatility in that range.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news