Gone are the days when a down payment was mandatory to secure a mortgage—nowadays there is a plethora of down payment resources available to the public in just about every state and the usage of these programs increased by 0.5% during the first quarter of 2023 according to Down Payment Resource (DPR).

Gone are the days when a down payment was mandatory to secure a mortgage—nowadays there is a plethora of down payment resources available to the public in just about every state and the usage of these programs increased by 0.5% during the first quarter of 2023 according to Down Payment Resource (DPR).

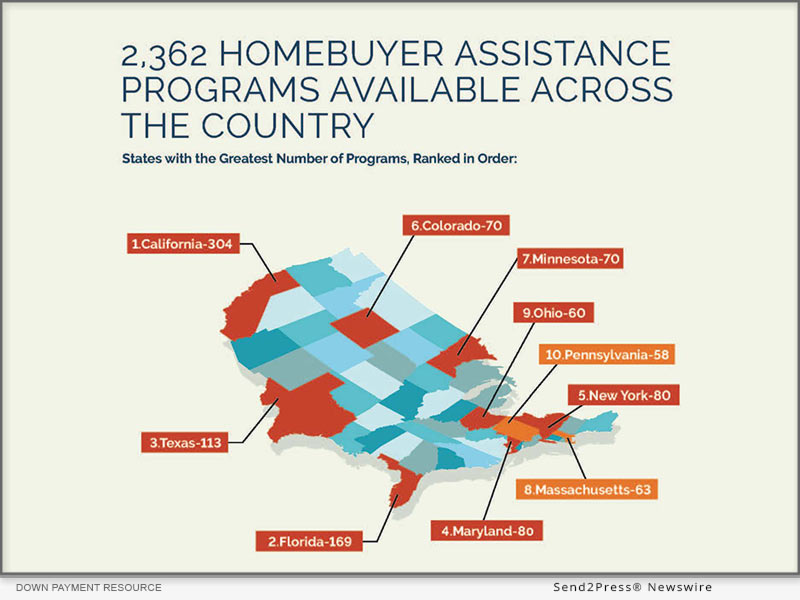

All-in-all, DPR found the number of down payment resources to number in the thousands to the tune of 2,362.

According to the DPR, the quarterly report surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits and other housing organizations. DPR communicates with over 1,200 program providers throughout the year to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates (MCCs) and affordable first mortgages, in the Down Payment Resource database.

Key findings as highlighted by the DPR include:

- The Q1 2023 HPI examined a total of 2,362 homebuyer assistance programs that were active as of April 7, 2023.

- The majority of down payment assistance (DPA) programs are forgivable.8% of DPA programs —which take the form of grants, community second mortgages or a combination of the two—are forgivable, meaning that they never have to be repaid as long as program conditions are met. Of all types of homebuyer assistance, 43.4% percent of programs are forgivable. The share of both categories of forgivable programs increased fractionally over last quarter.

- Incentivized programs are on the rise. There was a 3% increase in incentivized programs—which are geared toward public servants such as teachers and protectors, Native Americans, people with disabilities and veterans, among others—over the previous quarter. Programs with incentives now make up 17.5% of all available programs.

- Support for multifamily properties increased. Programs that support multifamily homeownership saw a 2.2% increase over the previous quarter. These programs now make up 29.8% of all homebuyer assistance offerings.

- There was an uptick in programs without a first-time homebuyer requirement. DPA programs without a first-time homebuyer requirement grew by 2% in Q1 2023. 39.7% of all assistance offerings do not feature a first-time homebuyer requirement.

“The increase in down payment assistance for several consecutive quarters represents growing opportunities for homebuyers that have been traditionally underserved,” said DPR Founder and CEO Rob Chrane. “DPR will continue to raise awareness about the myriad assistance programs available and enhance our solutions that enable housing professionals to help more people achieve their homeownership goals.”

A more detailed analysis of the Q1 2023 HPI findings, including infographics and examples of many of the programs described in this release, can be found here.

For a complete list of homebuyer assistance programs by state, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news