With more and more homebuyers nationwide giving in to the fact that they simply cannot overcome affordability issues presented by the current housing market, purchase demand is on the decline.

With more and more homebuyers nationwide giving in to the fact that they simply cannot overcome affordability issues presented by the current housing market, purchase demand is on the decline.

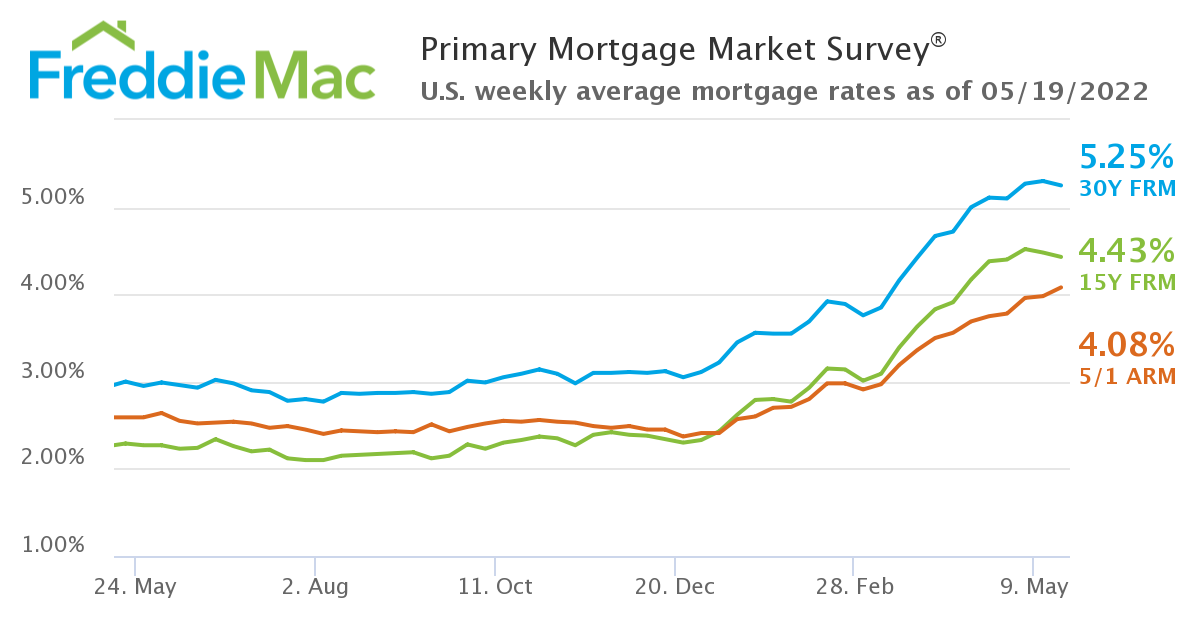

Making matters worse, mortgage rates continue to remain above the 5% mark, as this week, Freddie Mac reported in its Primary Mortgage Market Survey (PMMS) that the 30-year fixed-rate mortgage (FRM) was down to 5.25% from 5.30% last week.

At this time last year, the 30-year FRM stood at an even 3.00%.

"Economic uncertainty is causing mortgage rate volatility,” said Sam Khater, Freddie Mac’s Chief Economist. “As a result, purchase demand is waning, and homebuilder sentiment has dropped to the lowest level in nearly two years. Builders are also dealing with rising costs, meaning this posture is likely to continue.”

The National Association of Home Builders (NAHB) reported earlier this week that builder confidence for newly built single-family homes dropped eight points to 69 in May, marking the fifth consecutive month that builder sentiment has declined, and the lowest reading since June 2020.

Freddie Mac also reported the 15-year FRM at 4.43% with an average 0.9 point, down from the previous week when it averaged 4.48%. A year ago at this time, the 15-year FRM averaged 2.29%.

“Record-breaking and still-rising home prices, climbing mortgage rates and low inventory continue to put pressure on homebuyers,” said Hannah Jones, Economic Data Analyst at Realtor.com. “However, some hope is on the horizon as the market boasts more homes for sale year-over-year for the first time since March 2019. While this development is positive for buyers who have been waiting for their moment, it is the result of rising housing costs pushing many buyers out of the market altogether. Shoppers who are determined to find their perfect home will likely continue to utilize sizable down payments or even relocation to lock in affordable monthly payments. However, for buyers who are unable to contend with higher prices and climbing mortgage rates, still-high inflation and rental prices offer little relief.”

As buyers continue to be pushed out of the market, mortgage application volume continues to slide, dropping 11% week-over-week according to the Mortgage Bankers Association (MBA).

A product that was showing strength amid rising rates was the hybrid adjustable-rate mortgage (ARM), which the MBA reported ARM activity fell slightly to 10.3% of total applications this week, down slightly from 10.8% week-over-week. Freddie Mac reported the five-year Treasury-indexed hybrid ARM averaged 4.08% with an average 0.2 point, up from last week when it averaged 3.98%. A year ago at this time, the five-year ARM averaged just 2.59%.

"Meanwhile, housing inventory is showing promising signs," commented Senior Economist Nadia Evangelou, Director of Forecasting for the National Association of Realtors (NAR). "During the spring and summer seasons, the inventory of homes for sale typically increases. This is one of the seasonality trends that are observed in the real estate market. Specifically, inventory normally increases by 9% on average in April compared to February. However, this year, inventory rose even further by 21% in April. According to NAR, the number of homes for sale rose to above one million units. While May and July are generally the two busiest listing months, more homes are expected to be available in the market in upcoming months. Thus, these additional homes may help potential buyers to find a home while mortgage rates are still historically low."

And as Jones notes, actions by the Federal Reserve taken two weeks ago to increase the interest rate by another 50 basis points to 0.75-1.00% will inevitably cool the housing market.

“Federal Reserve Chair Jerome Powell continues to emphasize his commitment to a 2% inflation target, reiterating his willingness to continue raising interest rates until the goal of healthy prices is achieved,” said Jones. “This commitment to tighter monetary policy continues to shake financial markets as investors try to determine how inflation, rising interest rates, and ongoing concerns in China and Ukraine will impact economic growth. Yields on 10-year Treasury notes saw variability this week, surging close to 3.0% in the beginning of the week, before settling below 2.9% in the second half of the week as investors looked for stability amidst the challenging incoming data. The Federal Reserve’s monetary tightening is having the intended effect of cooling housing demand, allowing the market to begin normalizing.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news