Although home prices have remained steep after rapid growth during the height of the pandemic, paying $1 million or more for a house may seem excessive, if not impossible, to most Americans.

But just because most people aren’t spending seven figures on a house doesn’t mean million-dollar homes aren’t prevalent in some parts of the U.S.

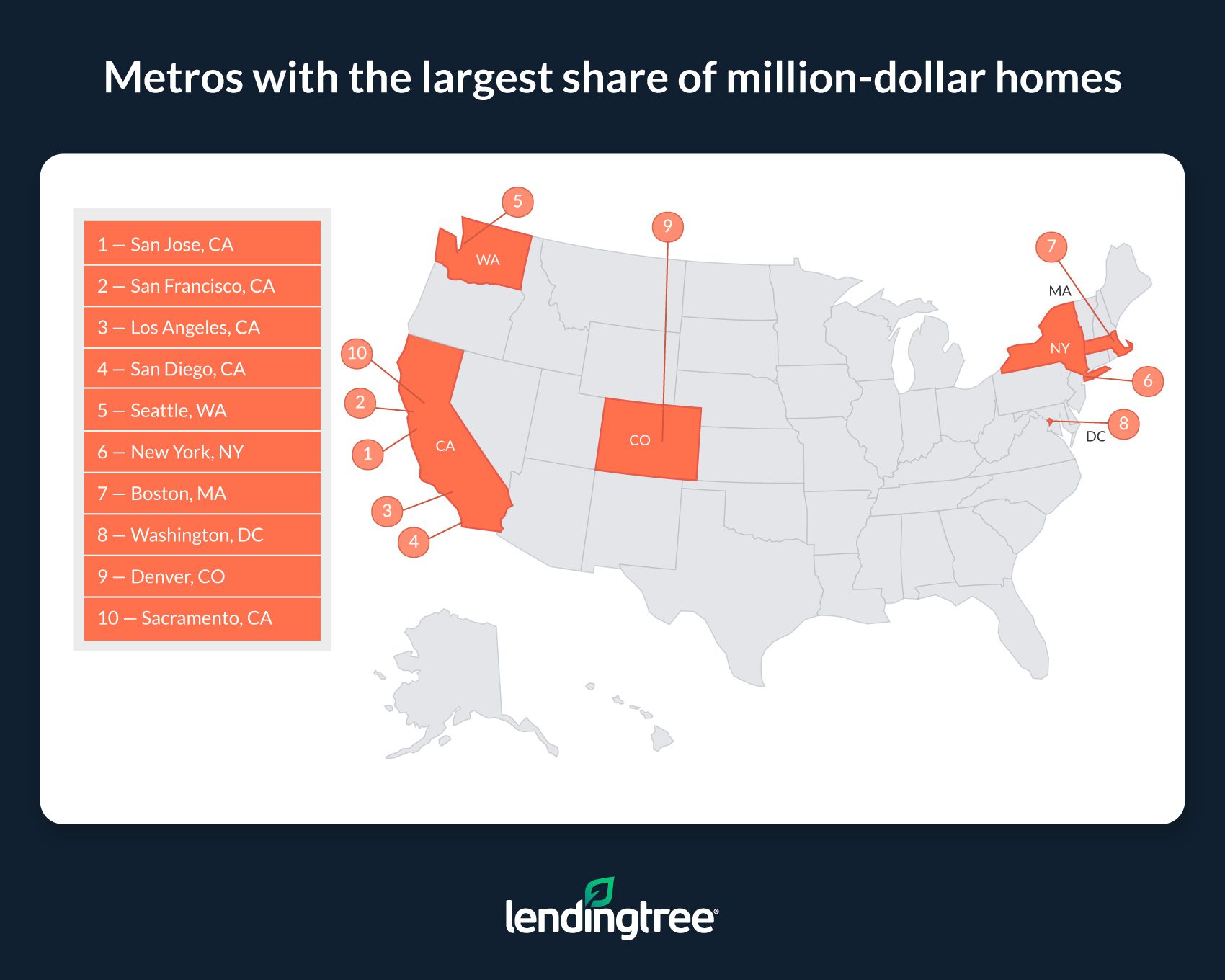

While million-dollar houses aren’t common in most of the nation’s largest metros, they make up a majority share of homes in two California metros, San Jose and San Francisco— notoriously high-cost areas.

To see where million-dollar houses are most common, LendingTree analyzed data from the U.S. Census Bureau’s American Community Survey to find the share of million-dollar homes in each of the nation’s 50 largest metropolitan areas.

Key Findings:

- Million-dollar homes are relatively uncommon in most of the country. An average of 6.68% of owner-occupied homes in the nation’s 50 largest metros in 2021 were valued at $1 million or more. Though this means there’ll likely be plenty of sub-million-dollar homes from which buyers can choose, the share of million-dollar homes is growing. According to our research last year, an average of 4.71% of owner-occupied homes in the nation’s 50 largest metros in 2020 were valued at $1 million or more.

- San Jose and San Francisco, CA, have the largest share of million-dollar homes. Respectively, 66.28% and 52.91% of owner-occupied homes in these metros are worth $1 million or more—making them the only two in our study where a majority of homes are worth at least $1 million. In last year’s study, San Jose was the only metro where a majority of owner-occupied homes were worth $1 million or more.

- Including San Jose and San Francisco, the four metros with the highest percentage of million-dollar homes are in California. Driven by factors including dense populations and the significant wealth generated by the tech and entertainment industries, an average of 42.21% of owner-occupied homes across San Jose, San Francisco, Los Angeles, and San Diego are valued at at least $1 million.

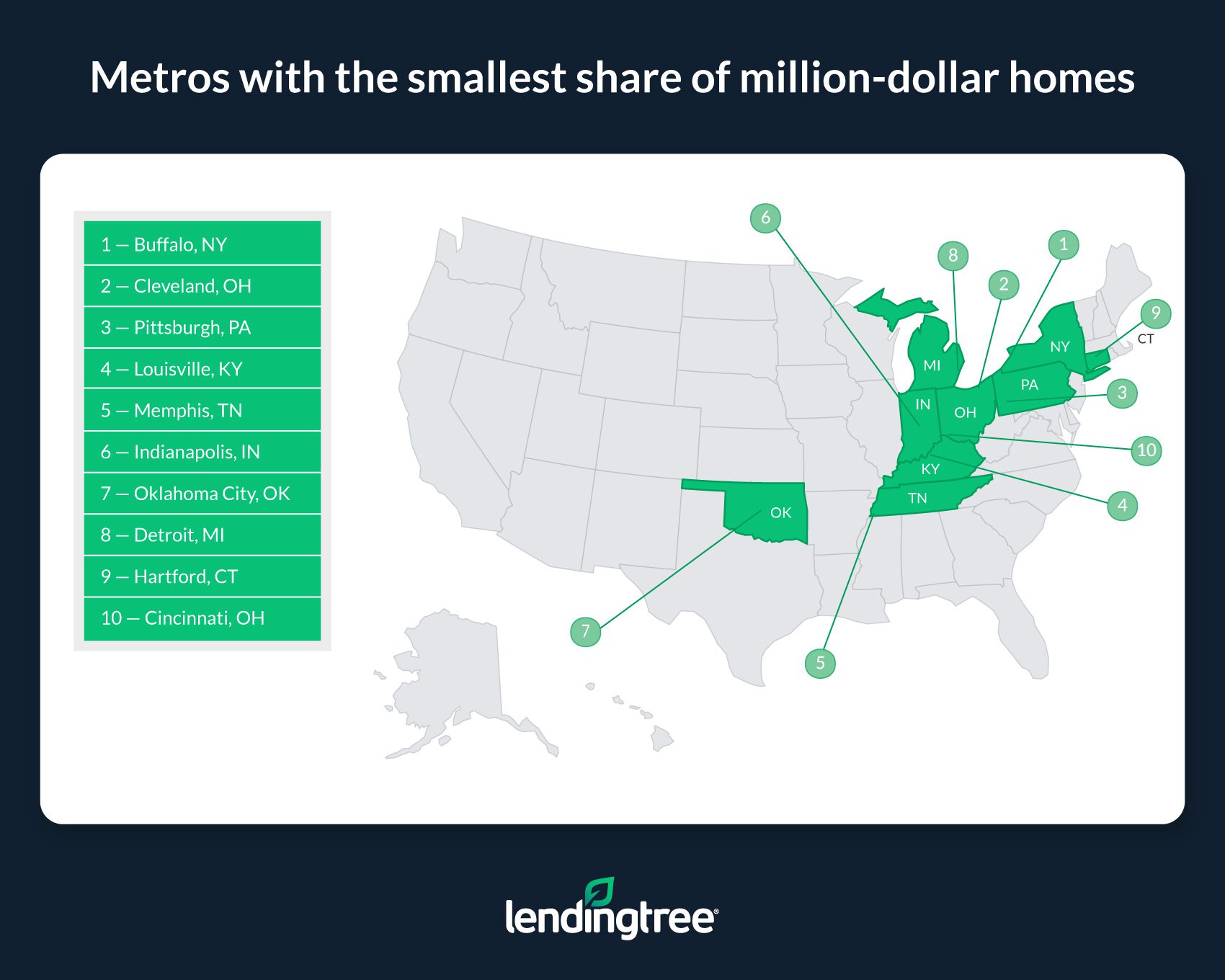

- Only four metros—Buffalo, NY, Cleveland, Pittsburgh and Louisville, KY—have fewer than 1.00% of owner-occupied homes valued at at least $1 million. An average of only 0.85% of owner-occupied houses in these generally affordable metros are worth $1 million or more. Last year, Columbus, Ohio, Cincinnati, Indianapolis, Detroit, and Memphis, TN. were also on the list of metros where fewer than 1.00% of owner-occupied homes were valued at $1 million or more, but their share of million-dollar homes has since grown.

While persistently high home values have priced many would-be homebuyers out of the market, high asking prices aren’t the only reason why buying a home can be difficult now.

Other factors like elevated mortgage rates and scarce housing inventory work together to make today’s housing market especially challenging to navigate.

Although they’ve come down from their recent peak in late 2022, 30-year fixed mortgage rates are sitting near a 20-year high. Because higher rates result in larger mortgage payments, buying a house can be far more expensive than it would’ve been this time last year or during the height of the pandemic—even in places where home prices have fallen slightly.

Top 10 Metros with the Largest Share of Million-Dollar Homes

1. San Jose, CA

- Number of owner-occupied housing units: 377,447

- Number of owner-occupied units valued at $1 million or more: 250,179

- Percentage of owner-occupied units valued at $1 million or more: 66.28%

- Median value of owner-occupied housing units: $1,237,800

2. San Francisco

- Number of owner-occupied housing units: 959,987

- Number of owner-occupied units valued at $1 million or more: 507,914

- Percentage of owner-occupied units valued at $1 million or more: 52.91%

- Median value of owner-occupied housing units: $1,042,300

3. Los Angeles

- Number of owner-occupied housing units: 2,176,998

- Number of owner-occupied units valued at $1 million or more: 576,537

- Percentage of owner-occupied units valued at $1 million or more: 26.48%

- Median value of owner-occupied housing units: $748,700

4. San Diego

5. Seattle

6. New York

7. Boston

8. Washington, D.C.

9. Denver

10. Sacramento, CA

On top of this, a lack of homes for sale exacerbates many of today’s housing-related challenges. Low inventory pushes home prices higher and gives would-be buyers fewer options. Even for those who can afford to buy, it may remain unfeasible because they can’t find a home that’ll fit their needs.

Top 10 Metros with the Lowest Share of Million-Dollar Homes

1. Buffalo, NY

- Number of owner-occupied housing units: 341,086

- Number of owner-occupied units valued at $1 million or more: 2,545

- Percentage of owner-occupied units valued at $1 million or more: 0.75%

- Median value of owner-occupied housing units: $192,000

2. Cleveland

- Number of owner-occupied housing units: 584,025

- Number of owner-occupied units valued at $1 million or more: 4,819

- Percentage of owner-occupied units valued at $1 million or more: 0.83%

- Median value of owner-occupied housing units: $184,500

3. Pittsburgh

- Number of owner-occupied housing units: 732,879

- Number of owner-occupied units valued at $1 million or more: 6,581

- Percentage of owner-occupied units valued at $1 million or more: 0.90%

- Median value of owner-occupied housing units: $190,000

4. Louisville, KY

5. Memphis, TN

6. Indianapolis

7. Oklahoma City

8. Detroit

9. Hartford, CT

10. Cincinnati

For those who can't afford a million-dollar property, just because you aren’t planning on spending $1 million or more on a home doesn’t mean you won’t find yourself in a high-cost area where there's no choice but to spend a little extra to buy a home.

At the end of the day, high home prices doubtlessly cause problems for many homebuyers nationwide. However, until mortgage rates decrease and housing inventory rises, buying-related challenges will likely remain prevalent in the housing market.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news