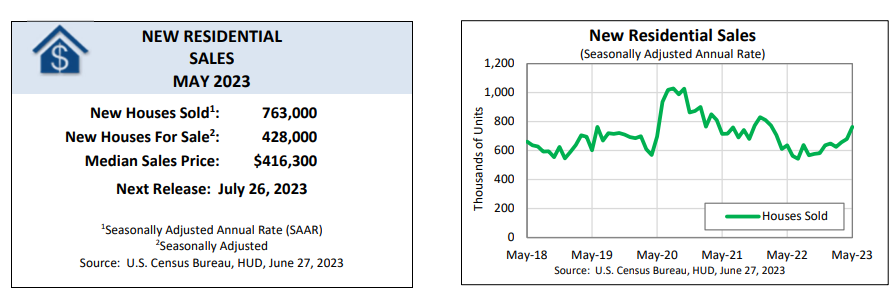

The U.S. Census Bureau and the U.S. Department of Housing & Urban Development (HUD) have announced the following new residential sales statistics for May 2023.

The U.S. Census Bureau and the U.S. Department of Housing & Urban Development (HUD) have announced the following new residential sales statistics for May 2023.

Sales of new single‐family houses in May 2023 were at a seasonally adjusted annual rate of 763,000—12.2% above the revised April 2023 rate of 680,000, and is 20% above the May 2022 estimate of 636,000.

“New single-family home sales, according to the Census Bureau, jumped 12.2% in May to a seasonally adjusted annualized rate (SAAR) of 763,000, the highest level since February 2022,” said Douglas G. Duncan, Chief Economist at Fannie Mae. “While this increase was stronger than our most recent forecast, it is not a surprise following last week’s reported surge in housing starts. The prior increases in active existing home listings at the start of the year have since reversed over the spring homebuying season, leaving few options for would-be purchasers. The ‘lock-in effect,’ in which existing owners are disincentivized to list their homes due to not wanting to give up a mortgage rate much lower than current market rates, continues to suppress the number of listings. Therefore, homebuyers have increasingly turned toward new homes, which is consistent with the recent firming in home price growth and homebuilder optimism over the past few months.”

HUD and the Census Bureau have also reported that the May 2023 median sales price of new houses sold nationwide was $416,300, with an average sales price of $487,300.

The seasonally‐adjusted estimate of new houses for sale at the end of May 2023 was 428,000, representing a supply of 6.7 months at the current sales rate.

“The seasonally adjusted estimate of the supply of new homes for sale at the end of May was 428,000, down modestly from the previous month. This represents a supply of 6.7 months at the current sales rate,” said First American Economist Ksenia Potapov. “Only 16.1% of the total new-home inventory is completed and ready to occupy, down from more than 20% pre-pandemic. The share of new-home supply that is under construction has fallen in recent months and is now at 60.5%, compared with nearly 70% in May 2022.”

A housing deficit remains an issue for many seeking homes nationwide, as Zillow recently found that a significant lack of new, affordable housing is at the heart of the affordability crisis. This shortage is primarily impacting Millennials and Gen Z who are at the prime home-buying time of their lives. This lack of affordable options for young singles and families has created what has been dubbed “missing” households, defined as potential homeowners who live with family members in owned or rental housing.

According to Zillow, in the year 2021, there were nearly eight million missing households compared to 3.7 million dwellings units available for rent or sale, resulting in a deficit of 4.3 million homes.

"The U.S. housing market is like a high-stakes version of the game musical chairs," said Orphe Divounguy, Senior Economist at Zillow. "There are simply not enough homes for millions of people. Unless we address the shortage of smaller, more-affordable, starter-type homes, we risk leaving families without a seat—and it will only get worse over time."

And in a very atypical spring home buying season, the latest National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI), found builder confidence in the market for newly built single-family homes in June 2023 to have gained five points and reaching the 55-point mark, making this the sixth consecutive month that builder confidence has increased, and the first time that sentiment levels have surpassed the midpoint of 50 since July of 2022.

“Builders are feeling cautiously optimistic about market conditions given low levels of existing home inventory and ongoing gradual improvements for supply chains,” said NAHB Chairman Alicia Huey. “However, access for builder and developer loans has become more difficult to obtain over the last year, which will ultimately result in lower lot supplies as the industry tries to expand off cycle lows.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news