Black Knight has released it latest iteration of the Originations Market Monitor report, which looks at mortgage origination data covering June 2023 by leveraging raw lock data from Black Knight’s Optimal Blue PPE platform.

"As May gave way to June, we saw banks lose some of their appetite for jumbo loans," said Andy Walden, VP of Enterprise Research and Strategy at Black Knight. "While the OBMMI 30-year conforming index rose 6 basis points over the month, the jumbo rate index was up by three times that level. Purchase loans continue to claim a larger share of a shrinking origination pipeline, as refinance opportunities remain scarce. Indeed, we saw the purchase lending share of June's locks hit another all-time high. But keep in mind: It is a dominant share of a very constrained market."

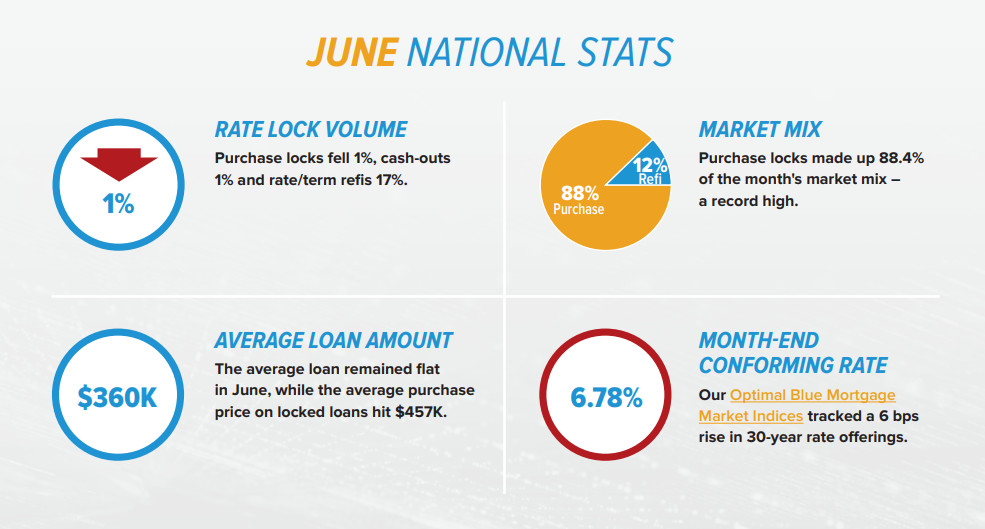

Overall, pipeline data showed rate lock activity fell across the board, lowering by 1% on a month-to-month basis. Purchase locks dropped by 0.6%, cash-out refinances dropped 1.4%, and rate/term refinance locks dropped by 17%. Purchase locks accounted for 88.4% of locks in June, the highest share on record. Even so, purchase lock counts were down 31% year over year and 29% compared with pre-pandemic levels in 2019.

"As we noted in our most recent Mortgage Monitor report, the housing market has been reheating as we approach the traditional tail end of the homebuying season," Walden said. "What's clear is that continued economic uncertainty, tightening credit and affordability concerns have all helped to skew the market toward higher-credit borrowers. In fact, the average credit score among purchase locks hit a record high in June. Likewise, the average purchase price rising for the seventh straight month, while the average loan amount remained flat, suggests lower loan-to-value ratios as well."

Other notable data, as highlighted by Black Knight includes:

- The Optimal Blue Mortgage Market Indices (OBMMI) showed 30-year conforming rates rose 6 basis points in June to 6.78%.

- Overall rate lock volumes were down 1% month-over-month in June, with conforming loans gaining share mainly at the expense of nonconforming loan products.

- Purchase lock counts were down 31% year-over-year and 29% compared to pre-pandemic levels in 2019, as higher interest rates and low inventories continued to have a chilling effect on demand.

- While purchase lending remains constrained, it continues to drive the overwhelming majority of volume, accounting for more than 88% of June rate locks—a record high.

- The average purchase price rose for the seventh consecutive month to $457,000, while the average loan amount remained flat at $360,000.

- Credit scores rose across the board again in June as economic uncertainty, tightening credit, and affordability concerns continued to skew the market toward higher-credit borrowers.

- At 735, the average credit score among purchase locks hit a record high in June, with the average credit score among rate/term refinances jumping 7 points in the month.

- The adjustable-rate mortgage (ARM) share of June lock activity fell to 7.38%.

- The 10-year Treasury yield rose 17 basis points in June to 3.81%, as the spread with mortgage rates remains historically wide at 2.97%.

To read the full report, including more data, charts, and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news